India’s data centre (DC) capacity has exceeded 1.5 gigawatts (GW) for the very first time, as a result of the fast digital transformation, AI adoption, and a vigorous policy push from both the central and state governments, as per real estate consultancy CBRE.

The largest part of the data centre capacity remains in Mumbai, which is responsible for 53% (1,530 MW) of the existing capacity as of September 2025. Rest three major cities i.e. Chennai, Delhi-NCR, and Bengaluru are comprising 37% of the total capacity together.

“India’s data centre capacity has seen significant growth in the last four to five years, mirroring the country's rapid digital transformation,” said Anshuman Magazine, Chairman and CEO, India, South-East Asia, Middle East & Africa, CBRE. “This is being supported by government policies and data localisation norms, positioning India as a key hub for global as well as domestic investors.”

Data Centre Growth Accelerates Amid Digital Surge

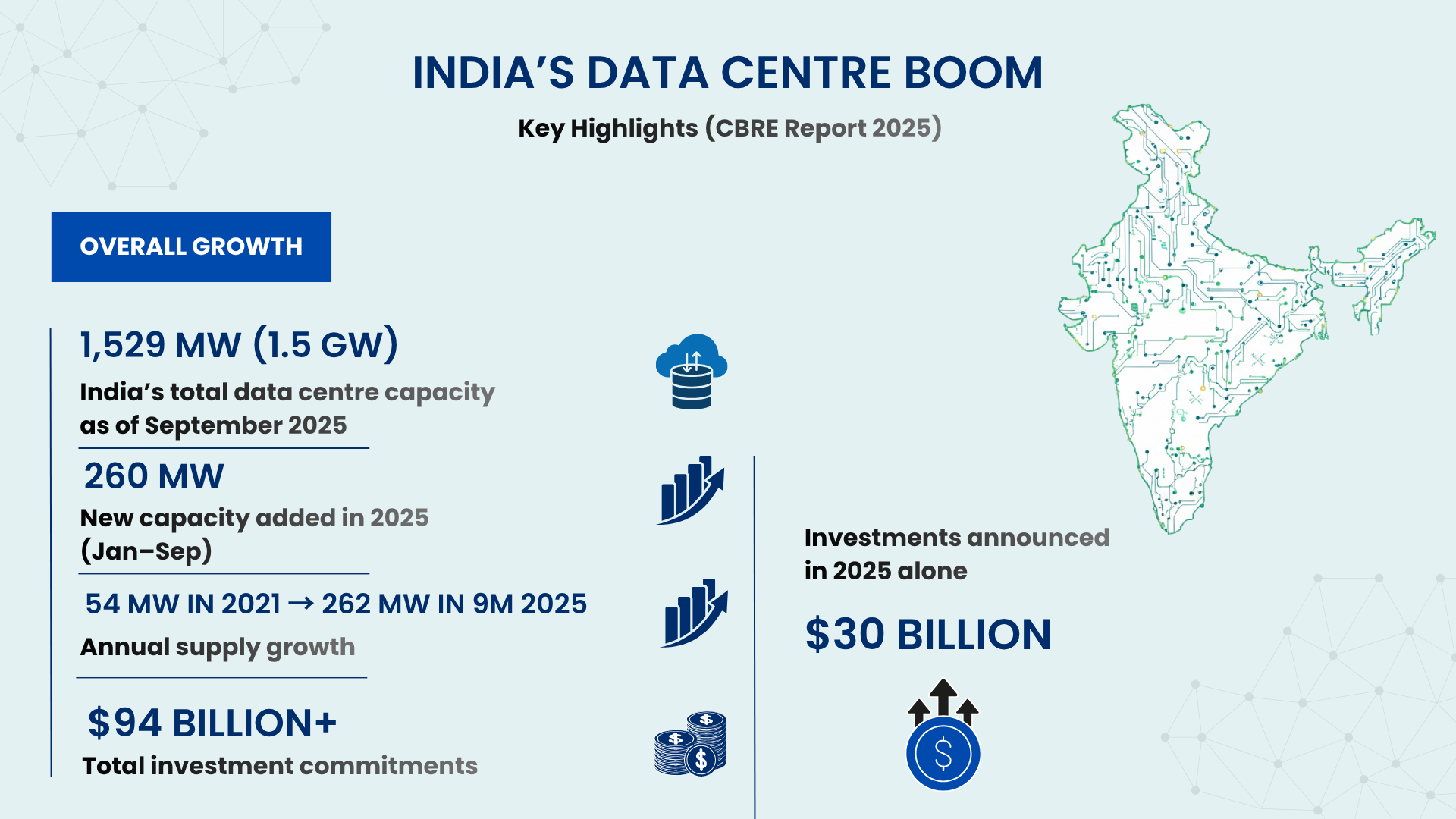

The report titled India’s Data Centre Market in a New Era, revealed that India has added nearly 260 MW of new capacity during the first nine months of 2025, thus increasing the total operational stock to 1,529 MW. As per the country, it is now one of the fastest-growing DC markets worldwide and is only behind the U.S. and China in terms of capacity pipeline for the next period.

The report explains that the surge has been supported by an unprecedented increase in data consumption, the launch of 5G, cloud adoption across enterprises, and AI-driven computing workloads. It is noted how states like Telangana, Maharashtra, and Tamil Nadu in India have turned into the major hyperscale and colocation DC projects locations. This is due to the policies favourable to such projects, the abundance of power, and the strategic connectivity.

As per the CBRE report, Mumbai continues to be the data centre hub of India. The city is responsible for about 53% of the total data centre activities in India based on its proximity to global internet exchange points and submarine cable landing stations that facilitate low-latency connectivity.

Chennai is next with 20% of the share due to its lively undersea cable ecosystem and strong infrastructure. The data centre markets in Delhi-NCR (10%) and Bengaluru (7%) are the other two big ones in India.

The data from CBRE reflects the significant capacity additions yearly to the tune of nearly five times over the past four years. It was 54 MW in 2021 and has grown to 262 MW in the first nine months of 2025, thus, highlighting the speed with which developers and investors are expanding.

India’s Cost and Talent Edge in the Global Market

The report pointed out that India remains one of the most cost-competitive DC destinations globally, offering significantly lower construction and electricity costs compared to other Asia-Pacific markets such as Singapore, China, and Japan.

Additionally, the country’s large and skilled digital workforce has emerged as a major competitive advantage. India now accounts for 16% of the global AI talent base, with over 600,000 professionals working in the field, a number expected to double by 2027, according to CBRE’s projections.

The report underscored the transformative impact of Generative AI, which is expected to reshape the DC demand landscape in India.

“Generative AI holds significant potential for the country's economy and is poised to unleash the next wave of data centre demand,” said Ram Chandnani, Managing Director, Leasing, CBRE India. “AI is also impacting global capability centres, helping them focus on automation, talent transformation, and cost optimisation,” he added.

As AI workloads become more data-intensive, hyperscale operators and enterprise users are expected to demand higher power density facilities and AI-ready infrastructure, CBRE noted.

Policy Support and Tier-2 Expansion Ahead

One of the major elements that led to the influx of money was the government's emphasis on improving digital infrastructure, protecting data, and encouraging DC investments through policies like the National Data Centre Policy.

Besides that, states like Maharashtra, Tamil Nadu, Uttar Pradesh, and Telangana have formulated such DC policies that provide subsidies on land, incentivise power use, and offer single-window clearances. With the growth of metro markets, developers are now looking more into Tier-2 areas like Pune, Hyderabad, and Ahmedabad for their next projects, according to CBRE.

“With digitalisation and AI adoption expected to only go up, India is likely to emerge as one of the biggest data centre markets globally,” said Anshuman Magazine.

The various voices in the industry foresee a scenario where the on-ground DC capacity in India could be more than 3 GW, thus the figure might get doubled by 2028 as the trend of enterprises, hyperscalers, and cloud providers expanding their digital footprints will continue unabated.

.png)