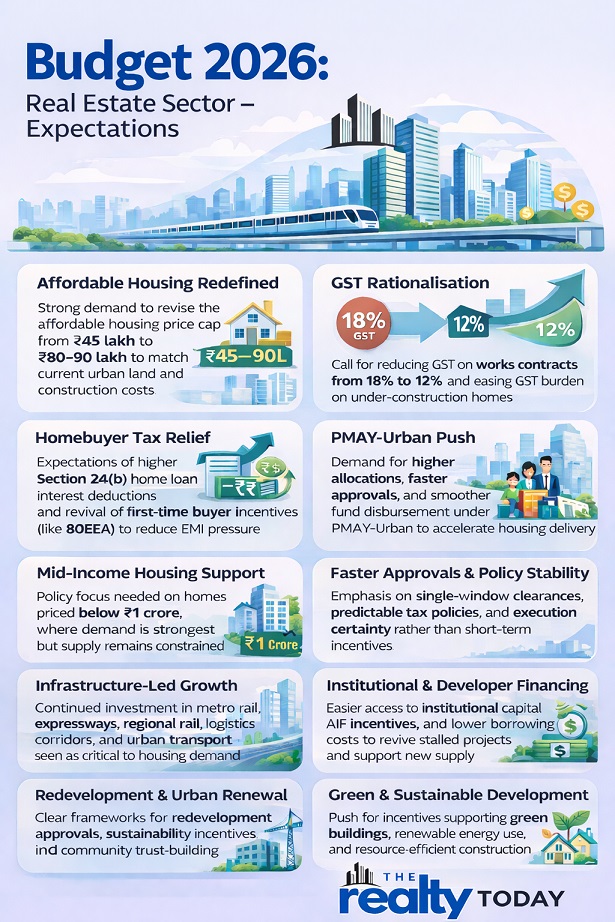

Housing Affordability and Infrastructure Top Real Estate Wishlist for Budget 2026

- Real estate sector seeks policy support in Budget 2026 to address housing affordability, rising construction costs, and shifting urban demand.

- Industry calls for revision of the affordable housing price cap, currently at ₹45 lakh, to better reflect present land and construction costs in major cities.

- Rationalisation of GST on under-construction homes and works contracts is seen as crucial to reducing project costs and reviving stalled developments.

- Developers urge faster approvals and higher allocations under PMAY-Urban to improve housing supply and support first-time buyers.

- Extension and enhancement of homebuyer tax benefits such as Section 24(b) and revival of 80EEA are expected to ease EMI burdens.

- Continued investment in metro rail, expressways, urban transport and infrastructure remains vital to unlocking demand in high-growth corridors.

- Industry leaders emphasise the need for policy predictability, stable taxation and quicker clearances over short-term incentives.

- Greater focus on institutional capital, redevelopment, and green construction incentives is seen as essential for sustainable, long-term sector growth.

With the Union Budget 2026 approaching, the real estate sector has also been quite vocal with its clear expectations from the government for addressing housing affordability pressures, which have been on a rise along with increasing construction and compliance cost in changing urban housing demand. Residential prices have continued to increase across major cities, while redevelopment has emerged as a dire necessity to replace aging housing stock and improve urban safety. In this context, developers are seeking policy measures that are in tune with the current land values, financing conditions, and scale of demand of housing in high-growth urban corridors.

The revision of affordable housing price thresholds, which already is no longer relevant to prevailing market realities in most metropolitan and emerging urban areas, remains a key ask from the industry stakeholders. Developers also want the rationalization of GST on under-construction homes and works contracts to bring down the overall project cost and enhance pricing efficiency. Faster approvals and increased funding under PMAY-Urban are seen as being crucial to project viability, speedy delivery of housing, and for helping first-time and mid-income homebuyers.

Along with this, continuous growth in investment on metro rail, expressways, and overall infrastructure development holds the key to the sustained growth of the sector. Such infrastructure development and increased connectivity are likely to provide fillip to new housing demand in the peripheral and emerging cities, relieving the pressure on existing city cores. These are, therefore, considered prerequisites for kick-starting stuck projects, strengthening the sector, and pursuing sustained growth in the real sector of India.

Budget 2026: Industry Expectations

Mr. Aniruddha Mehta, Chairman and Managing Director, Umiya Buildcon

“The Union Budget 2026 is a key opportunity to strengthen India’s real estate sector, particularly as urban housing demand continues to rise, with double-digit price growth observed in major cities over the past year. For developers, policy measures that enhance housing affordability, reduce financing costs, and incentivize sustainable development will be critical to sustaining growth and meeting rising demand.

Increasing tax benefits on housing loans under Section 24(b) could ease financial pressure on homebuyers, while enhancing incentives under Section 80-IBA for affordable housing projects would encourage developers to expand inclusive housing supply, addressing a nationwide shortfall of several million units.

With interest rates stabilising and urban housing demand remaining robust, a well-balanced budget that supports both buyers and developers can unlock investment, boost employment, and contribute meaningfully to India’s infrastructure and economic goals in 2026.”

Mrs. Ankita Luharuka, CEO, Alliance City Developers

“Budgets play a critical role in shaping how cities evolve. For developers who works closely with redevelopment communities, clarity around approval processes, sustainability-linked incentives, and disciplined financial frameworks can go a long way in easing the transition from ageing housing to safer, more livable urban homes. A Budget that reinforces transparency and long-term planning does not just support the real estate sector—it directly improves outcomes for residents who place long-term trust in the redevelopment process.”

Mr. E Lakshminarayana Reddy, Founder & CEO, EARA Group

"As we approach Union Budget 2026, the focus must shift beyond just housing numbers to the quality of living. While we anticipate standard relief measures like industry status and tax rationalization, our primary expectation is a strong policy push for sustainable, eco-sensitive development.

Specifically for markets like Bangalore, where luxury is increasingly synonymous with 'nature-near' living, we expect a strong policy push for developments that integrate biophilic design and renewable energy. A lower GST bracket for green-certified premium projects, coupled with higher tax deductions on home loan interest (Section 24), would be a game-changer for buyer sentiment. By incentivizing responsible luxury, the government can encourage developers to create spaces that are not just homes, but sanctuaries that co-exist with nature."

Mr Ravi Saund, Founding Director of Emperium Group

"The upcoming budget offers a chance to reinforce this link. “Budget 2026 is an opportunity to push the decongestion of major metros by incentivising investment in emerging urban corridors,” he said. “Measures such as rationalising GST or reintroducing input tax credit for under-construction homes would help early investors and support momentum in regions like Panipat and Gurugram.

“There is also room to better align fiscal benefits with current realities. Enhancing the home loan interest deduction limit from ₹2 lakh to ₹5 lakh would ease pressure on salaried households and help more families move from renting to owning, which remains central to the Housing for All objective.”

Mr. Shiv Garg, Director, Forteasia Realty Pvt. Ltd.

“The real estate sector is looking for a clear signal from the government regarding the alignment of tax policies with the new urban housing price realities as we approach Budget 2026. The existing limit of ₹45 lakh for the ‘affordable housing’ category and the associated 1% GST benefit do not correspond to the land and construction costs in most of the development areas.

A realistic price bracket of ₹80–90 lakh and a reduction in GST rates on works contracts from 18% to 12% can lead to the revival of the projects which are stalled and also the opening up of a new supply pipeline. In addition to this, a higher allocation for PMAY-Urban, along with quicker approvals, will not only benefit the first-time buyer in India’s growing cities but also the entire housing sector as it will lead to more livable and ready-to-move-in homes.”

Mr. Aman Gupta, Director, RPS Group

“Budget 2026 is a crucial chance to make the homeownership situation in NCR and other high-growth areas much better by giving incentives to buyers, developers and lenders in a more unified way. The mid-income housing projects have a major share of users who are above the ₹45 lakh affordable cap and, as a result, are not getting the benefit of the 1% GST and the tax incentives.

If the limit is raised to around ₹90 lakh, the revival of the first-time buyer additional interest deduction like 80EEA, and easing of credit for developers, then there will be a significant reduction in the acquisition cost as well as the EMI burden.

When sustained investment in metro, expressway, and urban infrastructure is added to these measures, the demand for housing in the peripheral corridors will be met with faster sales and the sector will enjoy a stable, long-term growth.”

Mr. Pakshal Sanghvi – Managing Director of Sanghvi Realty

“As the Budget approaches, real estate developers are closely watching how policy responds to the changing economics of urban housing. Construction costs, compliance requirements and capital costs have risen structurally over the past few years, while pricing power has remained selective. The next phase of growth will depend less on incentives and more on predictability—stable tax policies, faster approval frameworks and infrastructure-led planning. For developers, clarity is more valuable than concessions. A Budget that improves visibility on long-term urban development, financing access and execution certainty will help the sector plan responsibly rather than reactively.”

Mrs. Ankita Luharuka – CEO of Alliance City Developers

“Budgets play a critical role in shaping how cities evolve. For developers who work closely with redevelopment communities, clarity around approval processes, sustainability-linked incentives, and disciplined financial frameworks can go a long way in easing the transition from ageing housing to safer, more livable urban homes. A Budget that reinforces transparency and long-term planning does not just support the real estate sector—it directly improves outcomes for residents who place long-term trust in the redevelopment process.”

Ms. Manju Yagnik, Vice Chairperson of Nahar Group and Senior Vice President of NAREDCO- Maharashtra

“The real estate sector is looking to Budget 2026 for measures that can meaningfully expand homeownership and strengthen the residential ecosystem, particularly for first-time and mid-income buyers who are increasingly impacted by high property prices and borrowing costs. The recent repo rate reduction has provided a positive signal for the housing market, improving affordability and sentiment, and the Budget offers an opportunity to build on this momentum through targeted fiscal support.

A key expectation is a renewed focus on reducing the effective cost of home loans. Enhanced interest subventions, longer and more flexible loan tenures, and targeted incentives for first-time buyers can help convert lower policy rates into real EMI relief, especially in large urban centres where affordability remains stretched.

There is also a need to revisit housing incentive frameworks to align eligibility thresholds with current market realities. Updating income and property value limits in line with rising urban prices can ensure benefits reach genuine.”

Mr. Anurag Goel, Director, Goel Ganga Developments

“For a rapidly urbanising India, this Budget needs to regard housing as essential infrastructure rather than a treatable asset class. PMAY-Urban 2.0 and a multi-lakh-crore commitment for urban housing have already announced the tremendous intent of the government, but now the policy fine-tuning is critical to the supply on the ground matching the intent.

Rationalising GST on under-construction homes, increasing the affordable housing price band, and extending the targeted tax deductions for end-users will make the projects workable and the homes available, especially in Tier 1.5 and Tier 2 cities which are becoming the employment hubs.

If Budget 2026 provides clarity and stability in these areas, the developers would surely invest in environmentally friendly, high-density and near-transport communities that would be supportive of India’s growth during the next decade.”

Mr. Siddharth Maurya, Founder & Managing Director, Vibhavangal Anukulakara Pvt. Ltd.

“Both investors and potential homeowners are considering Budget 2026 as a potential signal regarding the seriousness with which India views the speeding up of its ‘Housing for All’ and urbanisation policy. The request from the authorities is very simple: redefine affordable housing, give more precise and time-limited tax incentives, and make the 1% GST benefit applicable to a broader and more realistic price range in the major cities.

GST reduction on developers’ input services and works contracts will help cut costs and prevent low-quality construction. Higher PMAY allocations and ongoing investments in metro, regional rail and logistics infrastructure could make real estate an even more robust source of jobs, consumption and long-term wealth creation for Indian families.”

Mr. Ankur Jalan, CEO, Golden Growth Fund (GGF), a category II Real Estate focused Alternative Investment Fund (AIF):

“As we look ahead to Union Budget 2026, our expectations reflect both the challenges and opportunities in India’s real estate sector, particularly in established urban markets like Delhi, Mumbai, Bengaluru etc. We hope the Budget will prioritise measures that strengthen demand-side support, including extension of tax incentives for homebuyer, continued focus on infrastructure investment - especially in urban transport, last-mile connectivity and sustainable utilities that will be vital in boosting the attractiveness and long-term value.

We also seek policies that encourage institutional capital flows into real estate, such as enhanced incentives for Alternative Investment Funds in order to make it more attractive to investors. Such a move will streamline investments, make it institutionalised and regulated. A balanced, growth-oriented Budget will not only support project execution but also drive confidence among homebuyers and investors alike and boost the Indian economy.”

Mr. Lalit Parihar, Managing Director, Aaiji Group, a Dholera-based real estate firm

"We expect the Union Budget 2026 to further strengthen infrastructure-led urban development. Continued investment in roads, logistics, airport, bullet train, industrial corridors, and smart city infrastructure will be critical in unlocking the full potential of regions like Dholera as future economic hubs. We also hope for renewed policy focus on Special Economic Zones (SEZs), including greater flexibility and fiscal incentives for developers, to accelerate industrial and mixed-use developments in these regions.

We look forward to measures that support housing affordability, such as rationalisation of GST, extension of tax incentives for homebuyers, and easier access to institutional finance for developers. Incentives for sustainable and green construction, along with faster approvals and reduced compliance burdens, would further improve project viability.

Overall, a balanced Budget combining fiscal discipline with long-term urban planning will help sustain real estate growth, boost investor confidence, and accelerate development across strategically important regions of Gujarat."

Mr. Vijay Harsh Jha, Founder and CEO of property brokerage firm VS Realtors:

" India’s real estate sector is beginning to show signs of slowdown in volume sales highlighting a structural supply gap—particularly in homes priced below ₹1 crore, where demand remains strong. To address this imbalance, timely government intervention is essential. Incentives such as tax breaks, access to affordable land for developers, and supportive policies can help ensure that housing supply aligns with the price points where demand actually exists. Equally important are continued housing loan incentives and tax benefits for homebuyers to help cater to this demand segment which played a key role in driving robust volume growth over the past three years.

The past two years have witnessed exceptional growth in value terms, reflecting a clear shift towards premiumisation. However, this trend may prove unsustainable over the long term. With job losses in the tech sector, moderating income growth, and rising geo-economic and geopolitical uncertainties, risks to housing demand are increasing. While the office segment continues to see strong momentum, residential sales volumes have yet to keep pace—underscoring the need for a more balanced and inclusive growth strategy in the housing market."

Mr. Kirthi Chilukuri, Founder & Managing Director, Stonecraft Group

“As India prepares for the Union Budget 2026–27, the real estate sector looks forward to policy measures that strengthen urban resilience, sustainability, and long-term capital efficiency. Continued focus on infrastructure-led urban development, faster project clearances, and easier access to institutional financing will be crucial for responsible developers. Incentivising green and biophilic developments, renewable energy integration, and resource-efficient construction can accelerate the transition towards future-ready cities. Additionally, targeted demand-side support for homebuyers and regulatory clarity on taxation will help maintain market momentum while ensuring balanced growth across residential and mixed-use developments.”

Mr. Rajat Khandelwal, Group CEO, Tribeca Developers

"Ahead of Budget 2026, the real estate sector is looking for policy continuity that supports both supply and demand. Granting industry status to real estate remains crucial, as it would ease access to long-term capital, lower borrowing costs, and improve execution efficiency for developers.

On the demand side, enhancing homebuyer incentives will be important. An upward revision in the Section 24(b) home loan interest deduction, along with targeted benefits for first-time buyers, can improve affordability and sustain housing demand.

A calibrated review of capital gains taxation can improve liquidity across residential segments, including luxury housing, which continues to see steady end-user interest. Continued focus on urban infrastructure and incentives for sustainable construction will further support long-term growth of the sector and its contribution to the economy.

Real estate growth is closely tied to infrastructure. Increasing investments in urban infrastructure, such as roads, public transport, and smart city initiatives, will not only make cities more livable but also enhance property values. Offering tax benefits or subsidies for adopting green building technologies and renewable energy solutions will encourage developers to contribute to India’s climate goals."

Mr. Divyam Shah, Whole-Time Director and Chief Financial Officer of Euro Panel Products Limited

“The upcoming budget is an opportunity to align industrial growth with environmental responsibility. We expect a clear roadmap that supports domestic manufacturers, especially MSMEs, in shifting their production towards renewable energy. On the operational front, easing norms for domestic players and removing hurdles in GST input credits will be vital to free up working capital. By increasing depreciation benefits and simplifying tax structures, the government can provide the robust support system Indian manufacturers need to scale up and compete in international markets.”

Way Forward

As India gears up for Budget 2026, the real estate sector finds itself at a critical juncture, with positive alignment between the budget and market realities poised to significantly influence the pace and scale of sectoral growth. Realigning affordable housing configurations in terms of current rates of land and construction costs, rationalizing GST rates on affected under-construction properties and works contracts, and providing tax reliefs to homebuyers share key attention in this regard.

Equally critical is the increasing pace of approvals and funding available under the PMAY-Urban scheme, including clearance measures that decrease the chances of executive delays, in favor of the builders. Further investment in metro rail, express highway development, and regional connectivity options can sustainably contribute to demand from peripheral and high-growth development corridors.

A peek into the future reveals that an increase in policy predictability, access to institutional capital, and incentives for sustainable as well as redevelopment-driven housing would be a key requirement in building safer, more inclusive, and future-proofed cities. A well-balanced Budget would play an important role in helping the real estate sector achieve significant contributions towards employment, urban resilience, as well as India’s growth story.

Image-freepik.com

.png)