Magicbricks recently released its Rental Update for Q3 2024 (July-September), showcasing significant trends in rental markets across 13 major Indian cities. The report reveals a notable 7.4% quarter-on-quarter (QoQ) increase in average rents, bringing the figure to INR 35.8 per square foot (psf) per month. This marks the steepest rental surge in the last two years, signaling a growing demand for rental properties amidst constrained supply.

City-Wise Rental Performance

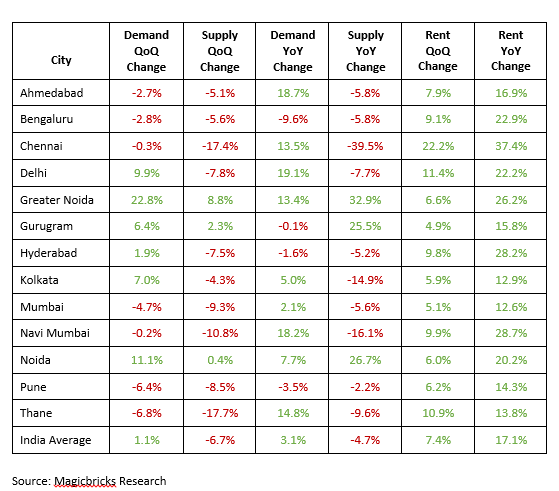

Among the 13 cities analyzed, Chennai exhibited the sharpest rental hike at 22.2% QoQ. The city’s average rent surged from INR 17.94 psf in Q2 2024 to INR 26.91 psf in Q3 2024, reflecting its strengthening appeal as a residential hub. Delhi and Thane followed closely with substantial rental increases. Delhi recorded an 11.4% QoQ jump to INR 37.55 psf, while Thane experienced a 10.9% rise, reaching INR 33.10 psf.

Mumbai continues to dominate as the most expensive rental market in India, with an average rent of INR 86.50 psf per month. Delhi and Navi Mumbai occupy the second and third positions at INR 37.55 psf and INR 33.83 psf, respectively. On the other hand, Greater Noida (INR 15.48 psf), Noida (INR 21.32 psf), and Kolkata (INR 22.14 psf) remain comparatively affordable markets, catering to a different segment of tenants.

Elaborating on the same, Prasun Kumar, Chief Marketing Officer, Magicbricks said, "This year, rental demand has shown a strong quarter-on-quarter surge, driving rents to the sharpest increase we've seen over the past eight quarters. It's evident that ready-to-move apartments are increasingly being purchased for self-use, contributing to a decline in rental supply. Meanwhile, the rise in under-construction supply suggests potential for market balance in the coming quarters, as more inventory becomes available."

Demand-Supply Imbalance Driving Price Increases

The report highlights an ongoing mismatch between rental demand and supply, further intensifying upward pressure on prices. After witnessing a robust 14.8% increase in rental demand in Q2 2024, the third quarter saw a moderated but steady growth of nearly 2%. However, the supply of rental properties declined by 6.7% QoQ during the same period, exacerbating the imbalance. This shortfall has been a critical factor in the steep rise in rents, as landlords capitalize on the limited availability of properties to command higher rates.

Gross Rental Yields and Trends

The report also provided insights into gross rental yields, which averaged 3.62% across the analyzed cities. Ahmedabad led the way with the highest rental yield at 3.9%, highlighting its position as a strong investment destination. Hyderabad, Kolkata, and Pune followed closely at 3.7% each.

Chennai emerged as the city with the most significant QoQ growth in yields, reporting a 21.3% increase. Other notable performers included Delhi (8.8%), Hyderabad (5.4%), and Navi Mumbai (5.3%). However, cities like Greater Noida, Gurugram, Kolkata, Mumbai, Noida, and Pune experienced yield declines, attributed to property price growth outpacing rental rate increases.

Looking Ahead

The data from Magicbricks emphasizes the need for interventions to balance demand and supply in the rental market. Measures such as encouraging rental housing schemes, expediting construction timelines, and introducing incentives for landlords could help address the current challenges. As urbanization accelerates and more professionals seek flexible housing options, the rental market is expected to remain buoyant. However, sustained growth will depend on creating a more balanced ecosystem that benefits both tenants and property owners alike.

.png)