Key highlights from Vestian’s 2025 Indian real estate investment report

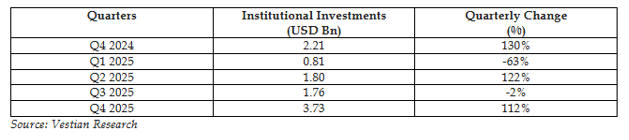

- Record inflows: Institutional investments hit an all-time high of USD 8.1 Bn in 2025, led by a historic USD 3.73 Bn in Q4, reflecting strong investor confidence.

- Sustainability focus: 13% of Q4 investments went into sustainable developments, with over 20% of foreign capital aligned with ESG and green projects.

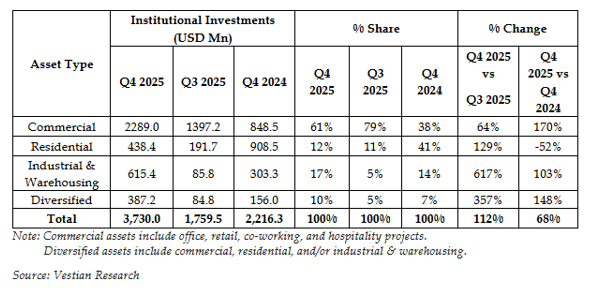

- Commercial dominance: Commercial assets led with a 63% share (USD 5.1 Bn) in 2025, driven by robust GCC demand.

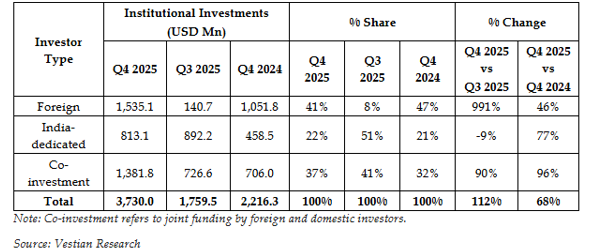

- Balanced investor base: Foreign inflows surged 10x Q-o-Q, co-investments grew 90%, while domestic capital touched USD 2.4 Bn, ensuring market stability.

India’s real estate sector attracted the highest-ever institutional investments of USD 8.1 Bn in 2025, anchored by an all-time high quarterly investment of USD 3.73 Bn in Q4 2025. Institutional investments in 2025 increased by 88% over 2023 and 19% compared to 2024, while the quarterly investments soared by 112% in Q4 2025 compared to the preceding quarter. Interestingly, 13% of the total quarterly investments were allocated towards sustainable project development, signalling investors’ decisive push to embed sustainability into real estate development.

Commercial assets accounted for 63% of the overall investments in 2025, rising from 35% a year earlier. In terms of value, it rose by 113% to nearly USD 5.1 Bn. Additionally, commercial assets continued to attract the largest share of investments in Q4 2025, owing to robust demand from GCCs. It accounted for 61% of total inflows, valued at USD 2.3 Bn.

Even though the share of investments in the residential sector remained relatively stable in the last quarter of 2025 compared to the previous quarter, investments increased by 129% to USD 438.4 Mn in terms of value.

Investments in the industrial and warehousing sector surged more than sevenfold Q-o-Q to USD 615 Mn, driven by strong demand for logistics parks amid peak domestic consumption across India. The sector’s share in total investments also rose to 17% in Q4 2025 from 5% in the previous quarter.

Foreign investments increased by more than 10 times to USD 1.5 Bn in Q4 2025 compared to the previous quarter, where over 20% of the quarterly investments were dedicated towards sustainability. As foreign investors remained cautious amid global uncertainties, co-investments surged sharply by 90% Q-o-Q to USD 1.38 Bn in Q4 2025. Concurrently, domestic investors continued to demonstrate confidence in the market, with cumulative inflows in 2025 increasing 18% Y-o-Y to nearly USD 2.4 Bn.

Investor Type

Shrinivas Rao, FRICS, CEO, Vestian said, “The record USD 8.1 billion in institutional investments recorded in 2025 reinforces sustained investor confidence in India’s long-term economic fundamentals. As capital increasingly aligns with sustainability-led development, sustained GCC-driven occupier demand, and rising domestic participation, Indian real estate continues to evolve into a resilient, diversified, and future ready investment market."

Looking ahead, the real estate investment sector of India is all set to continue its transformation deep into sustainability, led and asset, diversified growth, with strong GCC occupier demand, rising logistics and warehousing requirements, and increasing harmony of foreign capital with ESG, focused development acting as catalysts. With global investors slowly getting back their risk appetite, co, investment structures and green, focused funding are anticipated to pick up more traction, whereas domestic capital is likely to keep the market stable. Besides that, policy support, better transparency, and greater use of green construction methods will probably help India to become a resilient real estate investment destination that is not only future, ready but also capable of attracting long, term institutional capital through all cycles.

Image- unsplash.com

.png)