Beyond the Metros: Where India’s Real Estate is Truly Booming- Key Highlights

- Bhubaneswar Leads 10-Year Growth – Residential prices up 148.3% (2015–2025), outperforming metros like Bengaluru and Gurgaon.

- Other Top Performers – Ahmedabad (147.3%) and Gandhinagar (145.6%) also showed strong long-term appreciation.

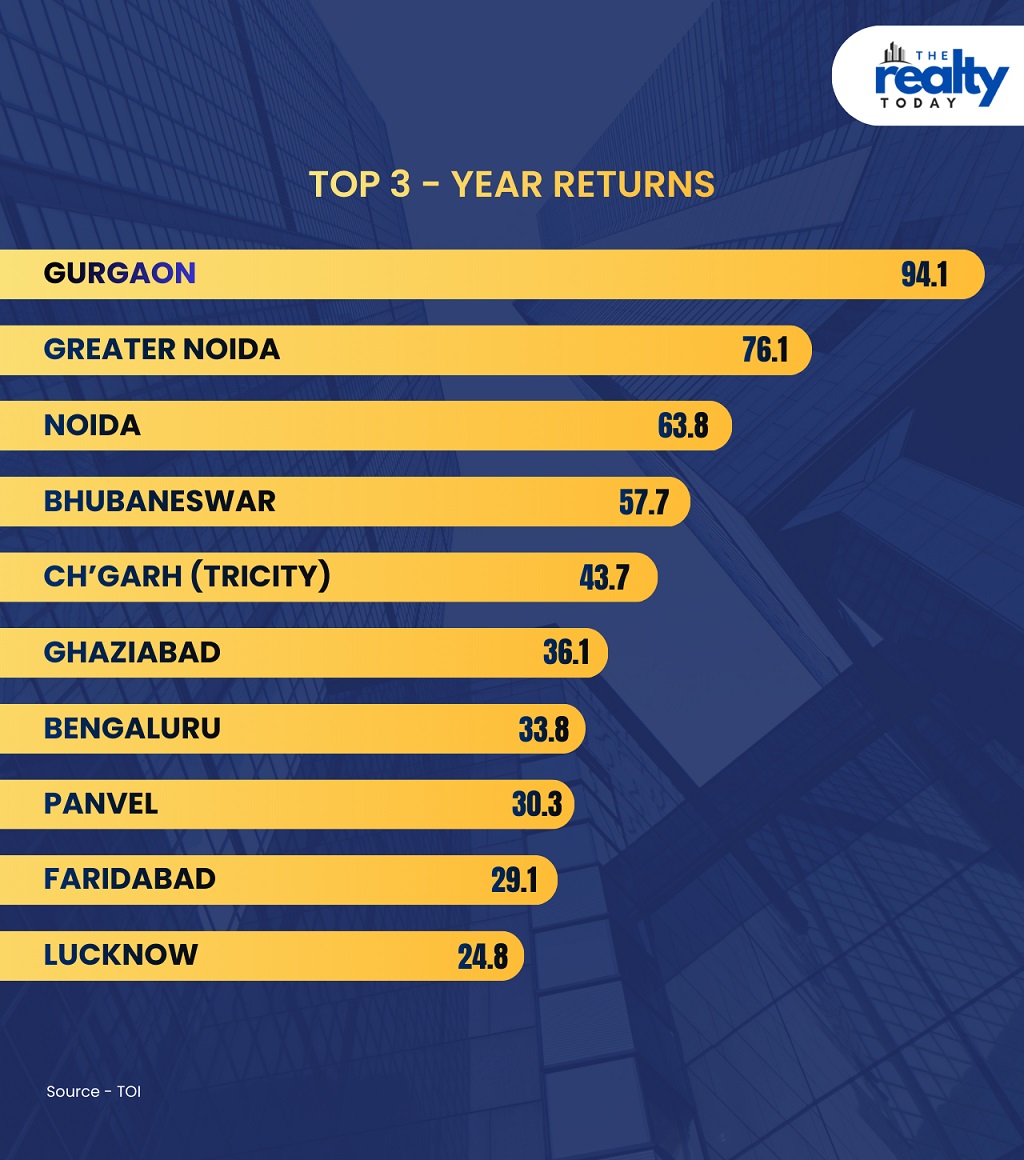

- Medium-Term Opportunities – Gurgaon (94.1%), Greater Noida (76.1%), and Navi Mumbai (short-term gains of 23–26%) present attractive 3–5 year returns.

- Infrastructure Drives Growth – Union Budget 2026’s ₹12.2 lakh crore capex, City Economic Regions, and industrial corridors support Tier 2 & 3 city development.

- Investor Strategy – Look beyond metros to well-connected emerging cities for stable, long-term returns, while metros continue to focus on luxury and commercial real estate.

India's real estate market is going through a slow but meaningful change in how investments are made. Even though Mumbai, Delhi, and Bengaluru grab most of the media attention for the sale of luxury homes worth several crores, it is the less, known, smaller cities that have now become the main drivers behind long term price appreciation and investor returns. Investors, thus, prefer emerging markets as they offer better growth potential and more stable, long, term gains.

National Housing Bank's RESIDEX data, as reported by Times of India, reveals that Bhubaneswar has been the most notable city in terms of residential property price rises over the last ten years.

The residential property prices in Bhubaneswar have increased by 148.3% between September 2015 and September 2025 thus leading the pack and surpassing the metro cities and other popular investment places. Ahmedabad and Gandhinagar were not far behind at 147.3% and 145.6%, respectively, while Gurgaon and Greater Noida registered 131.2% and 125.2%. Although Bengaluru is one of the major centers of IT and commerce in India, it remained under the 100% level during the equal time frame.

Average residential price ranges across key localities in 2025 were reported as follows: Patia (₹5,500–₹7,000/sq ft), Khandagiri (₹4,200–₹6,500), Sundarpada (₹3,500–₹5,500), and Tamando (₹3,800–₹5,200) — each with steady year-on-year increases.

Emerging Micro-Markets: Where Growth Is Concentrated

- Certain localities are turning into prime investment and demand hotspots:

- Patia continues to attract IT professionals, delivering strong rental returns and steady occupancy.

- Chandrasekharpur and Nayapalli offer significant capital appreciation, supported by excellent connectivity and robust social infrastructure.

- Gothapatna, Jatni, and Pahala are fast-evolving residential corridors, fueled by proximity to transport links, educational hubs, and planned industrial growth.

- Saheed Nagar and Jaydev Vihar are emerging as key commercial zones, witnessing rising demand for premium office spaces.

This movement reflects a larger transition in the real estate landscape. For the most part, metro cities still hold a demand for luxury segments but at the same time, they are showing some limitations or signs of saturation which will then affect how quickly prices can increase, i.e. they will not be able to grow as fast. The investors who want to have a safe and gradually increasing return over a period of time, choose the tier, 2 and tier, 3 cities, which at the moment, give the best prices, have a good increase in business activities and new developments in their infrastructure.

A look at the medium, term trends over five years up to 2025 only confirms this pattern of change. Gurgaon, once a satellite city next to the metro, gave a return of 94.1%, Greater Noida a return of 76.1%, and Bhubaneswar a steady growth of 57.7%. Other smaller but well, located cities such as Noida, Ghaziabad, and the tri, city region of Chhattisgarh have also shown very good price increases.

Short-term trends in three and one-year periods mirror this pattern:

- 3-Year Returns: Gurgaon and Greater Noida lead; Bhubaneswar remains consistent

- 1-Year Returns: Gurgaon (25.9%), Navi Mumbai (23.9%), Greater Noida (23%), Bengaluru (11.3%)

The Union Budget 2026 reinforces this shift with its infrastructure-first strategy, increasing public capital expenditure to ₹12.2 lakh crore. While Mumbai and Delhi dominate luxury property headlines, the Budget emphasizes improving connectivity and unlocking growth in tier-2 and emerging cities, potentially reshaping India’s real estate landscape.

Experts consider the Budget to be a major move towards urban and economic growth over the long term. The significant focus on infrastructural development, City Economic Regions, and industrial corridors is predicted to set a cycle going that links the creation of jobs, the demand for housing, and planned urban growth. By increasing the geographical size of cities, the Budget makes it possible for residential growth in areas outside the overcrowded urban cores, thus directing the development to well connected outskirts as well as Tier 2 markets.

Industry experts also pointed out that the government's promise of 5, 000 crore per year for City Economic Regions, along with a concentrated effort toward Tier, 2 and Tier, 3 cities, could massively alleviate the pressure for development in the metros while at the same time, unlocking new housing and investment corridors across the urban clusters that are emerging.

Despite the positive signals, the Budget was received with a mixed reaction from the real estate sector. Industry bodies such as CREDAI lamented the Budget's failure to include specific measures to uplift the segment of affordable housing. Soaring construction costs and rising land prices, along with the non-existence of a supportive policy, are gradually causing the affordable housing projects to become non profitable.

Investor takeaways:

- Look beyond traditional metro hubs to identify high-growth, well-connected non-metro cities

- Long-term winners: Bhubaneswar, Ahmedabad, Gandhinagar

- Medium-term opportunities: Gurgaon, Greater Noida, Navi Mumbai

- Infrastructure and connectivity investments are likely to drive future real estate appreciation

While luxury and commercial real estate in Mumbai, Delhi, and Bengaluru will undoubtedly continue to be in the limelight, the most attractive returns are progressively being realized in emerging and peripheral cities. Not only does the Union Budget 2026 emphasize this movement from the metros to other parts of the country, but it also sets out the path for sustainable development that is supported by investment in infrastructure, urbanization, and proper planning over the long term. Smart investors who make the right call early and invest in these new hot spots will be rewarded handsomely as India's real estate landscape moves beyond the traditional stronghold of the metros.

.png)