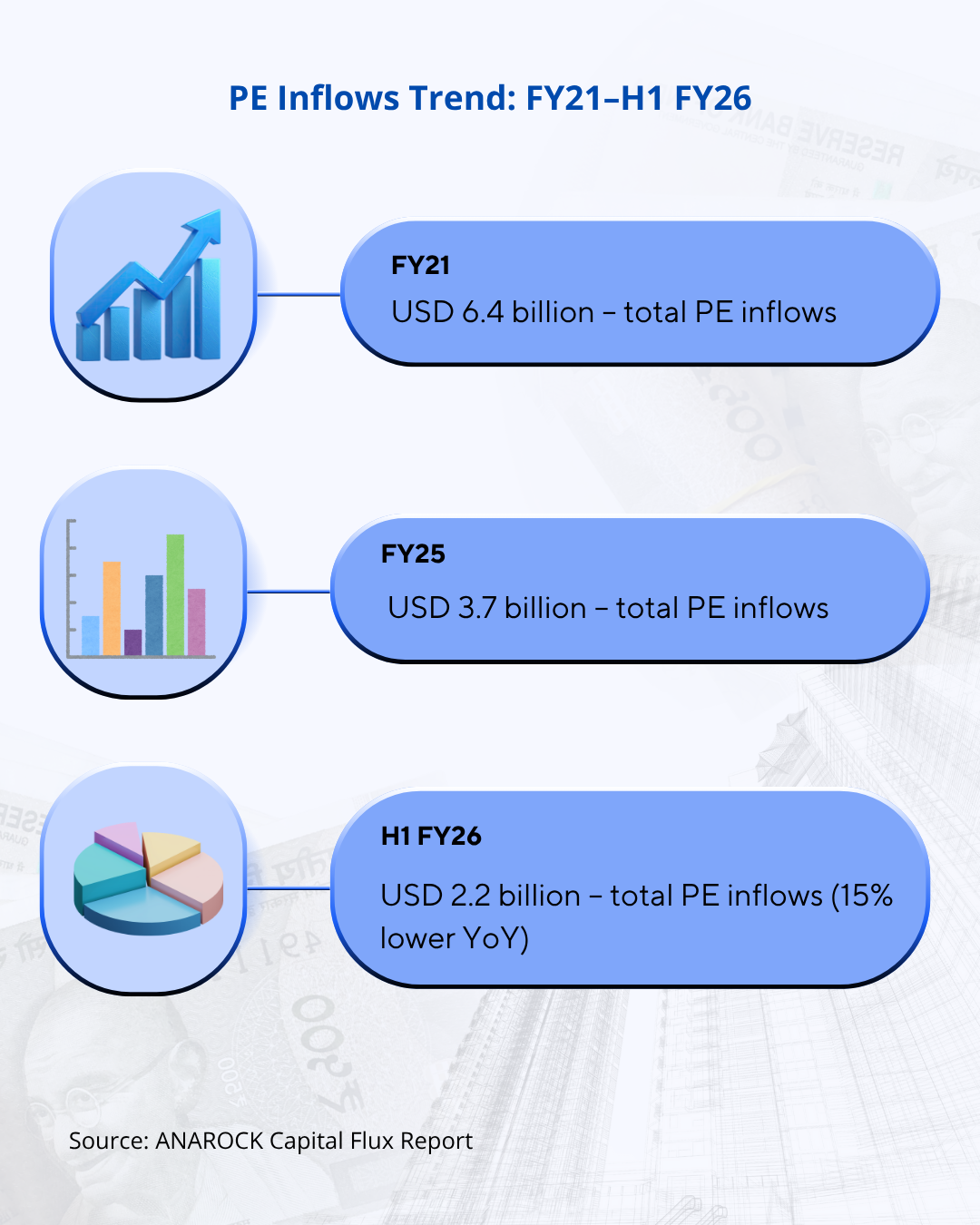

Private equity (PE) inflows into India’s real estate sector declined by 15% year-on-year in the first half of fiscal year 2025-26, reflecting a slowdown in transaction activity despite stable deal sizes, according to the latest ANAROCK Capital Flux report. The report indicates that total PE investments reached USD 2.2 billion during H1 FY26, down from USD 2.6 billion in the same period last year. Average deal sizes remained in the range of USD 60–100 million, highlighting that while fewer transactions were completed, significant capital continued to flow into prominent deals.

The report notes a long-term moderation in India’s real estate private equity inflows. PE investments in the sector have gradually reduced from USD 6.4 billion in FY21 to USD 3.7 billion in FY25, indicating a more cautious investor approach amid market corrections and economic uncertainty. Despite a relatively strong start in Q1 FY26, momentum slowed in the second quarter, underscoring the uneven nature of capital deployment in the sector.

A deeper analysis of the data reveals that the decline in overall PE activity was primarily driven by a lower number of transactions rather than a drop in the size of individual deals. The top ten PE deals accounted for 77% of total investment in H1 FY26, compared to 93% during the same period in the previous year. This trend suggests a gradual broadening of capital distribution across multiple deals, as investors increasingly explore mid-sized and emerging opportunities beyond marquee projects.

Geographically, the Mumbai Metropolitan Region (MMR) and Kolkata emerged as the most active hubs for private equity activity, accounting for 33% and 17% of deals, respectively. In contrast, pan-India or multi-city transactions witnessed a steep decline, falling from 51% to just 7% of total deal activity. This shift indicates a preference among investors for localized, high-potential micro-markets over larger, multi-location portfolios.

Sectorally, retail, mixed-use developments, commercial offices, hotels, and data centres became the preferred asset classes for PE investments, while industrial and logistics sectors did not witness any institutional transactions during the review period. Equity investments dominated the PE landscape, making up 78% of total investments. Additionally, foreign capital played a significant role, contributing 73% of PE inflows in H1 FY26, up from 65% in FY25, reflecting a growing interest from international investors in India’s real estate market. The report also highlighted an increasing trend of joint domestic-foreign investments, signaling collaborative strategies among investors despite an overall market slowdown.

Within individual real estate segments, residential properties entered a consolidation phase, with new launches and sales moderating, though investor interest remained buoyed by India’s economic growth and sector formalization. Commercial properties witnessed robust leasing momentum, particularly in Grade A office spaces and co-working segments, attracting USD 869 million in PE capital during H1 FY26.

Retail assets remained resilient, supported by healthy operating metrics and high-quality transactions, including deals by Nexus Select and Blackstone. India’s REIT market also displayed strong performance, with listed REITs appreciating by 15–27% and maintaining stable yields between 5–6%. H1 FY26 additionally saw the successful listing of Knowledge Realty Trust, the fifth Indian REIT, which was oversubscribed 12.5 times, reflecting sustained investor confidence in the sector.

ANAROCK report anticipates steady investor engagement in the medium term, particularly in key asset classes such as commercial offices, retail, and REITs. The evolving asset mix, combined with rising domestic-foreign collaboration, is expected to shape the next growth phase for India’s real estate investment landscape.

Image- freepik.com

.png)