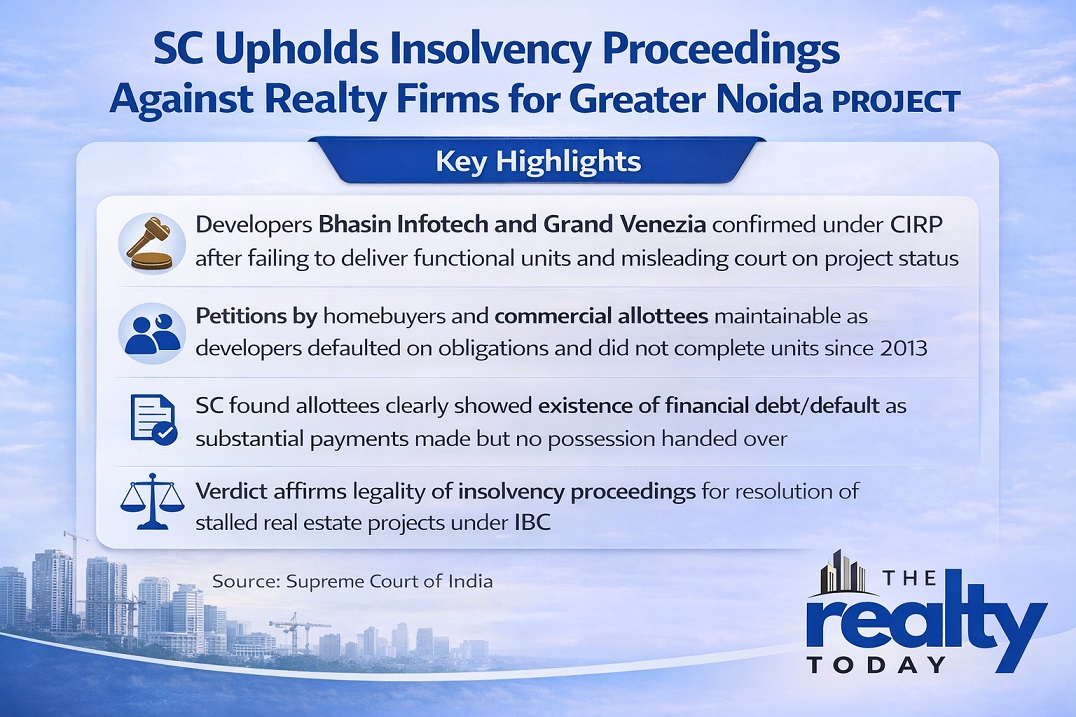

SC Upholds Insolvency Proceedings Against Realty Firms for Greater Noida Project- Key Highlights

- The Supreme Court on February 2 dismissed appeals by former directors of Bhasin Infotech & Infrastructure Pvt Ltd and Grand Venezia Commercial Towers Pvt Ltd, confirming CIRP under the Insolvency and Bankruptcy Code (IBC).

- Developers failed to deliver functional units and misled the court by claiming project completion and possession, which was factually untrue.

- Insolvency petitions filed by homebuyers and commercial allottees were maintainable, as the companies defaulted on financial obligations and units remained incomplete.

- The case originated from a 2021 petition by 141 allottees, who alleged delays since 2013, absence of completion certificates, and non-payment of promised returns.

The Supreme Court reaffirming the homebuyers' and commercial allottees' legal rights in the case of stalled real estate projects, has confirmed the filing of corporate insolvency resolution proceedings (CIRP) against Bhasin Infotech and Infrastructure Private Limited and Grand Venezia Commercial Towers Private Limited.

A bench of Justices Sanjay Kumar and K Vinod Chandran dismissed the appeals of the former directors of the two companies including Satinder Singh Bhasin, against the orders of the National Company Law Tribunal (NCLT) which were later upheld by the National Company Law Appellate Tribunal (NCLAT).

The Supreme Court found that the developers failed to provide the buyers with functional units and that they misled the court by stating that the project was complete and that possession had been given to some allottees.

Disagreeing with the developers' position, the bench noted that the claim that all aspects of construction had been completed and possession handed over was disallowed and lacked factual foundation.

As per Hindustan Times, Justice Sanjay Kumar, who authored the judgment, noted, “Notwithstanding the letters and documents sought to be relied upon in that regard, the ground reality is otherwise. Neither has the construction been completed nor could possession of units be delivered to the allottees without fulfilling all necessary formalities in that regard after completion of the building in all respects.”

The court further held that the insolvency petition filed by the allottees was maintainable on all counts. It observed that the allottees had clearly established both the existence of financial debt and default, as the units for which substantial consideration had been paid were neither completed nor handed over.

The verdict stated:, “We, accordingly, find no error having been committed either by the NCLT in admitting the company petition or by the NCLAT in confirming the same in appeal. Hence, civil appeal Nos. 13779 and 13812 of 2025 are bereft of merit and deserve to be dismissed.”

The matter arises from a petition of 141 allocation holders of the Grand Venezia Commercial Tower project in Greater Noida, filed in 2021. Out of these, insolvency proceedings in the case of 103 allottees, whose claims were at length considered by the tribunals and the Supreme Court, were pushed forward.

The allottees stated that the possession of the units was to be given by May 2013 but the project was left incomplete and not suitable for habitation. They also mentioned that the developers did not get a completion certificate from the Uttar Pradesh State Industrial Development Authority (UPSIDA), which is a compulsory step for lawful possession.

Besides, it is alleged that the developers even stopped paying assured returns to investors in 2014, though they had made contractual commitments. Not getting the statutory approvals, the long delay, and the failure to provide the usable units, led the allottees to go to the insolvency tribunal under the Insolvency and Bankruptcy Code (IBC).

The NCLT, in December 2023, admitted the insolvency application, agreeing that the developers had defaulted on their obligations. The same order was later confirmed by the NCLAT, which resulted in the appeals before the Supreme Court.

The final verdict of the Supreme Court is interpreted as a powerful endorsement of buyer rights under the IBC, especially the homebuyers and commercial allottees who have poured enormous amounts into stalled or incomplete projects. According to legal experts, the judgment emphasizes that, without statutory approvals and actual readiness for possession, simple claims of completion cannot be used to negate insolvency proceedings.

The ruling is anticipated to have significant consequences for real estate developers in general, particularly those whose projects have been delayed for a long time and who have failed in delivery commitments.

.png)