The implementation of the Real Estate Regulatory Authority (RERA) has significantly influenced the Indian real estate sector. Between 2017 and 2024. A total of 1.19 lakh projects, comprising approximately 97.14 lakh residential units, have been registered with the top ten State RERAs, according to a report by NSE-listed data analytics firm PropEquity. This registration process has brought increased transparency and accountability to the sector, encouraging investment confidence and regulatory compliance.

Distribution of Registered Projects Across Top States

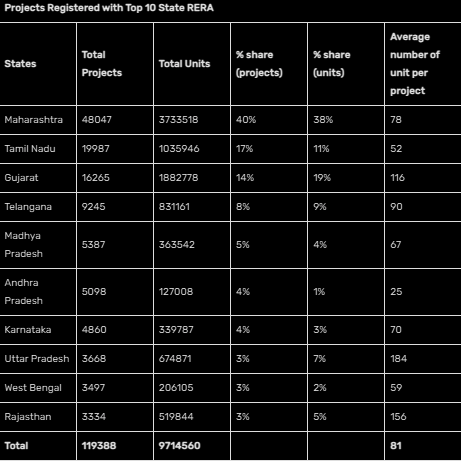

The ten states with the highest number of registered projects include Maharashtra, Tamil Nadu, Gujarat, Telangana, Madhya Pradesh, Andhra Pradesh, Karnataka, Uttar Pradesh, West Bengal, and Rajasthan. Among these states, Maharashtra leads with 48,047 registered projects, accounting for 40% of the total. Tamil Nadu follows with 19,987 projects (17%), and Gujarat ranks third with 16,265 projects (14%).

The report highlights that compliance and transparency in real estate have improved significantly due to RERA, fostering increased investments from both individual and institutional investors. According to Samir Jasuja, Founder and CEO of PropEquity, the improved regulatory environment has led to greater investment confidence.

He said, “Due to RERA, there has been a vast improvement in compliance by real estate developers as a result of which the sector has seen huge transparency. This has led to a rise in investment by individual investors, and both domestic and foreign institutional investors thereby further espousing not just India’s but also real estate sector’s growth story.”

“The real estate market across 9 top Tier 1 cities are today valued at over Rs 5.5 lakh crore. Unlike the pre-RERA years, absorption every year, post RERA implementation, has been more than launches (except covid year CY 2020), which shows the maturity that this regulation has ushered amongst developers thereby laying a strong foundation for a $1 trillion real estate economy,” he added.

Market Trends and Project Registrations

PropEquity’s report also sheds light on market trends observed post-RERA. The average number of units per project varies across states, with Uttar Pradesh having the highest average at 184 units per project, followed by Rajasthan with 156 units and Gujarat with 116 units. On an overall basis, the average number of units per project across the top ten states stands at 81 units.

City-Wise Project Registrations

Among Indian cities, Pune has the highest number of registered projects with 12,346, followed by Thane (8,858), Hyderabad (7,180), Mumbai (6,923), and Chennai (6,426). Other cities with a significant number of projects include Navi Mumbai (5,468), Ahmedabad (5,367), Nashik (3,759), Vadodara (2,903), and Kolkata (2,680).

Growth Trends in RERA Registrations

Since RERA’s inception, PropEquity has tracked data from 20 states, revealing that 1.43 lakh projects comprising 1.11 crore units were registered between January 2017 and January 2025. The growth in project registrations peaked between 2020 and 2022, rising by 145% to 25,281 projects. However, registrations witnessed a decline of 21% between 2022 and 2024. The year 2020 recorded the lowest number of project registrations, primarily due to the impact of the COVID-19 pandemic.

Future Prospects

RERA has played a crucial role in bringing accountability to the real estate sector. Developers have increasingly adhered to compliance norms, reducing the risk for investors and homebuyers. According to industry experts, the government should consider aligning regulatory measures with favorable tax policies to further strengthen the sector.

As the sector continues to evolve under the RERA framework, the emphasis remains on sustainable growth, improved buyer confidence, and a transparent marketplace. The registration trends and investment flows indicate that the real estate market is stabilizing, and stakeholders are adapting to the regulatory framework for long-term benefits.

.png)