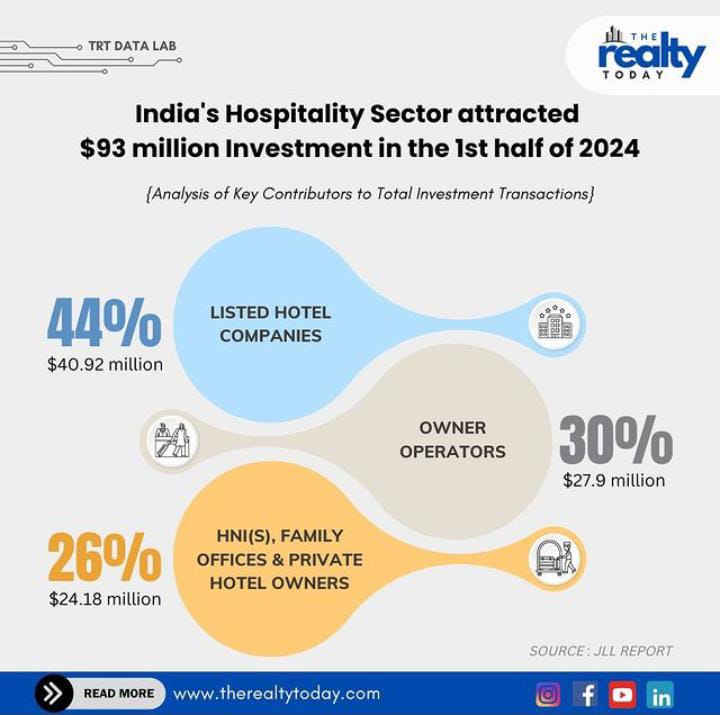

The Indian hospitality market experienced significant growth in the first half of 2024, attracting approximately $93 million in investment inflows, driven by factors such as a recovering economy, strong domestic demand, and an investment-friendly environment in Tier II and Tier III cities. These emerging cities accounted for 83% of the 19,442 hotel keys signed during this period, reflecting a shift in focus away from traditional Tier I cities. The upscale hotel segment dominated the transaction volume, followed by mid-scale and luxury segments. The participation of smaller investors, high-net-worth individuals, and family offices marked a diversification in investor profiles. The robust development in Tier II and Tier III cities, coupled with rising urbanization, has driven growth in these markets.

While smaller cities led in the number of hotel signings, Tier I markets like Mumbai, Hyderabad, Pune, and Chennai remain crucial to the overall hospitality sector. These cities saw strong demand for upscale and mid-scale hotel signings, supported by growing commercial activities and MICE (meetings, incentives, conferences, and exhibitions) tourism. Investor confidence in both operational assets and greenfield projects remains high, with JLL projecting total investment volume for 2024 to reach $413 million, a 22% increase from the previous year. Key macro-economic factors such as improved air connectivity and government infrastructure initiatives continue to bolster the sector's long-term growth potential.

To explore, complete details, visit- https://therealtytoday.com/news/indias-hospitality-sector-sees-93-million-investment-surge-in-h1-2024

.png)