Home affordability for Indian buyers has experienced an improvement in 2025, mainly owing to lower interest rates on housing loans as well as an increase in the average salary of the Indian, as observed in the latest report by Knight Frank India on their Affordability Index. This really demonstrates confidence among buyers, giving the housing market momentum for 2026, as the outlook for the market looks positive.

One of the prime drivers of the conducive affordability scenario has been the monetary easing cycle initiated by the Reserve Bank of India. Since February 2025, the RBI has cumulatively cut the policy repo rates by 125 basis points, halting the process of tightening that began in mid-2022 as a strategy to contain inflation. This has resulted in lowering home-loan rates, thereby substantially reducing the EMI burden on home buyers.

According to the report, this supportive interest rate scenario has contributed significantly to the recovery of affordability levels, which were temporarily affected during the 2022-23 cycle of interest rate hikes. With inflation on a downward trajectory while the economy is growing steadily, the RBI’s prudent easing has come as a godsend to the housing market, which is the most sensitive to interest rates.

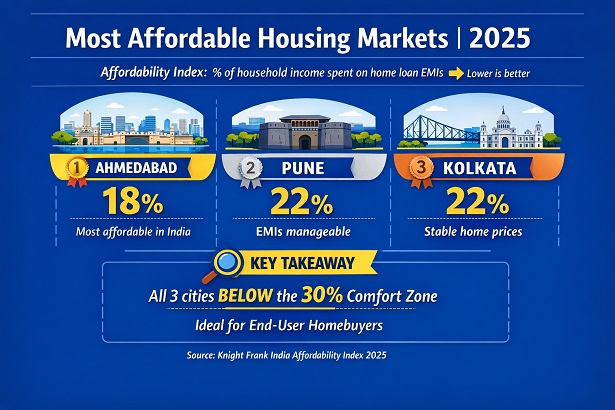

Ahmedabad Tops as the Most Affordable City

Amongst the total of eight major Indian cities analyzed by Knight Frank India, Ahmedabad has been identified to be the most affordable real estate destination in the year 2025. This city had an affordability index ratio of just 18%, which suggests that not very much of the income of households was being consumed in repaying EMIs of the housing loan. The other two cities that followed closely- Pune & Kolkata had an affordability ratio of 22% each.

These cities offer the advantages of relatively moderate house prices, diversified employment patterns, and increasing levels of earnings. Of course, the relationship between house prices and wages has remained well balanced, ensuring that affordability still stays within sustainable levels, despite rising demand.

Mumbai Breaks an Historical Record

Among the most notable trends highlighted by the report is the improvement in Mumbai from a housing affordability perspective. Long regarded as the least affordable housing market in India, the EMI-to-income ratio for Maharashtra's largest metropolis has reduced to 47% in 2025—the first time it has ever gone below 50%, which is generally seen as a much healthier level for buyers to absorb from a financing perspective.

This is because the scenario is not only driven by the reduction in interest rates, but there is a gradual increase in the income levels of the urban population and a moderate escalation in prices as well. Although Mumbai is still an expensive city, the outlook suggests that the city is in a new era where there is structural affordability.

According to the Affordability Index launched by Knight Frank, the percentage of EMI paid on income, the affordability of housing in big cities witnessed an improvement in the periods 2010 – 2021. Further, the COVID-19 crisis brought an acceleration in this process when the RBI cut policy rates to historic lows in a decade.

However, in an attempt to manage the rise in the prices, the central authority had to raise the repo rate by 250 basis points within nine months from May 2022. However, due to stability in interest rates from February 2023, affordability trended towards optimal levels and ensured smooth growth momentum in 2025.

Income Growth Builds Consumer Confidence

According to Shishir Baijal, International Partner, Chairman & Managing Director, Knight Frank India, supportive affordability is key to sustaining homebuyer demand and sales momentum, which drives economic growth. He notes that while both weighted average property prices and income levels have risen in recent years, home loan interest rates have declined following the repo rate, which fell by 125 basis points this year. With income levels improving faster and interest rates reducing, overall home affordability has strengthened.

Housing Sales Remain Close to Record High

The conducive affordability context has ensured that residential sales remain around the same levels as the aftermath of the pandemic, that is, close to the highest levels reached in 2024. Though speculations were rising at the start of 2025 that either overheating or correction might follow, the segment remains resilient. Knight Frank is of the opinion that the residential segment will end the year without any turbulence.

This report is supplemented by the fact that the stability of India’s wider macroeconomic environment has been an important driver of housing demand levels. This is created from a controlled inflation environment, a job market on an upbeat streak of hiring, and an ever-growing GDP scale.

Accordomg to, Mr. Lalit Parihar, managing director, Aaiji Group, a Dholera-based real estate firm, "Over the past fifteen years, Ahmedabad has steadily emerged as one of India’s most affordable yet fast-growing residential markets. The city’s strong economic momentum—driven largely by industrial expansion, including semiconductor manufacturing, and major infrastructure upgrades—has fueled a sustained rise in household incomes. Combined with measured, consistent price appreciation, these factors have created a market where homeownership remains both desirable and attainable.

Looking ahead, Ahmedabad is poised to maintain its leadership in affordability and livability. Large-scale infrastructure investments tied to the upcoming Commonwealth Games, along with continued growth in employment-generating industries, are expected to attract greater migration and further expand the city’s economic base. Together, these dynamics are paving the way for a new generation of smart, sustainable communities that will define the city’s next chapter."

Future Prospects for the Year 2026

With the RBI forecast for GDP at 7.3 percent for the year FY2026 and low interest rates, the levels for affordability would continue to favor demand in the buying of homes. Even though there may be appreciations in prices for desired locations in the micro-markets, the levels for the rest would continue to be in the comfortable zones. Conclusion: Notably, the simultaneous effects of lower home loan rates, increasing earnings, and an overall stable macro environment have ensured a favoring cycle of affordability for 2025. With the rising cycle of affordability in seven major cities of India, the residential real estate market exhibits immense potential for growth for both wealth generation within the household sector as well as overall development.

.png)