Goa, one of India’s most prominent tourist destinations, is witnessing a rare phase of price correction across both its real estate and hospitality sectors. Industry insiders and analysts describe this trend, involving a 15–20 per cent dip in tariffs and rentals, as a “healthy cycle” that could set the stage for long-term market stability.

According to The Economic Times, hotel tariffs in North Goa have been the most impacted, particularly in the free and independent traveller segment, which is highly price-sensitive. Nikhil Sharma, Managing Director and COO (South Asia) at Radisson Hotel Group, told the publication that rates in both hotels and long-term rentals have eased by nearly 15–20 per cent this year.

The residential rental market has also felt the impact. Group housing units catering to mid-segment tourists and long-stay visitors have seen rental values slide. While this has immediate consequences for owners, market watchers argue that the correction makes properties more affordable and broadens demand.

Stabilisation in Villa Pricing

Luxury villas, a dominant segment of Goa’s real estate market over the past decade, are also undergoing price stabilisation. Analysts point out that villa prices in North Goa surged nearly 30 per cent in 2022, driven by post-pandemic demand and increased inflows of non-resident Indian (NRI) investment. However, with oversupply now entering the market and buyer sentiment turning cautious, prices in the first half of 2025 have corrected.

Aditya Kushwaha, CEO and Director of Axis Ecorp, has termed this stabilisation a healthy sign, arguing that it introduces a more realistic entry point for buyers. This is particularly relevant for NRIs, who continue to see lifestyle and investment value in Goa’s second-home market. In contrast, South Goa has largely held its pricing strength, owing to relatively limited supply and restricted development in certain coastal zones.

Developers Continue to Launch Projects

Despite the slowdown in price momentum, real estate developers from across the country are actively announcing new projects in Goa. Market experts describe the current phase as a “cooling-off period” rather than a long-term downturn. The influx of new supply—ranging from boutique villas to branded residential complexes and mid-sized hotels—has temporarily pressured pricing but is also expanding choice for buyers.

Analysts further point to improved infrastructure as a stabilising factor. Connectivity enhancements, including ongoing upgrades at Goa’s Mopa international airport and road improvements linking key tourist hubs, are expected to sustain long-term demand. Developers see this as an opportunity to capture a market that, while currently under correction, retains strong fundamentals.

Surge in Tourist Arrivals

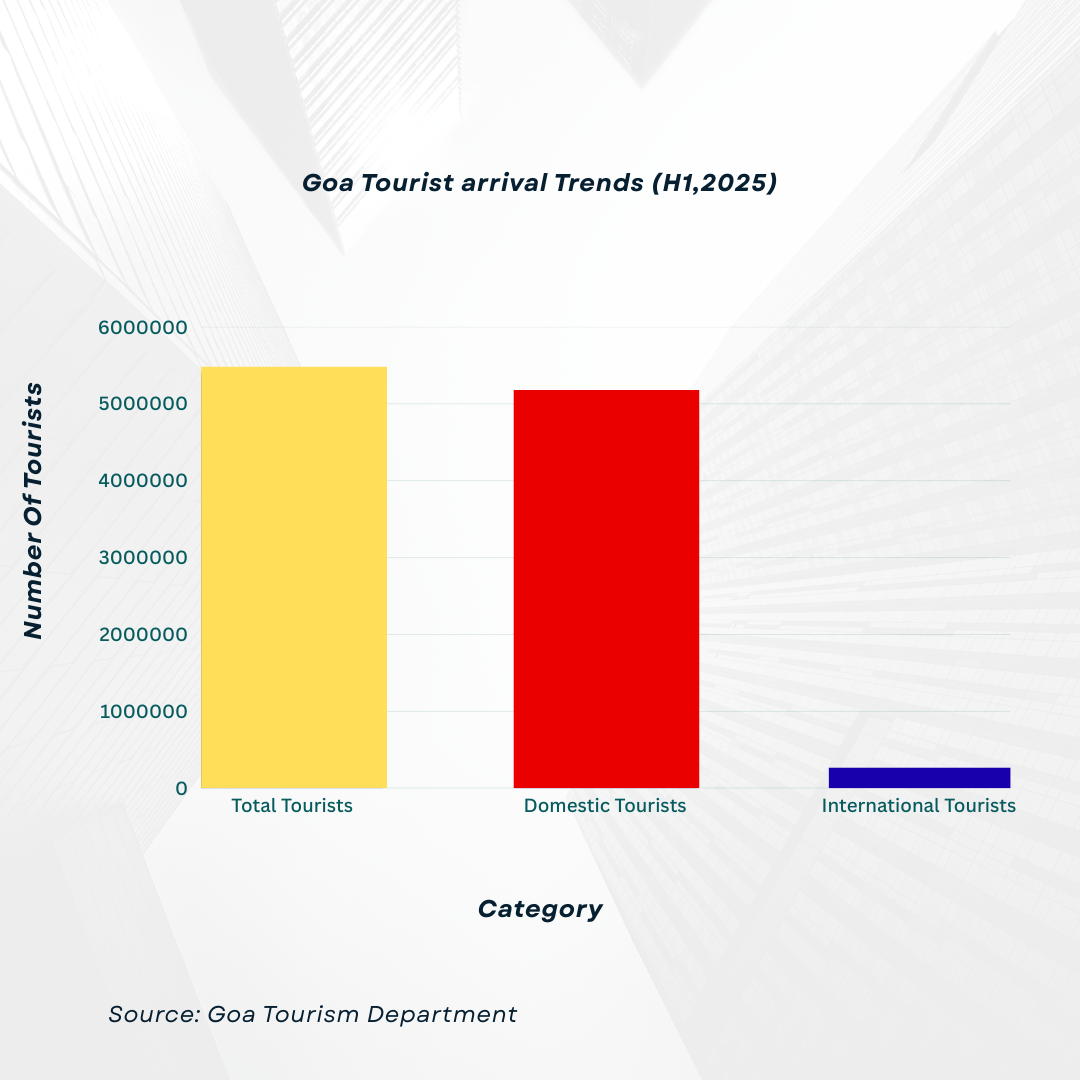

Interestingly, the correction comes at a time when tourist arrivals in Goa are surging. Official data from the state tourism department shows that in the first half of 2025 alone, over 5.4 million tourists visited Goa. Of these, 5.18 million were domestic travellers and 271,000 were international visitors. January was the strongest month, registering nearly 1 million tourists, while February and March also saw footfalls crossing 900,000 each.

Industry observers highlight this as a paradox—high tourist inflows accompanied by downward pressure on tariffs and rentals. The explanation lies in the sharp increase in supply. Several new hotels, homestays, and villa developments have come online, particularly in North Goa, leading to competitive pricing strategies aimed at retaining occupancy levels.

While the near-term picture suggests moderation, the longer-term outlook remains positive. Industry leaders believe that the correction will remove speculative pricing from the market and ensure sustainable growth. By improving affordability, the dip in rates is expected to stimulate demand not just from domestic buyers but also from the NRI segment, which views Goa as a stable second-home and investment market.

In hospitality, tariff corrections are expected to improve occupancy and attract a wider demographic of travellers. At the same time, stabilisation in real estate prices could encourage more structured development, particularly in areas that had witnessed rapid and unplanned growth.

The broader sentiment is that Goa’s hospitality and real estate industries are entering a phase of consolidation. With supply and demand gradually aligning, stakeholders expect stronger fundamentals to emerge, positioning the state for another cycle of sustainable expansion.

.png)