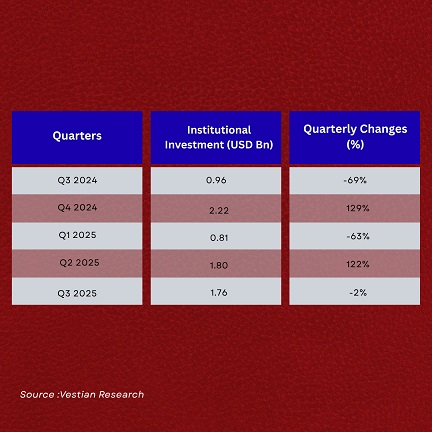

As per Vestian Report, the Indian real estate sector recorded institutional investments of USD 1.76 Bn in the third quarter of 2025, the highest quarterly inflow of funds compared to any Q3 in the past four years. While investments reported a marginal dip of 2% over the previous quarter, investments rose by 83% compared to the same period a year earlier. This underscore heightened investor confidence and resilience of the real estate sector despite global uncertainties.

The commercial sector accounted for the largest share of investments (79%), surpassing its earlier record of 61% in the last quarter and 71% in the same quarter a year ago. In terms of value, investments soared to nearly USD 1.4 Bn, registering a robust annual growth of 104%.

The residential sector attracted investments worth USD 191.7 million in Q3 2025, accounting for 11% of the total—down from 21% in the previous quarter. This reflects a sharp quarterly decline of 49%, despite registering a 6% year-on-year growth.

The industrial and warehousing sector accounted for a nominal 5% of the total institutional investments. However, investments surged by 168% over the previous quarter to USD 85.8 Mn, primarily due to the growing demand for logistics parks.

Note: Commercial assets include office, retail, co-working, and hospitality projects.

Diversified assets include commercial, residential, and/or industrial & warehousing.

Shrinivas Rao, FRICS, CEO, Vestian, said, “Driven largely by the commercial asset class, institutional investments in Indian real estate have surged by 83% year-on-year, reaffirming the sector’s strong resilience amid global headwinds. While foreign investors adopt a cautious approach, the significant rise in the share of domestic investments and co-investments underscores the growing confidence of domestic investors in India’s growth story.”

Amid persistent global economic pressures and policy uncertainties, the share of foreign investments dropped significantly to a yearly low of 8%. On the other hand, the share of domestic investments surged to a significant high of 51%, marking a 115% annual and 166% quarterly increase in terms of value. Foreign investors, while cautious due to global uncertainty,chose to invest in collaboration with local expertise, boosting the share of co-investments to 41% in Q3 2025 from 15% a quarter earlier.

The outlook for India’s real estate sector remains strongly positive, supported by domestic capital inflows, steady policy reforms, and sustained demand in both commercial and residential segments. While global economic headwinds may continue to temper foreign participation in the near term, the rising dominance of domestic investors and co-investment models indicates growing market maturity and confidence in India’s long-term fundamentals. With robust infrastructure expansion, regulatory transparency under RERA, and the government’s push toward urban development, institutional investments are expected to remain resilient through 2026—driven by the commercial office, logistics, and data center segments, which continue to attract both global and local investors seeking stable, yield-generating assets.

.png)