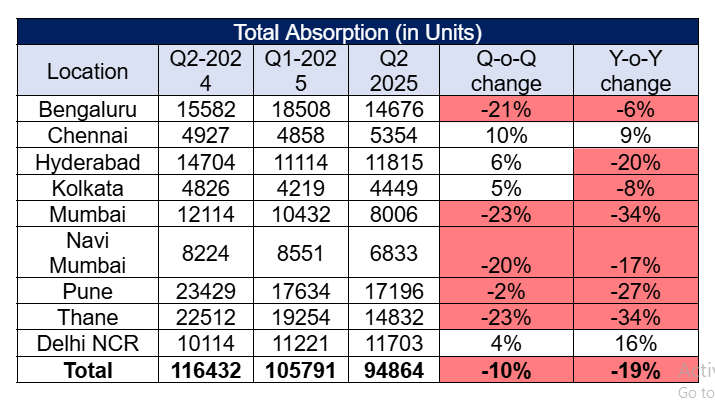

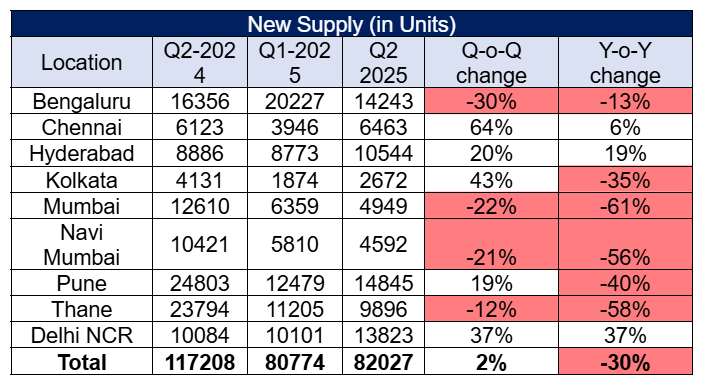

Housing sales across India’s top nine cities declined by 19% year-on-year in the April–June 2025 quarter, falling to 94,864 units, while new launches dropped 30% to 82,027 units, according to a new report by real estate data analytics firm PropEquity. This marks the first time in nearly four years that quarterly housing sales have fallen below the one-lakh-unit mark, signaling a period of moderation following the record-breaking activity seen in 2023 and 2024.

The PropEquity report highlighted that seven of the nine cities studied recorded a decline in housing sales compared to the same quarter last year. The most notable drop was recorded in Mumbai, where sales fell 34% year-on-year to 8,006 units, while new supply plummeted 61% to 4,949 units. Thane mirrored this trend with sales also falling 34%, and new launches dropping 58%, pointing to a marked slowdown in supply and absorption in the Mumbai Metropolitan Region (MMR).

According to Samir Jasuja, Founder and CEO of PropEquity, this decline in sales and supply across major markets is partly due to base effect and a natural correction. “This is the first time since Q3 2021 that housing sales have dipped below the 1 lakh mark. A similar trend is seen in supply, which has remained below this threshold for the fourth consecutive quarter. Cities like Mumbai, Bengaluru, and Navi Mumbai had peaked in 2023–24 and are now reverting to more stable activity levels,” he noted.

Despite the broader decline, a few markets showed resilience. Delhi-NCR saw 16% year-on-year growth in sales and a 37% increase in new supply, driven by a surge in project launches in Ghaziabad and Greater Noida. Chennai was the other city to buck the trend, recording a 9% increase in housing sales and a 6% rise in supply. Hyderabad saw mixed results—while housing sales fell 20% to 11,815 units, new launches increased 19% to 10,544 units, reflecting selective confidence from developers.

Bengaluru, one of the largest real estate markets in the country, experienced a relatively mild 6% decline in sales, totaling 14,676 units. New supply also dropped 13% to 14,243 units, indicating a cautious stance from developers amid ongoing price corrections and market consolidation.

Pune, another key market, reported a 27% fall in housing sales, down to 17,196 units, and a 40% decline in supply at 14,845 units. In Navi Mumbai, sales dropped 17%, while new supply declined sharply by 56% to just 4,592 units. The fall in both launches and sales in these regions suggests a cautious sentiment amid higher property prices and delayed decision-making by buyers.

The report also noted that quarterly (Q-o-Q) declines were evident in cities like Mumbai, Bengaluru, and Navi Mumbai, reflecting a tapering of momentum after strong performance in previous quarters. Developers in these cities are focusing more on clearing existing inventory and recalibrating project timelines based on current demand trends.

While macroeconomic stability, rising income levels, and infrastructure investments continue to support long-term housing demand, the report suggests that short-term trends are now influenced by price sensitivity, cost of borrowing, and geopolitical uncertainty. With the festive season approaching later in the year, industry stakeholders will be closely monitoring buyer sentiment and the pace of project launches.

The moderation seen in the second quarter of 2025 is being viewed as a normalisation phase rather than a sharp downturn. Analysts believe that cities with robust infrastructure pipelines and employment hubs will continue to see demand return gradually, especially in mid-income and affordable segments.