Driven by renewed investor confidence, strong homeownership sentiments, extensive infrastructure development, and increasing land and construction costs, the National Capital Region (NCR) experienced an impressive 137% surge in housing prices between 2019 and September 2024. According to a report by PropEquity, cities like Noida, Gurugram, Ghaziabad, and Greater Noida saw prices more than double during this period, highlighting the region's robust real estate growth.

Detailed Housing Price Growth Across NCR

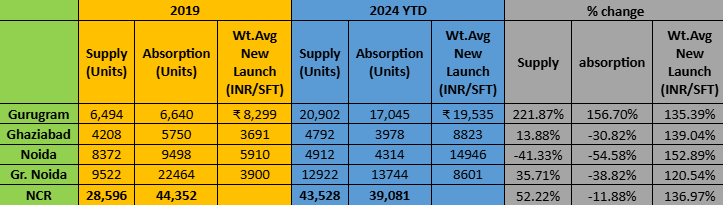

According to data released by NSE-listed PropEquity, the housing price increases from 2019 to September 2024 are as follows:

- Noida: 152% increase (from ₹5,910 per sq. ft. in 2019 to ₹14,946 per sq. ft. in 2024)

- Ghaziabad: 139% increase (from ₹3,691 per sq. ft. in 2019 to ₹8,823 per sq. ft. in 2024)

- Gurugram: 135% increase (from ₹8,299 per sq. ft. in 2019 to ₹19,535 per sq. ft. in 2024)

- Greater Noida: 121% increase (from ₹3,900 per sq. ft. in 2019 to ₹8,601 per sq. ft. in 2024)

Commenting on this trend, Samir Jasuja, Founder and CEO of PropEquity, stated, “The NCR is witnessing an infrastructural metamorphosis never seen in decades, with developments like Noida International Airport, Dwarka Expressway, Delhi-Meerut Expressway, rapid rail, and metro expansion giving a much-needed fillip to all segments of real estate. The pandemic further gravitated investors’ money and homebuyers’ sentiments towards real estate. Additionally, the emergence of branded developers and government efforts have reinstated the confidence of investors, homebuyers, corporates, and brands in the NCR market. The NCR market will continue to outperform other tier-1 cities and attract more investment and expansion from branded developers.”

Supply and Absorption Trends

On the supply front, Noida experienced a decline of 41%, while Gurugram saw a remarkable 222% rise. Ghaziabad and Greater Noida reported increases of 14% and 36%, respectively. However, in terms of absorption, only Gurugram recorded growth of 157%, while Noida, Ghaziabad, and Greater Noida saw declines of 55%, 31%, and 39%, respectively.

"The unsold inventory has seen a consistent decline across all markets, with Noida, Greater Noida, and Ghaziabad witnessing significant reductions," Mr Jasuja added. He also highlighted the UP government's efforts in resolving the stalled project crisis, which has been instrumental in reducing inventory levels.

Challenges in the NCR Real Estate Market

Despite the positive trends, the NCR continues to face challenges related to stalled housing projects. PropEquity's report identifies 167 stalled projects in Greater Noida comprising 74,645 units, 103 stalled projects in Noida with 41,438 units, 50 stalled projects in Ghaziabad with 15,278 units, and 158 stalled projects in Gurugram with 52,509 units.

With ongoing infrastructure projects and government initiatives, the NCR real estate market is set for steady growth. The sharp rise in housing prices highlights the region’s increasing appeal to investors and homebuyers. While challenges like stalled projects persist, efforts by developers and authorities are expected to strengthen NCR’s standing as a top real estate market in India.

Image source- freepik.com

.png)