Delhi-NCR’s real estate market is undergoing a powerful and rare transformation. The luxury housing prices have increased by a phenomenal 72% between 2022 and 2025, according to ANAROCK, which is the steepest increase of all major Indian cities and is telling a very different story of how value is being created. Moreover, the area has experienced a 54% increase in the mid-range and premium housing segments and a 48% rise in the affordable segment, thus becoming the most aggressive growth market in real estate in the country.

However, these figures are not the only story the market is telling. They also reflect a change in the mindset of investors. Buyers are abandoning tightly packed, overbid areas and looking for emerging micro-markets that are shaped by infrastructure, connectivity, and long-term liveability. The trend is obvious: the NCR next wealth generation will come from the corridors that are built for the future and not the past.

The thing that makes 2026 so important is the timing. NCR is about to experience a delivery of peak infrastructures: new expressways are close to being completed, metro lines are going to extend more into suburbs, and airport-linked connectivity is going to change completely the patterns of mobility. This is precisely the type of ecosystem that speeds up value.

Moreover, the Dwarka Expressway is the one that most clearly benefits from the rise of all the new corridors. The corridor has become one of the most attractive real estate destinations of the region, and property prices have skyrocketed by 3.5 times between 2020 and 2025, as per the report by Square Yards. The sharp reversal, which signifies a 28% annual growth rate, is very indicative of the corridor’s shift of rapid evolution from a fledgling micro-market to one of the most in-demand residential destinations of NCR. The reason for the attraction lies in something very basic: a connectivity that really makes a difference in the everyday life. Besides, with a direct link to IGI Airport, Gurugram’s corporate hubs, and NH-8, the expressway has been a natural attraction for luxury and upper-mid homebuyers. As hospitality, retail, and office clusters are rapidly developing, the corridor is getting an ecosystem advantage.

In addition, the Noida–Greater Noida Expressway has a completely different, but equally attractive, investment story to tell. The metro’s rapid expansion and new multi-modal connectivity lines have made the corridor very accessible and, therefore, a natural choice for both residents and businesses. Its increasing concentration of Grade-A office spaces is attracting MNCs, GCCs, and fintech innovators, thus, creating a tenant pool that leads to rental stability and capital appreciation in the long run. With the likes of Media City, Film City, and major institutional hubs being the micro-market’s upcoming anchors, it is turning into a self-sufficient ecosystem. This corridor is the place that satisfies the needs of investors looking for a combination of stability and growth.

Sanjay Sharma, Director, SKA Group, says, “Over the past few years, the Noida–Greater Noida Expressway has transformed into one of NCR’s most strategically aligned real estate markets. You can feel the shift on the ground with better roads, faster metro access, and now the buzz around the Noida International Airport, which is already influencing how people view luxury housing here. Buyers are also now seeing Wave City Ghaziabad region as a smarter, future-focused bet. It's this rare combination of improving liveability and long-term value creation that makes this corridor stand out.”

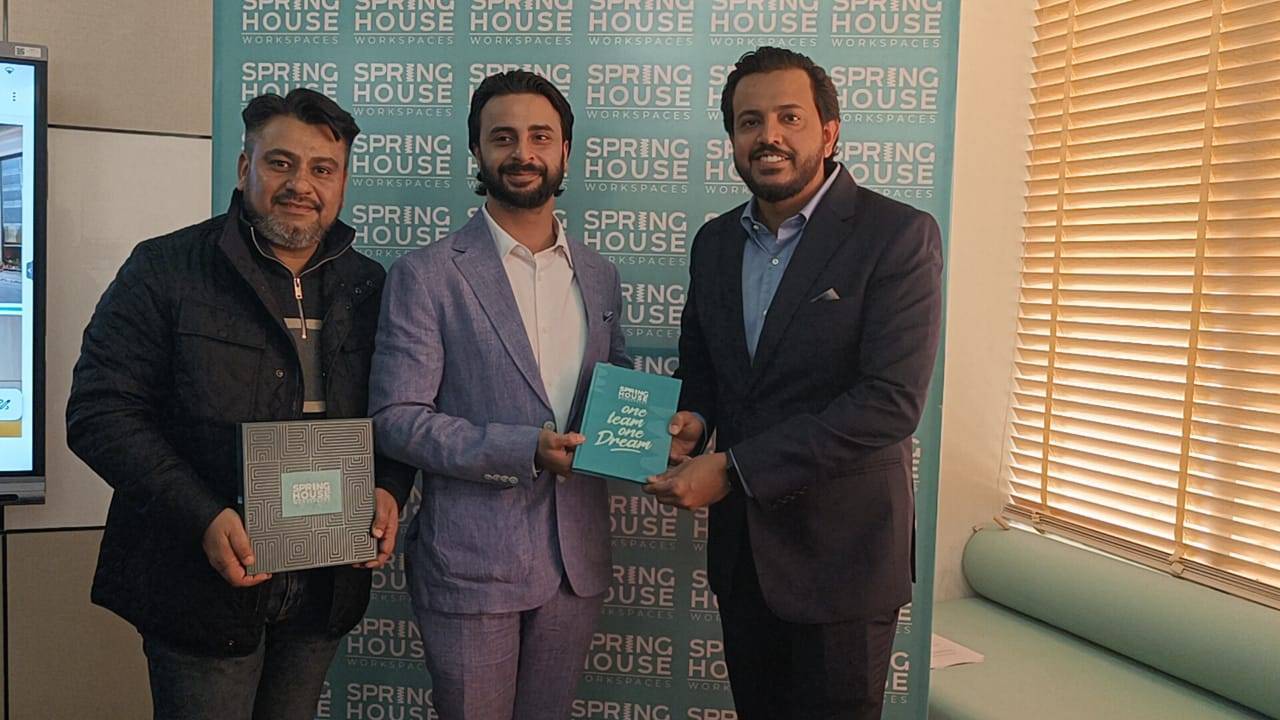

Ashok Singh Jaunapuriya, MD & CEO, SS Group, says, “In Gurugram, micro-markets like New Gurgaon are entering a decisive maturity phase, and it’s visible across both residential and commercial segments. On one hand, we’re seeing strong interest from corporate occupiers, co-working players and retail brands; on the other, families are choosing the area for its connectivity, planned layouts and improving social infrastructure. This dual momentum is pushing the market into a new orbit. With infrastructure strengthening and demand broadening, New Gurgaon is poised for standout ROI in 2026.”

Rajjath Goel, Managing Director, MRG Group, says, “The way the Dwarka Expressway has evolved over the years has been remarkable. It has become one of the most aspirational luxury housing corridors in the country. What we’re seeing is a clear shift in buyer behaviour: people want to stay close to the airport, major business districts, and still enjoy a cleaner, less congested lifestyle. And as premium retail and social infrastructure catch up, the area is gaining a lifestyle edge that goes beyond connectivity. For investors, the equation is straightforward — demand at the top end keeps rising, while supply remains limited. With several key deliveries lined up for 2025–26, the next wave of appreciation is already taking shape.”

In addition to this, the Yamuna Expressway is a distinctly different type of prospect that is predicated on the long term rather than the short-term spikes. Around the Noida International Airport, the whole belt is getting a facelift due to the expansive master plan of YEIDA that ranges from logistics and industrial corridors to tourism zones, data centers and a world-class sports city.

Moreover, according to MagicBricks data, the prices along the expressway near the Jewar airport have increased from Rs 4,564 per square foot in 2023 to Rs 8,923 per square foot in 2025. Such a scale of planning opens a rare early-mover window where the entry prices of today can turn into considerable profits by 2027–2030. Therefore, the Yamuna Expressway is turning out to be NCR’s next multi-decade growth engine for investors with the ability to wait and who have the foresight.

Vishal Sabharwal, Head Sales, Orris Group, says, “The Yamuna Expressway is entering a phase we typically see only once in a generation, when massive infrastructure, global-scale development and rising lifestyle aspirations converge. The upcoming Noida International Airport and YEIDA’s master planning are transforming the region into a long-term luxury destination. We’re seeing early demand for curated townships, premium plotted developments and low-rise luxury formats. Investors are recognising that this corridor offers both scale and scarcity, reflecting ‘before the boom’ moment prices. As the airport goes live and supporting ecosystems take shape, the Yamuna Expressway will emerge as one of NCR’s strongest wealth creators.”

Paras Rai - Co-Founder & Managing Director, Property Master, says, “A lot of investors still look at NCR through an old lens, but the shift is already underway. Today, value is being created along infrastructure corridors, not in traditional saturated pockets. What we suggest end-users is simple: follow the roads, the rail, and the airport. Corridors like Dwarka Expressway and Yamuna Expressway are becoming structured growth markets. Areas like Faridabad are also serving a different purpose, whether it’s luxury housing, stable rentals, or long-term land value appreciation. For 2026, the smartest investments will be those made early in micro-markets where infrastructure visibility is already translating into real demand.”

2026 will be a year to remember for the National Capital Region. One of the most prominent themes is certainly the importance infrastructure-led corridors will have for the investors. The micro-markets are like different books of returns on investments; some are capable of showing a fast rise in residential value, while others give the possibility of stable commercial yields, and some few are only suitable for long-term wealth creation. However, when combined, they are pointing to a relocation of the next chapter of growth in the region.

.png)