India’s residential real estate market continued to show resilience in the July–September quarter of 2025, driven by rising demand for premium and luxury homes. According to Knight Frank India’s quarterly report, homes priced above ₹1 crore formed 52% of total sales across the top eight cities, the first time the premium category has overtaken the sub-₹1 crore segment, which fell to 48%.

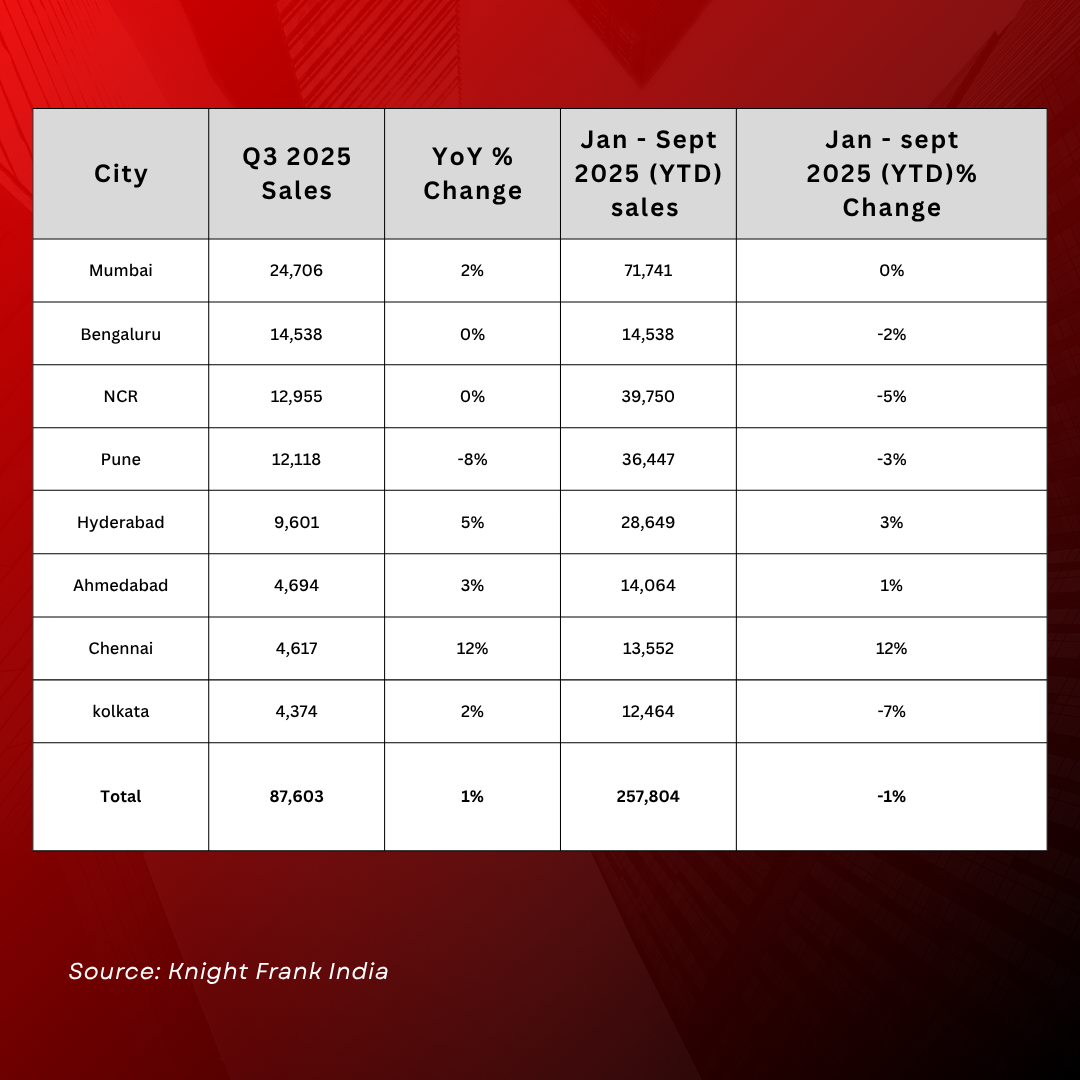

A total of 87,603 units were sold during the quarter, representing a marginal 1% year-on-year increase, even as new launches dipped by 2% to 88,655 units. The shift towards larger, high-value properties was evident across all metros, reflecting evolving consumer preferences and improved affordability due to stable interest rates.

NCR, Bengaluru, and Hyderabad Drive Price Growth

The National Capital Region (NCR) recorded the sharpest price rise at 19% year-on-year, followed by Bengaluru at 15% and Hyderabad at 13%. Price momentum was supported by limited supply, steady absorption, and a preference for projects in established micro-markets with strong infrastructure connectivity.

Mumbai remained the largest housing market, contributing 28% of total national sales with 24,706 units sold, up 2% from the previous year. Bengaluru registered 14,538 units, maintaining stable volumes, while NCR saw 12,955 units sold. Hyderabad followed with 9,601 units, up 5% year-on-year. Chennai reported the fastest growth rate of 12%, selling 4,617 units — its highest since the pandemic. Pune was the only major market to post a decline, with sales down 8% to 12,118 units.

Shift Toward Larger and Premium Units

Knight Frank’s data shows the ₹1–2 crore segment led the market, growing 17% year-on-year, while homes priced below ₹1 crore declined. In contrast, the ultra-luxury segment (₹10–20 crore) witnessed an exceptional 170% jump in sales, highlighting robust demand among affluent buyers in metro cities.

Industry analysts attribute the trend to rising incomes, urban lifestyle shifts, and improved access to credit. Developers are responding with flexible financing schemes, including subvention offers and partnerships with banks, to support end-user affordability.

The report notes that the housing upcycle, which began in 2021, has now entered its fifth consecutive year, supported by steady end-user demand. Gulam Zia, Senior Executive Director – Valuation, Advisory and Research at Knight Frank India, observed that premium housing has become the dominant segment, accounting for more than half of all sales this quarter. He added that the strong performance of the ₹1–2 crore category indicates a structural change in urban home-buying behaviour.

Macroeconomic Stability Supporting Demand

The study credits the sector’s stability to favourable macroeconomic conditions. Consumer confidence has been boosted by easing inflation, which fell to 2.07% in August 2025, and a 1% reduction in the RBI’s repo rate since late 2024. Lower borrowing costs and improved liquidity have enabled both developers and buyers to sustain momentum despite higher prices.

Shishir Baijal, Chairman and Managing Director of Knight Frank India, observed that the market has shown “an impressive ability to sustain momentum,” reflecting evolving aspirations for larger and better-quality homes. The demand shift is also supported by the expansion of employment in technology, financial services, and global capability centres, particularly in Bengaluru, Hyderabad, and NCR.

India’s unsold housing inventory rose slightly by 4% year-on-year to 5.06 lakh units, but market health indicators remain stable. The Quarters to Sell (QTS) ratio stood at 5.8 quarters, equivalent to less than 18 months of available stock — a level considered balanced by industry standards.

Inventory accumulation was largely seen in higher price segments, especially between ₹2–5 crore, as developers continue to launch premium projects anticipating sustained buyer interest. Analysts believe that the sector’s long-term fundamentals remain sound. With homebuyers showing a clear preference for spacious layouts, integrated amenities, and well-connected locations, developers are expected to maintain their focus on the mid-premium and luxury categories through 2026.

Despite a moderation in new supply, the Indian housing market remains on a strong footing. The combination of favourable credit conditions, economic stability, and consumer preference for premium housing is expected to sustain growth momentum in the coming quarters. Analysts anticipate that festive-season demand, supported by new project launches and financing incentives, will further boost sales in the final quarter of 2025.

.png)