Hyderabad's residential real estate market has seen shifts, with a high level of inventory overhang in recent months. According to an Anarock report, the city recorded a 19-month overhang, higher than the 14-month average seen in other major cities across India. This indicates a slower absorption rate despite growth in the residential housing sector.

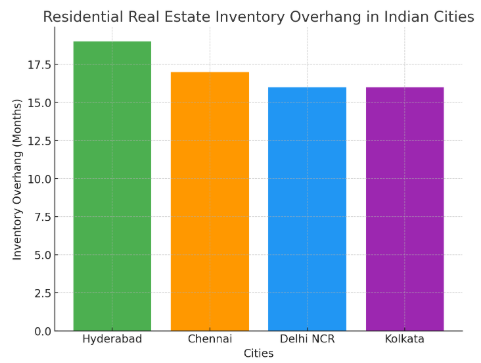

"Inventory overhang" refers to the time required for unsold residential units to be absorbed, assuming sales continue at the current pace. Hyderabad’s overhang is notable but not unique; cities like Chennai, Delhi NCR, and Kolkata also show significant overhangs, with waiting times of 17 and 16 months, respectively. In contrast, Bengaluru has a faster absorption rate, with an 8-month overhang, suggesting quicker sales in that market.

The report highlights that the issue stems largely from unsold units in the branded housing segment, which have not been absorbed. Developers are now focusing on affordable housing to meet the growing demand in this segment. This shift is expected to increase, as affordable housing addresses the unmet need for such units in the city.

Factors Behind the Slow Absorption Rate

Several factors contribute to the slow absorption rate in Hyderabad’s residential real estate market. A primary factor is the significant supply of housing in the past few years, particularly in the branded housing category. Despite large volumes of stock being developed, many units remain unsold. This results from challenges including pricing, the economic climate, and shifts in consumer preferences.

Additionally, the market conditions in 2024 have been less favorable due to delays in project approvals, worsened by state and national elections. These delays, especially in the first half of FY25, disrupted the launch of new housing projects, making it harder for developers to meet market demand.

Delays in Project Approvals and Market Slowdown

Anarock’s report notes that, in the first three quarters of 2024, delays in project approvals caused setbacks. These delays were primarily due to political factors, including elections, which affected the timeline for obtaining necessary clearances. As a result, developers were unable to release the expected supply of new units.

By the first half of FY25, only about 23% of the planned residential supply had been made available, leaving a substantial portion of planned developments delayed. These delays affected the entire real estate market, especially in key cities like Hyderabad. The market’s growth was further impacted by regulatory hurdles, which complicated the approval process.

Outlook for the Real Estate Market in 2025

Despite the slow absorption in 2024, the outlook for Hyderabad’s residential real estate market in 2025 is positive. Developers, especially large, listed companies, are expected to release new residential supply, addressing existing demand. With the conclusion of election-related delays, the second half of FY25 is expected to see more timely project completions and new launches.

Anarock Group Regional Director & Head of Research, Dr. Prashant Thakur pointed out that, compared to the unsold stock in the last two years, Bengaluru has seen a reduction of six months, while Hyderabad's unsold stock has only decreased by two months. This indicates that the inventory levels are gradually improving, and more supply is expected in the coming months as elections are now over.

This is expected to reduce the inventory overhang and improve absorption rates, resulting in a healthier market in the coming years. Developers are also likely to align their offerings with changing consumer preferences, focusing more on affordable housing solutions for the under-housed segment.

.png)