Bengaluru Premium Residential Market Backed by Demand, Infrastructure and Policy Clarity- Key Highlights

- Bengaluru’s premium residential market showed sustained growth and stability throughout the 2025 period

- Capital values increased steadily, supported by infrastructure development and limited land availability

- Rental values recorded strong growth across key premium micro-markets

- Lower interest rates improved affordability and boosted buyer confidence

- Demand remained strong from end-users, corporate executives, and investors

- Infrastructure projects such as metro expansion and improved road connectivity drove location preferences

- Reduced price gap between under-construction and completed projects reflected market maturity

- Developers adopted disciplined pricing and calibrated launches

- Premium housing supply increased, led by South and North Bengaluru corridors

- Regulatory clarity and improved governance strengthened buyer trust and long-term confidence

Bengaluru's luxury housing market ended 2025 on a strong and confident note, characterized by continuous price increases, robust rental growth, and a significant expansion in new supply. Although there were occasional global uncertainties and fluctuations in foreign trade, the upscale housing market of the city showed great strength and stability throughout the year, supported by economic steadiness, lower interest rates, development driven by infrastructure, and a greater clarity in regulations. The advancement of the market was also seen through the reduced difference in prices between projects that were under construction and completed ones, indicating a move towards greater market maturity, pricing discipline, and buyer preference for getting delivered property guarantee.

The Savills report covers a lot of ground in terms of the premium residential segment of Bengaluru houses that cost INR 2 crore and above. It looks into the backdrop of the economy, policy as well as regulatory changes, movement in capital and rental values at the level of micromarkets, supply side, and gives a forecast for 2026.

Economic Backdrop: Strong Fundamentals Support Residential Confidence

India's economy kept its solid momentum throughout 2025, thus, a positive macroeconomic environment was maintained for the residential real estate market. The growth was broad, based as it was stimulated by robust domestic demand, continued steady investment inflows, and the production sectors of manufacturing and services that were still on the rise. In line with the strength shown, the Reserve Bank of India has decided to increase the estimate for FY26 GDP growth to 7.3% from 6.8% previously, which is an indication of the faith in India's core economic fundamentals, in spite of the global challenges.

Quarterly statistics have shown that this positive sentiment has been well justified. The GDP growth rate went up to 8.2% in the July, September FY 2025, 26 period, which is the highest point in six quarters, hence, it substantiates the long, lasting production surge in the main sectors. The result of this expansion was that new jobs were created continuously and notably in the local economy of Bengaluru, technology, consulting, and services are the main driving factors, and this has a direct influence on the demand for the premium residential segment.

Inflation dynamics were very good throughout 2025. Retail inflation kept on a steady disinflation path, finally coming down to an historically low 0.3% in October 2025. This easing was mostly led by price rationalisation due to GST, lower commodity prices, and a good supply situation which together resulted in increased household purchasing power and better consumer sentiment.

Monetary policy also helped to keep the momentum going.

The policy repo rate was cut in total by 125 basis points over the year starting from 6.50% in January to 5.25% in December 2025 with the RBI taking a neutral stance to credit growth and domestic demand. For premium homebuyers, this implied better affordability, higher transaction confidence, and the possibility of a more visible long, term investment.

Key macro tailwinds for housing in 2025 included:

- Strong GDP growth and employment momentum

- Historic low inflation levels

- Meaningful reduction in benchmark lending rates

- Improved credit availability and affordability

GST 2.0: Structural Cost Relief to the Construction Ecosystem

The major policy development during the year was the launch of GST 2.0 which has made the indirect tax regime much simpler by introducing only two slabs of 5% and 18%. For the real estate sector, the biggest change came from the essentially lower GST rates on the major construction materials like cement, steel, tiles, and electrical components.

The move is likely to bring down the cost of construction slowly over the medium term thus giving the developers more leeway in managing project economics and at the same time being able to keep margins. From the point of view of buyers, GST 2.0 may help to keep the increase in prices in check and thus offer better value propositions especially in projects that are under construction. In a city like Bengaluru, where land prices account for a large part of the cost, these sort of cost savings will have a significant effect on the ability of supply to meet demand.

Regulatory Developments in Karnataka: Governance and Safety in Focus

Governance and safety were the main themes of regulatory changes in Karnataka real estate sector in 2025. The state's regulatory announcements have therefore mirrored a strong emphasis on transparency, governance, and safety in residential developments.

December 2025 saw the state government unveiling the Karnataka Apartment Bill 2025 that is set to replace the archaic apartment laws. The new draft law intends to delineate the ownership rights of the members, facilitate the delivery of common property to individual apartment owners and embolden the governance structure of residential communities. One of the most significant aspects of the bill is the setting up of a grievance redressal mechanism which by sides it besides other benefits like reducing conflicts between developers and residents and thus being able to speed up the buyers' confidence, especially those in the high, end segment.

Earlier in August 2025, the Fire Force Department of Karnataka amended the Fire Force Act by imposing a 1% fire cess on new multi, storey and high rise buildings, i.e., including the residential projects. In fact, such a small percentage increase of the project cost through this cess would be more than offset by the gains as the funds are to be used for upgrading the fire safety infrastructure and emergency response systems. In the long run, the increased safety standards will make high rise residential buildings in Bengaluru more desirable, durable, and have a higher reputation.

Capital Value Trends: Infrastructure, Driven Appreciation Continues

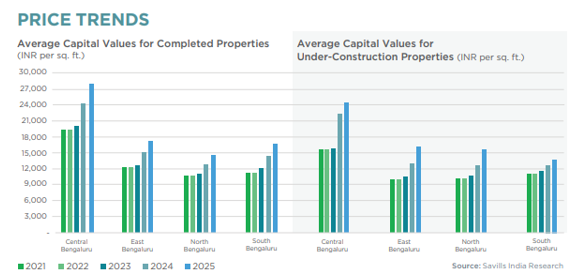

Capital value of the premium residential segment in Bengaluru kept increasing very strongly all along 2025. It was mainly supported by the fast pace of infrastructure development, limited amount of land for new residential developments in the prime areas, and the residential supply concentrated mostly in a few select growth corridors. Both kinds of projects under, construction and completed have shown good appreciation indicating the strong demand base coming from end users as well as long term investors.

On average, under construction premium projects registered capital value growth of close to 13%, 15% year on year. East and North Bengaluru led the appreciation, recording growth of around 23%24% YoY, facilitated by metro rail expansions, upgradings along the Outer Ring Road, and the airport led connectivity improvements. These infrastructure developments have raised the accessibility level and the regions' growth potential to such an extent that these areas were redefined as the major hubs for premium housing demand.

- South Bengaluru recorded comparatively moderate price appreciation of around 8% YoY, as higher new launches and increased price competition were balanced by sustained end-user demand and improving metro connectivity, supporting steady absorption.

- Central Bengaluru, marked by limited new supply and high land acquisition costs, witnessed capital value appreciation of approximately 9.5% YoY. Despite moderate incremental growth due to elevated base prices, absolute values remained among the highest in the city owing to its core location advantage.

- Completed premium residential projects across key micro-markets posted steady appreciation of around 12%–14% YoY, reflecting strong demand for quality, ready inventory.

- Central Bengaluru continued to lead the market in terms of value growth, recording the strongest appreciation at around 15%–16% YoY.

- East, North, and South Bengaluru registered balanced price growth of nearly 14%–15% YoY, indicating broad-based stability across the city’s residential markets.

One of the interesting structural developments during the year was the reduction in the price gap between projects under construction and completed ones. The coming together of prices signifies a market in which buyers are starting to give more weight to factors such as certainty of delivery, the possibility of immediate occupancy, and the safety of a property price going up rather than down, thus developers have been led to use calibrated launches coupled with disciplined pricing strategies.

Rental Market Performance: Broad, Based Growth Across Micromarkets

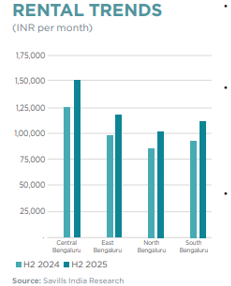

Strong rental value increase were reported across Bengalurus premium residential segment in 2025, with the growth being citywide, thus highlighting the citys continued pull factor for corporate executives, expatriates and senior professionals. The main factors that kept on pushing rental prices upward in all the major micromarkets were the very moderate availability of the ready, to, move inventory and the constant office, led demand.

Citywide rents for completed premium projects went up by about 18%20% YoY. Among the rental growth leaders, Indira Nagar dominated central Bengaluru, the increase in values by nearly 21% YoY being mainly due to strong demand in well, established locations such as Lavelle Road, Cunningham Road and Mission Road.

South Bengaluru came next with rental growth of about 20.5% YoY, which was mainly the result of a combination of stable absorption in areas like Koramangala, Jayanagar and Bannerghatta Road and better metro connectivity. In the East and North of Bengaluru, rents went up by approximately 18%20% YoY, the main drivers being the location close to the office corridors, the greater focus on larger and more amenity, rich homes and the stability of white, collar employment.

In these areas, upgrading of the infrastructure and a very limited ready supply were the main factors that kept on supporting rental resilience.

Key drivers of rental growth included:

- Limited ready inventory in premium locations

- Sustained corporate and expatriate demand

- Preference for larger, amenity-rich residences

- Stable employment and infrastructure upgrades

- Supply Dynamics: Premium Launches Surge Sharply

- Premium residential launches in Bengaluru surged by ~40% YoY in 2025, increasing from 10,164 units in 2024 to 14,186 units, indicating strong demand momentum and renewed developer confidence in the premium housing segment.

- South Bengaluru emerged as the largest contributor to new premium supply, accounting for 49% of total launches, supported by improved connectivity and the availability of larger land parcels.

- North Bengaluru followed closely, contributing 42% of premium launches, driven by infrastructure upgrades and growing residential demand.

- The concentration of supply in South and North Bengaluru was influenced by enhanced connectivity, land availability, and evolving lifestyle preferences of homebuyers.

- Developers increasingly emphasised integrated amenities, wellness-oriented features, expansive green spaces, and smart home technologies to cater to the expectations of discerning premium buyers.

Top Tier Deals Deepen The Market

High and value property transactions for the year included various deals. Some of the significant ones are: the sale of a plot with a bungalow on Lavelle Road for INR 165.6 crores, a luxury flat in Jayamahal Extension for INR 64 crores, and a residential plot in Sadashiva Nagar for INR 55.5 crores. The above deals are indicative of the fact that there is still a high demand for high-end properties in prime locales.

Outlook for 2026: Infrastructure, Technology and Lifestyle to Lead Growth

North and East Bengaluru are set to be the top performers in capital value appreciation by 2026, according to the forecast. The growth will be mainly driven by the extension of metro networks, new ring roads, and policy, backed infrastructure investments. Besides that, the demand for plotted developments and branded eco, tech luxury homes in the newly developing areas like Devanahalli, Doddaballapura, and Whitefield will rise, providing more flexibility and higher long, term returns.

Smart technology is expected to be a basic feature of high, end housing. Homebuyers of 2026 will be more and more interested in having comfort, energy efficiency, and security through seamlessly automated systems, such as app controlled features, smart access, and infrastructures that are ready for the future.

The premium residential segment in Bengaluru is going into 2026 with a positive outlook. The market is backed by strong price appreciation, solid rental growth, controlled supply, and regulatory clarity. The local infrastructure, good macroeconomic environment, and changes in buyer preferences together with the premium residential market will be hale and hearty, and more mature, thereby consolidating Bengaluru as a top, notch real estate destination in India.

.png)