In 2024, Bengaluru strengthened its position as India’s top destination for office leasing, setting a new record in the city’s commercial real estate sector. CBRE report shows that Bengaluru accounted for a significant portion of the country’s office space absorption, with gross leasing reaching nearly 21.8 million square feet. The rise in demand for office spaces reflects the city’s economic growth, fueled by its expanding tech sector, the growth of Global Capability Centres (GCCs), and the increasing need for flexible office spaces.

Office Leasing in Bengaluru

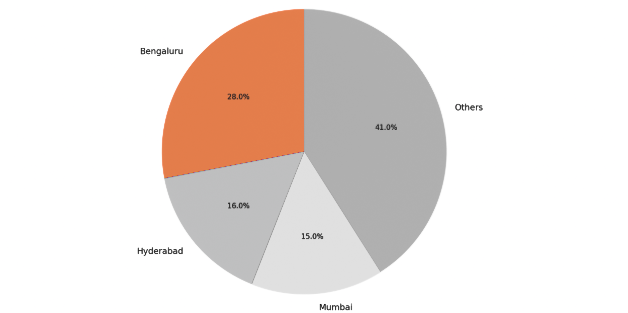

The IT hub dominated office space absorption in 2024, capturing about 28% of the country’s total office leasing activity. This is a clear reflection of the city’s sustained appeal to businesses across various industries, particularly the technology, finance, and consulting sectors. After Bengaluru, Hyderabad followed closely with a 16% share, while Mumbai accounted for 15% of total office leasing. Other major cities like Pune and Delhi also saw significant growth in office space demand, though they lagged behind the top three cities in terms of volume.

Info source- CBRE Report

On a pan-India scale, office leasing reached an unprecedented 79 million square feet in 2024, marking a 16% year-on-year (YoY) growth. This historic high reflects the increasing appetite for office space across the country, driven by a mix of domestic expansion and foreign investments.

The total supply of office space in India during 2024 stood at 52.3 million square feet, with Bengaluru, Hyderabad, and Pune collectively accounting for 67% of this new supply. This indicates that while demand is robust, the market is also responding with a substantial increase in supply, ensuring that the growth is sustainable.

Sectoral Drivers of Demand:

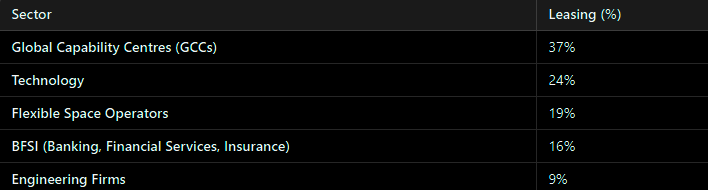

The demand for office spaces in 2024 was primarily driven by sectors like technology, banking, financial services, insurance (BFSI), engineering, and manufacturing. Here are the sector-wise leasing contributions:

Global Capability Centres (GCCs): The GCCs were particularly significant, accounting for 37% of the total office leasing activity in 2024. These centres, established by global corporations to tap into India’s skilled workforce, have become one of the largest drivers of office space demand. GCCs’ requirement for both traditional and flexible workspaces continues to push leasing activity in key cities.

Technology Sector: The technology sector alone accounted for 24% of the total office leasing. With India’s increasing role as a global IT hub, the demand for office space by tech companies remains strong, as businesses scale up their operations, especially in cities like Bengaluru and Hyderabad.

Flexible Office Spaces: Another notable trend was the increased demand from flexible space operators, who accounted for 19% of the total leasing. This trend highlights the shift towards more dynamic, adaptable workspaces, especially in response to hybrid working models adopted post-pandemic.

BFSI Sector: The BFSI sector continued to show strong growth, contributing 16% of total leasing activity. The sector’s steady demand for office spaces is tied to the expansion of financial services and banking operations, both domestic and international.

Engineering and Manufacturing: Engineering and manufacturing companies contributed 9% of the office leasing, showing a steady but slower growth in comparison to tech and service-oriented sectors.

Info source- CBRE Report

Domestic vs. International Leasing Activity:

In terms of leasing activity, domestic companies played a dominant role, accounting for 45% of total office leasing in 2024. This was followed by companies from the Americas (34%), Europe, the Middle East, and Africa (16%), and Asia Pacific (5%). The dominance of domestic firms in leasing activity can be attributed to the growing need for office space by Indian firms, particularly in flexible work environments and tech-driven businesses.

Quarterly Breakdown and Trends:

The final quarter of 2024 saw a peak in leasing activity, with 22.2 million square feet of office space leased — the highest ever in a single quarter. This surge in leasing activity was driven by the need to accommodate the rising demand for office spaces, particularly from the technology, BFSI, and research & consulting sectors.

As India’s office leasing market looks to 2025, experts predict sustained growth, particularly in Bengaluru, Hyderabad, and Pune. Anshuman Magazine, Chairman & CEO of CBRE India, emphasized that demand from sectors such as technology, BFSI, and engineering would continue to drive the market. The need for both traditional and flexible office spaces will likely remain strong, with businesses increasingly prioritizing adaptable workspaces to meet the demands of a hybrid workforce.

Key trends to watch for in 2025 include:

- Increased Demand for Hybrid Workspaces: As businesses embrace flexible working models, there will be a continued rise in demand for hybrid office solutions.

- Expansion of GCCs: India’s skilled talent pool will continue to attract global companies, particularly in tech-driven sectors, boosting leasing activity from GCCs.

- Continued Growth in Flexible Spaces: The demand for co-working spaces and flexible office solutions will likely continue to grow, catering to startups and large corporations alike.

Looking Ahead to 2025:

India’s office leasing market is expected to continue its growth trajectory, with Bengaluru leading the charge due to its thriving tech sector and expanding Global Capability Centres (GCCs). The demand for both traditional and hybrid workspaces will remain strong, driven by the increasing adoption of flexible working models across industries. Flexible office spaces, co-working hubs, and adaptable work environments will see sustained demand, catering to both startups and large enterprises. Additionally, the BFSI sector’s growth, along with the continued expansion of domestic and international companies, will fuel leasing activity. As India’s commercial real estate market adapts to evolving business needs, the outlook for office leasing in cities like Bengaluru, Hyderabad, and Pune remains optimistic, with robust sectoral demand and rising supply ensuring a dynamic market.

.png)