India’s expanding wealth landscape has been mapped out in the newly released Mercedes-Benz Hurun India Wealth Report 2025, which shows a sharp rise in millionaire households across the country. Mumbai has emerged at the forefront with the largest concentration of affluent families, strengthening its position as the financial capital and a global wealth hub in the making.

According to the report, India is now home to 8,71,700 millionaire households, defined as families with a net worth of at least ₹8.5 crore. This marks a 90% jump compared with 2021, when the figure stood at 4,58,000 households. Millionaires today account for about 0.31% of total households, up from 0.17% four years ago, highlighting the rapid pace of wealth creation.

The trend is expected to continue in the years ahead, with economic momentum, corporate expansion, and urban real estate growth providing fertile ground for further additions to India’s high-net-worth population.

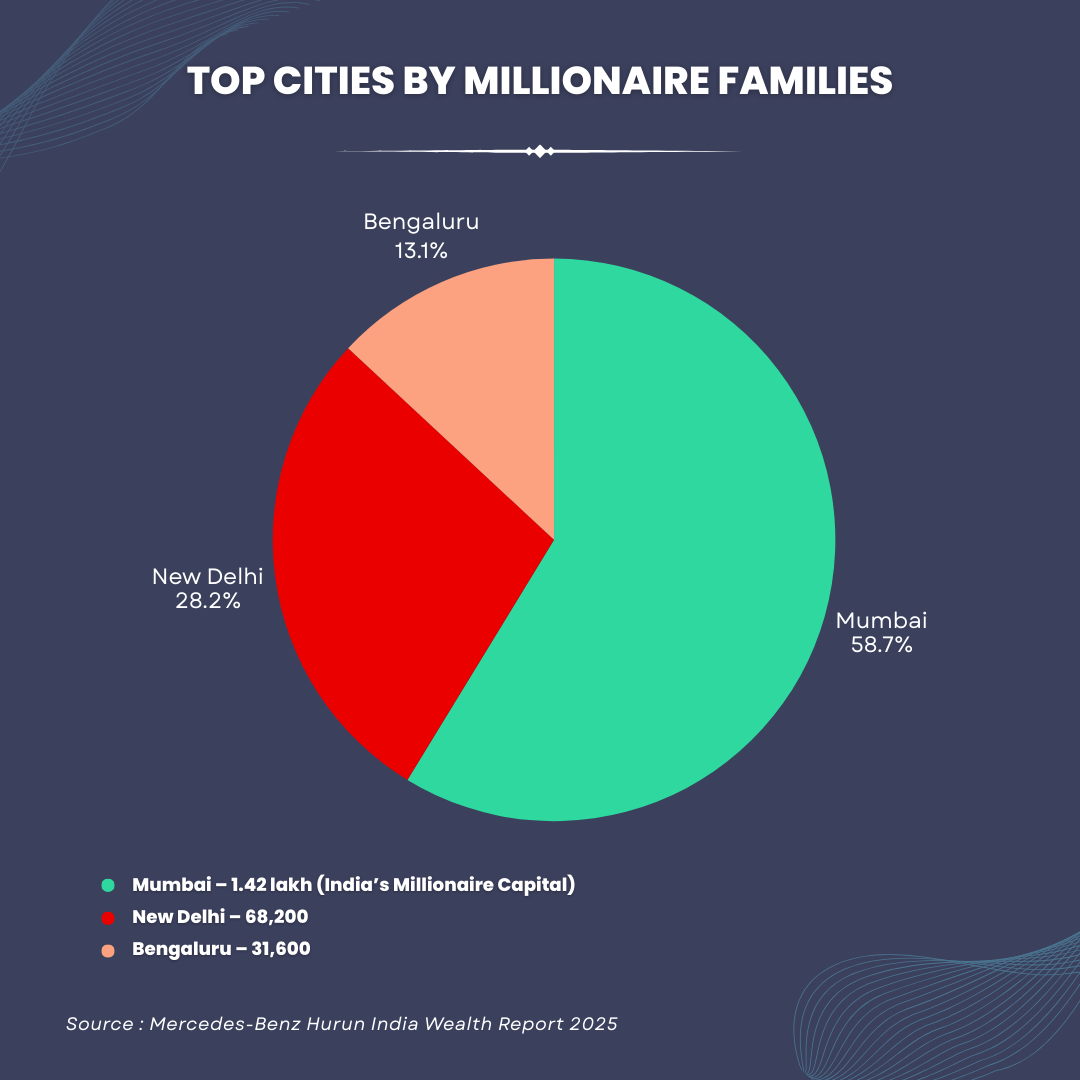

City-Wise Distribution of Wealth

Mumbai leads the millionaire tally with 1.42 lakh families, followed by New Delhi with 68,200 households, and Bengaluru with 31,600 households. Together, these three cities form the core of India’s affluent class.

At the state level, Maharashtra dominates with 1,78,600 millionaire households, buoyed by a 55% rise in its Gross State Domestic Product (GSDP) since 2020–21. Much of this is concentrated in Mumbai, reinforcing the city’s role as the country’s premier financial and investment hub.

The report also notes that Mumbai is increasingly seen as a leading global city of the coming decade, ahead of international peers such as New York, London, and even Delhi in perception surveys among wealthy respondents.

Investment Preferences of Millionaires

The Mercedes-Benz Hurun India Luxury Consumer Survey 2025, conducted alongside the wealth report, highlights the evolving investment priorities of affluent Indians. Based on responses from 150 millionaires with an average age of 32 years, the findings show:

- 22% prefer investing in stocks

- 21% choose real estate

- 18% favour gold

- 13% plan to invest in start-ups

Looking ahead, 51% of respondents expect the real estate market to grow in the next two years, while 38% believe it will remain stable. This signals confidence in property as a long-term asset class, particularly in high-demand urban centres such as Mumbai, Delhi, and Bengaluru.

Lifestyle and Consumption Patterns

The survey also sheds light on luxury consumption habits. Among India’s wealthy, 64% live in residences exceeding 100,000 sq. ft., with many occupying homes that span between 100,000 to 500,000 sq. ft. This reflects both lifestyle aspirations and the centrality of real estate in wealth preservation.

Luxury automobiles, branded residences, and global travel remain strong components of discretionary spending, underlining the role of consumer aspirations in driving demand for premium goods and services.

Global Comparison and Future Potential

Despite the surge, India’s millionaire base remains modest when compared with global leaders. China is estimated to have around 5.1 million millionaire households, while the United States has an even larger pool. However, the report frames this gap not as a shortfall but as a growth runway.

With the economy projected to double over the next decade, the number of Indian millionaire households could rise to 1.7–2 million by 2035, effectively doubling from current levels.

The findings carry important implications for real estate developers, financial institutions, and policymakers. The strong preference for property among millionaires, combined with expectations of sustained growth, indicates continued demand for luxury housing, gated communities, and branded residences.

At the same time, equity markets and alternative assets such as start-ups are gaining traction, reflecting the younger demographic profile of India’s wealthy. The average age of 32 highlights a generation that is digitally connected, investment-savvy, and willing to explore new asset classes alongside traditional holdings.

Broader Economic Context

The surge in millionaire households is being driven by several macro factors, including rising GDP, growth in the stock market, urbanisation, and wealth generation in technology and services sectors. The rise of India’s domestic market, coupled with global investor interest, is also contributing to this wealth expansion.

As states such as Maharashtra, Karnataka, and Delhi NCR continue to consolidate their economic dominance, the concentration of millionaires in urban clusters is expected to deepen. This will have downstream effects on luxury housing demand, premium retail expansion, and infrastructure needs.

The Mercedes-Benz Hurun India Wealth Report 2025 underscores the rapid rise of India’s millionaire class, with Mumbai cementing its position as the nation’s wealth capital. With nearly 8.72 lakh millionaire households today and projections of doubling in the next decade, India is firmly on a trajectory of expanding affluence.

For real estate, financial markets, and luxury consumption, the trends highlighted in the report point to strong and sustained demand. At the same time, India’s global standing as a wealth hub is rising, positioning cities like Mumbai not only as national leaders but as global centres of economic influence in the coming years.

.png)