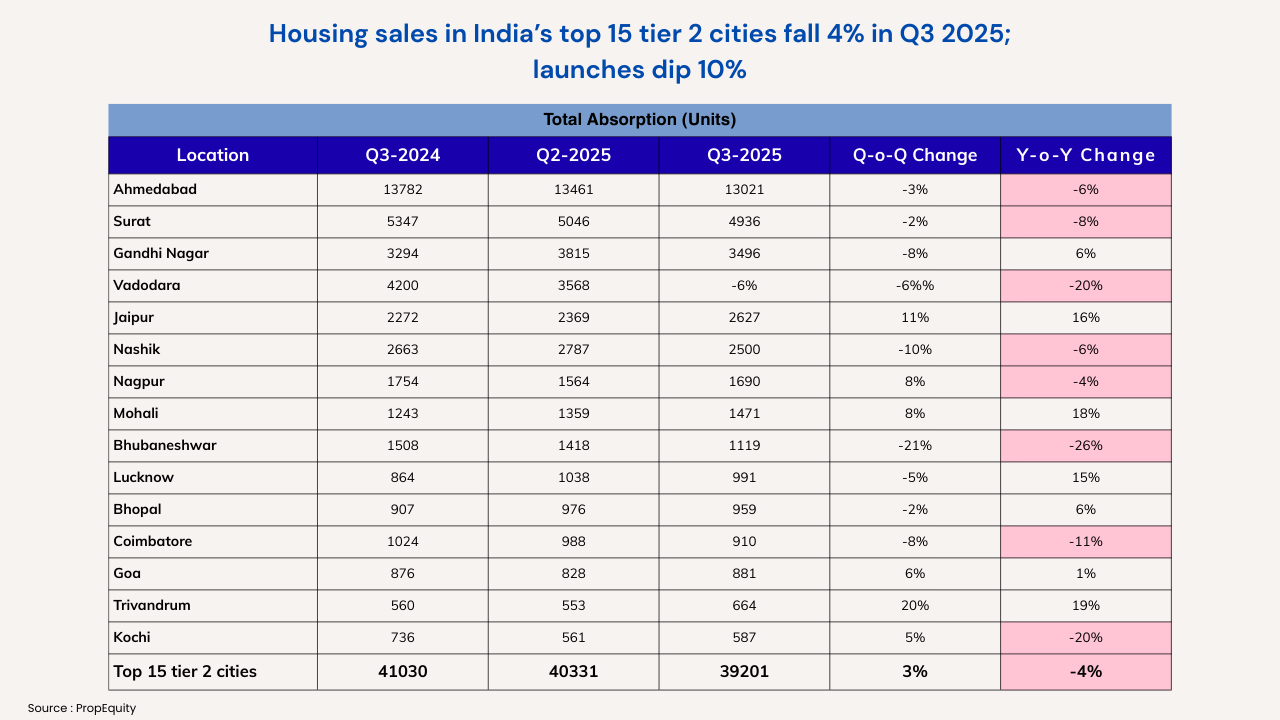

Housing sales in India’s top 15 tier 2 cities fell 4% YoY to 39,201 units in Q3 2025 even as the sales value rose by 4% to Rs 37,409 crore indicating a gradual shift towards premium homes, according to a report by NSE-listed real estate data analytics firm PropEquity.

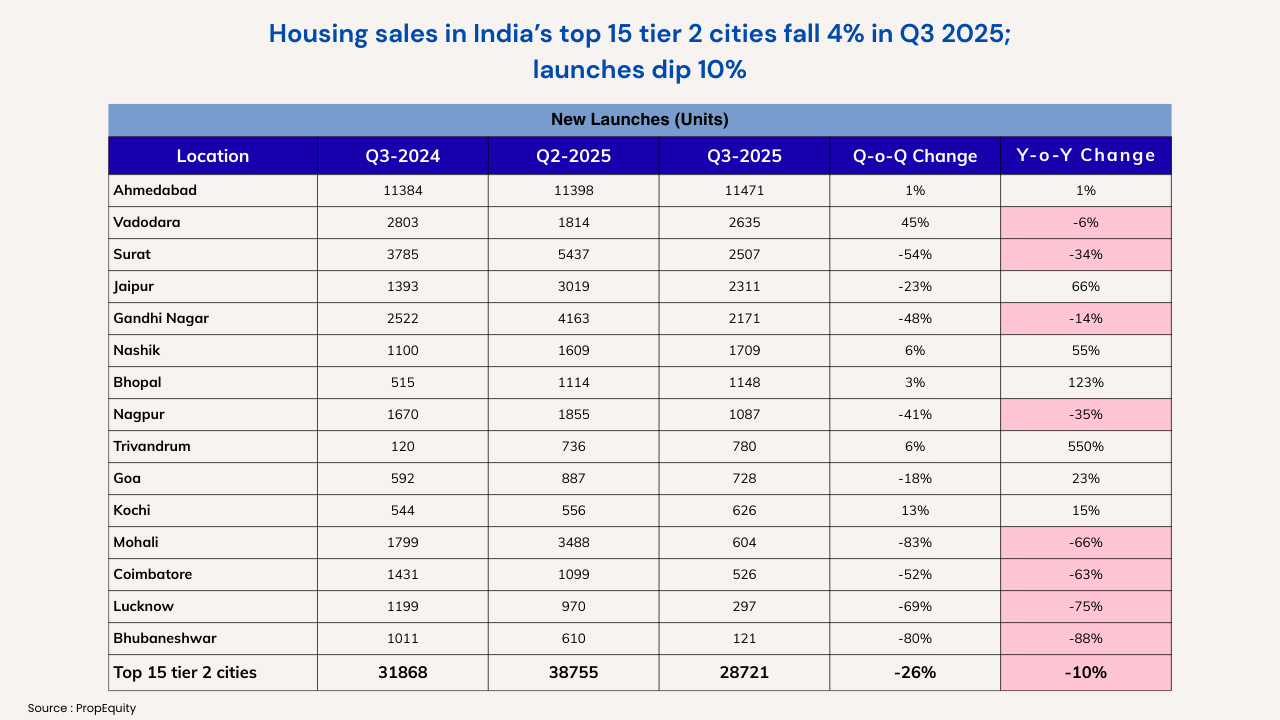

New supply was down 10% year-on-year to 28,721 units in the third quarter ending September 2025, indicating that developers had become more cautious in the mid-income and affordable segments. Year-on-year, seven cities out of the 15 witnessed a drop in sales, with Bhubaneshwar recording a 26% decline in sales, while Trivandrum seeing a 19% increase, thus indicating the emergence of southern markets with pockets of demand that continue to grow.

Besides Bhubaneshwar which had an 88% plunge in new launches, the majority of cities (8 out of 15) also saw new launches trending downwards. As a result of robust tier-2 residential activities, Ahmedabad is still leading the way in terms of both sales and new launches, a prominent hub for the continuation of the trend.

Samir Jasuja, Founder & CEO, PropEquity said, “There has been a steady decline in new housing launches, especially in the high-volume affordable and mid-income segments. With rising input costs and evolving consumer aspirations pushing up home prices and home sizes, sales momentum in these markets has begun to moderate.”

He added, “That said, Tier 2 cities remain the key engines of India’s growth story. Expanding employment opportunities, improving infrastructure, and stronger connectivity continue to drive sustained demand across residential, commercial, and retail real estate.”

Compared to the previous quarter, Q3 2025, housing sales fell by 3%, sales value was down by 1%, and launches went down significantly by 26%.

Western India consisting of Ahmedabad, Surat, Gandhi Nagar, Vadodara, Nashik, Nagpur, and Goa, witnessed a fall of 6% year-on-year and 4% quarter-on-quarter in sales. The region accounted for 76% of the total sales volume. On the other hand, the northern part of India which consists of Lucknow, Mohali, and Jaipur showed a 16% year-on-year and 7% quarter-on-quarter increase, the industrial and IT sectors being the major contributors to the growth. The south of India made up of Coimbatore, Trivandrum, and Kochi witnessed a 7% year-on-year decrease and a 3% quarter-on-quarter increase, while the middle and the east of the country (Bhopal, Bhubaneshwar) saw 14% year-on-year and 13% quarter-on-quarter declines.

The data reveals that the sales volumes of homes in tier-2 cities have dropped with a particular focus on the affordable and mid-income segments while the rise in the sales value points to the luxury segment as the most enticing for buyers. In response to this, builders have been cutting back on their new launches and focusing on high-demand, high-value projects.

.png)