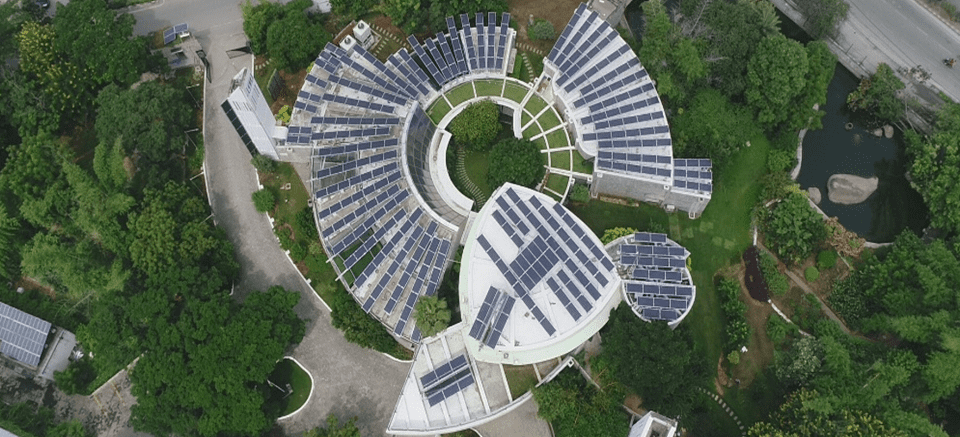

Mumbai-based fractional ownership platform hBits has announced its latest investment opportunity in the Mumbai Metropolitan Region (MMR). The new Grade A commercial asset, valued at Rs 54.66 crore, is located at Ashar IT Park in Wagle Estate, Thane, reflecting the company’s ongoing focus on expanding its portfolio of premium real estate assets. This development marks the 16th property in hBits’ portfolio, bringing its total assets under management (AUM) to approximately Rs 500 crore.

The property is fully leased to Teleperformance, a multinational company listed on Euronext Paris and specializing in customer experience management. The tenant's global revenue exceeds €10 billion (approximately Rs 89,000 crore), adding significant credibility to the investment. Ashar IT Park spans 1.1 million square feet, with the majority of its space occupied by Teleperformance. Other key tenants in the Wagle Estate area include Raymond, Cipla, and DHL, which collectively enhance the location's attractiveness as a commercial hub.

The new asset offers investors an entry yield of 8.75% and an internal rate of return (IRR) of 15.16%, positioning it as a promising investment. With easy access to key infrastructure such as the Eastern Express Highway, Thane Railway Station, and the soon-to-be operational Wagle Circle Metro Station, the location is well-suited for long-term growth.

Wagle Estate has become a significant center for commercial real estate, attracting businesses from various sectors. The BFSI (Banking, Financial Services, and Insurance) sector, in particular, is experiencing significant growth in India, which is driving the demand for premium office spaces in metro cities like Mumbai. According to industry data, Mumbai accounts for about 44% of the total space occupied by domestic financial organizations, underscoring the importance of the region in India’s financial ecosystem.

Shiv Parekh, the founder and CEO of hBits, emphasized the significance of the investment, noting that the growth of the BFSI sector, particularly in fintech, is driving increased demand for commercial real estate in major metropolitan areas. He explained that the new asset aligns with the company’s strategy of acquiring properties in prime locations to provide valuable investment opportunities. The launch of the project in Thane reflects the rising demand for Grade A commercial spaces in the region.

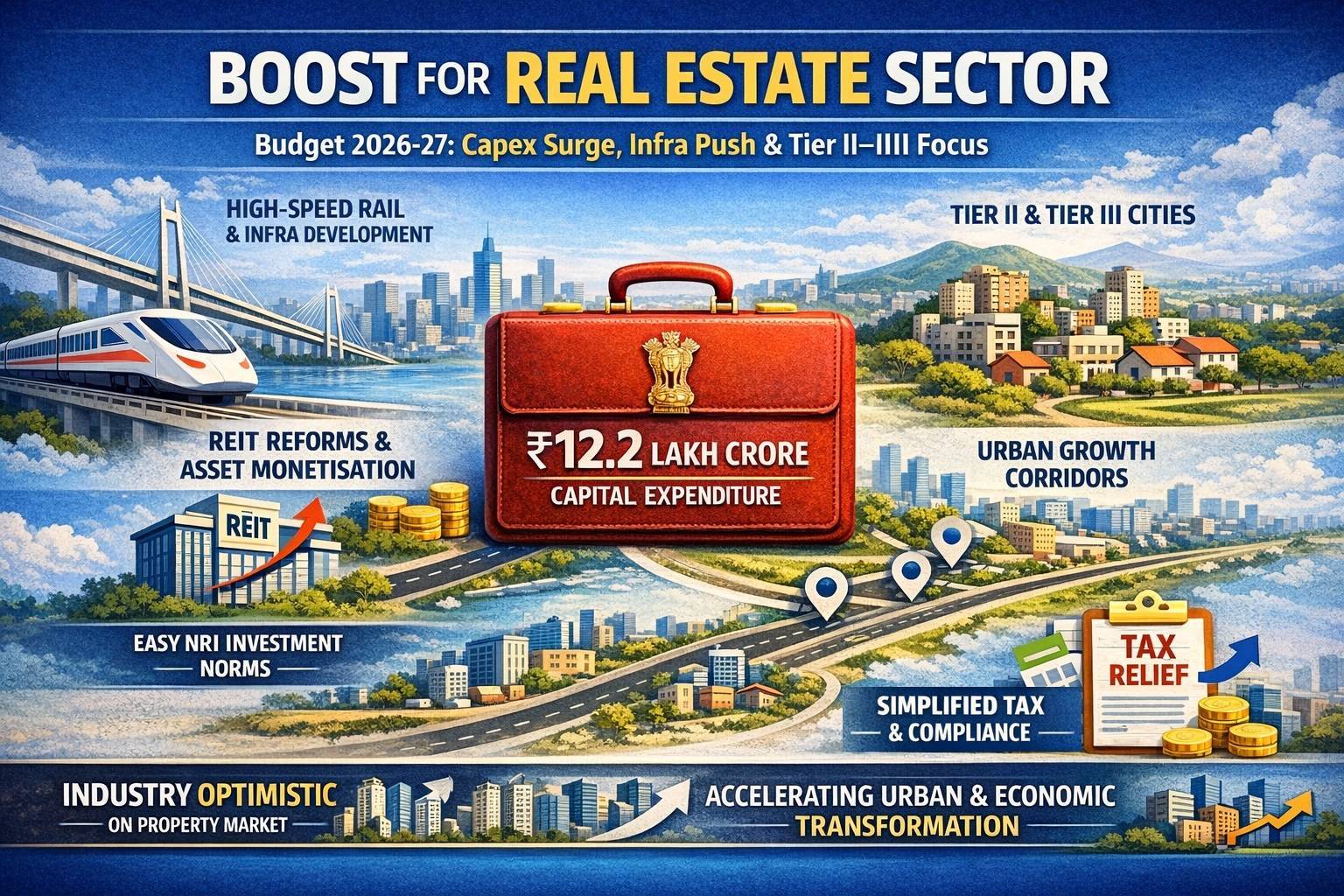

hBits has been actively working towards diversifying its offerings. It recently filed an application with SEBI to list its first SME Real Estate Investment Trust (REIT). The inclusion of this new property reflects its strategy of investing in high-quality assets that promise strong returns while catering to the needs of evolving sectors such as BFSI and technology.

The commercial real estate sector in India has shown consistent growth, with leading office rentals in major cities witnessing annual increases of 4-8%. This trend is supported by the expansion of multinational companies, infrastructure improvements, and rising demand for high-grade office spaces. Wagle Estate, with its established connectivity and growing tenant base, stands out as a strategic location for such investments.

Image source-hbits

.png)