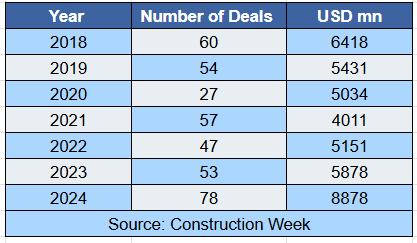

India’s real estate sector achieved a milestone in 2024, attracting $8.9 billion in institutional investments across 78 deals, the highest annual investment ever recorded. This figure surpassed the previous peak of $8.4 billion in 2007 and reflected a 51% increase from 2023’s $5.8 billion. The number of deals also rose sharply by 47%, showcasing the growing confidence among investors in India’s real estate market.

The year also saw $2.4 billion in platform commitments, with funds planned for gradual deployment over the next 3-5 years, underscoring long-term interest in the sector. This record-breaking performance highlights the resilience of Indian real estate amid evolving global and domestic economic landscapes.

Shifting Investor Dynamics and Market Preferences

Foreign institutional investors continued to lead the charge, contributing 63% of the total investments. However, domestic institutional investors significantly ramped up their activity, accounting for 37% of investments, up from an average of 19% between 2019 and 2022. This increased domestic participation was driven by the growing adoption of investment vehicles like Real Estate Investment Trusts (REITs) and Qualified Institutional Placements (QIPs).

- REITs saw investments grow more than threefold to $800 million compared to 2023.

- QIPs raised $2.7 billion for the real estate sector, reflecting strong market confidence and a continued recovery post-pandemic.

A concise shift was observed in asset preferences. Non-core assets like data centers, healthcare, student housing and life sciences gained friction, accounting for 77% of total transaction volumes, up from 53% in 2023. This indicates a growing appetite for higher returns and diversification among investors.

Residential Sector Leads the Pack: Claims 45% of Total Investments

The residential segment emerged as the top performer in 2024, capturing 45% of total investments and recording over $4 billion across 49 deals, a fourfold increase from 2023.

- Equity investments in the residential sector surged to 54% from just 8% in 2023, signaling heightened confidence in this market’s potential for growth and returns.

- More than half of residential investments, about $2.3 billion, came through QIPs, emphasizing its dominance as a funding route.

In contrast, the office segment, which had traditionally dominated real estate investments, saw a 17% drop from 2023 but still managed $2.5 billion across 18 deals, focusing heavily on core assets. Warehousing investments also stood out due to a single major deal of $1.5 billion by Abu Dhabi Investment Authority (ADIA) and KKR in Reliance Retail Ventures’ warehousing assets.

India’s real estate sector is poised for sustained growth as new asset classes and investment vehicles attract diverse capital. In 2025, two warehousing investment trusts (InvITs) are expected to raise $1 billion, while a US-India REIT collaboration aims for an additional $1 billion by mid-2025.

Lata Pillai, Senior MD & Head of Capital Markets at JLL India, highlighted:

“India’s strong economic growth, political stability, and growing range of investment opportunities are positioning its real estate sector as a global leader. The rise in REITs, QIPs, and platform commitments reflects the sector’s maturity and ability to attract long-term capital.”

Dr. Samantak Das, Chief Economist at JLL India, added:

“The residential sector has outperformed expectations, while emerging asset classes like data centers and healthcare reflect the market’s adaptability. With continued innovation and strong fundamentals, India’s real estate is set for sustained growth.”

As the sector continues to evolve, 2024 stands out as a year that laid a strong foundation for a promising future in Indian real estate.

.png)