When buying property in Uttar Pradesh (UP), it's important to understand stamp duty and registration charges, as these are essential costs in the property registration process. In this article, we will simplify the concept of stamp duty, explain how to calculate it, and guide you through the process of paying it, both online and offline.

What is Stamp Duty?

Stamp duty is a tax levied by the state government on property transactions. It is mandatory to pay this tax to obtain legal ownership of the property in government records. In UP, the stamp duty is generally between 6% to 7% of the property’s value, depending on the buyer's gender. Registration charges are an additional 1% of the property value.

Why Is It Important to Pay Stamp Duty?

Stamp duty is a critical component of property transactions for several reasons:

1. Legal Recognition: Paying stamp duty ensures that the property transaction is legally binding and recognized by the state government. It validates the transfer of ownership, granting the buyer undisputed rights to the property.

2. Dispute Resolution: A stamped document is admissible as evidence in courts. In case of ownership disputes, a stamped and registered document serves as a legal proof of ownership, offering protection to the buyer.

3. Government Revenue: Stamp duty is a significant source of revenue for the state government, which is used for infrastructure development and public services.

4. Avoiding Penalties: Non-payment or underpayment of stamp duty can lead to heavy penalties, interest, or even legal action. Ensuring timely payment avoids these complications.

5. Facilitates Future Transactions: A property with proper stamp duty and registration documentation is easier to sell, mortgage, or transfer in the future, as it eliminates any legal ambiguities about ownership.

What Are Registration Charges?

Fees paid to record the property transaction in the State’s official land records. This process formally documents the transfer of property ownership, creating a legal acknowledgment of the buyer’s rights over the property. Registration charges serve as proof of ownership and are required for protecting property rights in case of disputes or legal challenges.

Paying both these charges is mandatory for the property transaction to hold legal validity. Without proper payment and registration, the property transaction is considered incomplete and could lead to disputes.

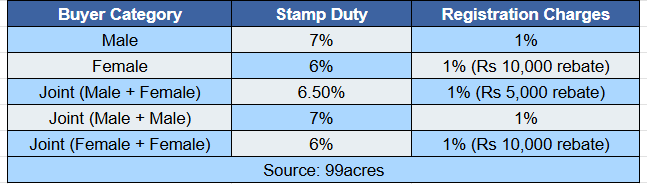

Current Stamp Duty and Registration Rates in Uttar Pradesh

- The rebate for female buyers applies only to properties valued up to Rs 10 lakh.

- Joint ownership involving male and female buyers provides a partial rebate on stamp duty.

Amendments in Registration Charges

Previously, properties priced below Rs 10 lakh incurred a registration fee of 2%, while those above Rs 10 lakh were capped at Rs 20,000. However, since February 2020, the UP government revised the registration fee to 1% of the property value, applicable across all price brackets. This move simplified the calculation and provided consistency in charges.

Amendments in Stamp Duty

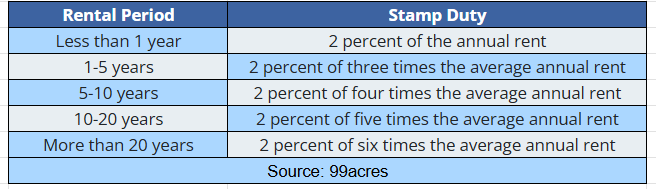

In June 2024, the government introduced a reduction in stamp duty for residential, commercial, and non-residential rental agreements. Along with this, simplified processes were implemented to streamline procedures and improve efficiency, making it easier for individuals and businesses to complete rental transactions.

In September 2023, the government revised the stamp duty structure for gift deeds. The stamp duty for family transfers was capped at Rs 5,000, benefiting transactions between immediate relatives, such as spouses, siblings, children, and parents. However, non-family transfers, including those involving companies or trusts, continue to attract a 7% stamp duty.

Documents Required for Stamp Duty and Registration

Before initiating the payment, ensure you have the following documents ready:

- Sale Deed

- Tax receipts for the last three months

- Power of Attorney (if applicable)

- Previous registered agreements (for resale properties)

- Latest bank statements

- Encumbrance Certificate

- Sale Agreement

- Electricity bill

- Sanctioned building plan

- Occupancy/Possession certificate from the builder

Having these documents ensures a smooth registration process and avoids unnecessary delays.

Factors Affecting Stamp Duty

Stamp duty in Uttar Pradesh is influenced by various factors. Understanding these can help buyers anticipate costs more effectively:

1. Gender and Age of the Buyer

- Women Buyers: Women home buyers benefit from reduced stamp duty rates, which are 6% compared to 7% for men. This rebate aims to encourage property ownership among women and reduce gender disparities in asset ownership.

- Senior Citizens: Many states, including Uttar Pradesh, offer concessions to senior citizens to make property transactions more affordable for them. While UP does not currently have specific senior citizen discounts, buyers in this category should check for any applicable state schemes.

2. Location of the Property

- Urban vs. Rural: Properties located in urban areas, especially municipal zones, typically attract higher stamp duty rates due to their higher valuation and better infrastructure. Conversely, rural properties have relatively lower rates to promote development in these areas.

- Prime Locations: Properties in high-demand localities or near commercial hubs often come with a higher valuation, directly increasing the stamp duty payable.

3. Type of Property

- Residential Properties: Stamp duty for residential properties such as apartments, flats, and independent houses varies based on their market value. Apartments often attract higher duties due to shared amenities and infrastructure costs.

- Commercial Properties: These properties usually have higher stamp duty rates than residential ones due to their potential for income generation.

- Agricultural Land: Agricultural land may have lower stamp duties to encourage farming and rural development. However, this depends on the land’s intended use and location.

4. Purpose of the Transaction

- Gift Deeds: Stamp duty for property transfers via gift deeds within families is significantly reduced. For instance, transfers between close family members attract a flat Rs 5,000 fee.

- Sales Transactions: Regular property sales are subject to the standard stamp duty rates.

5. Market Value of the Property

Stamp duty is calculated as a percentage of the property’s market value or the circle rate (minimum price set by the government), whichever is higher. Properties with higher valuations will naturally incur higher duties.

6. Government Policies and Rebates

Periodic updates to state policies can influence stamp duty rates. For example, the introduction of rebates for women buyers or reduced charges for certain property types can lower costs for eligible buyers.

Understanding these factors can help buyers plan their finances better and leverage applicable rebates.

Payment Methods

Online Payment:

- Visit the UP Stamp and Registration Department website.

- Select ‘आवेदन करें’ (Apply) and create an application number and password.

- Log in using your credentials and fill in the required details.

- The system calculates the charges automatically.

- Make the payment through the treasury portal and save the receipt for submission at the sub-registrar’s office.

Offline Payment:

- Schedule an appointment at the sub-registrar’s office.

- Visit the office with the seller, witnesses, and all required documents.

- Submit the payment along with the documents.

- The sub-registrar verifies the information and issues the stamped certificate.

Both methods are designed to accommodate the varying preferences of buyers, ensuring flexibility and ease of use.

Tax Benefits

Under Section 80C of the Income Tax Act, 1961, buyers can claim tax deductions for stamp duty and registration charges, subject to the following conditions:

- The maximum deductible amount is Rs 1.5 lakh.

- Deductions are applicable only for new properties.

- Joint owners can claim deductions individually, up to the maximum limit.

These benefits provide financial relief and encourage compliance with legal requirements.

Stamp duty on rent agreement in UP

Stamp duty and registration charges are indispensable to property transactions in Uttar Pradesh. By understanding the rates, exemptions, and payment methods, buyers can ensure compliance and avoid legal issues. The state’s efforts to simplify and digitize the process have made it more accessible, enabling smoother property transactions. Stay informed and make well-planned decisions to benefit from rebates and tax deductions.

.png)