Home sales across India’s 8 prime residential markets stabilized in the July-September quarter, with a marginal 1% year-on-year dip in volume to 95,547 units sold. In sharp contrast, the total value of properties sold during the quarter surged by 14% annually to reach INR 1.52 lakh crore, a clear indication of a market shift towards premiumization. These findings were published in the latest quarterly report, ‘Real Insight Residential: July-September 2025’, by digital real estate transaction & advisory platform PropTiger.com, which recently acquired by listed entity Aurum PropTech Ltd.

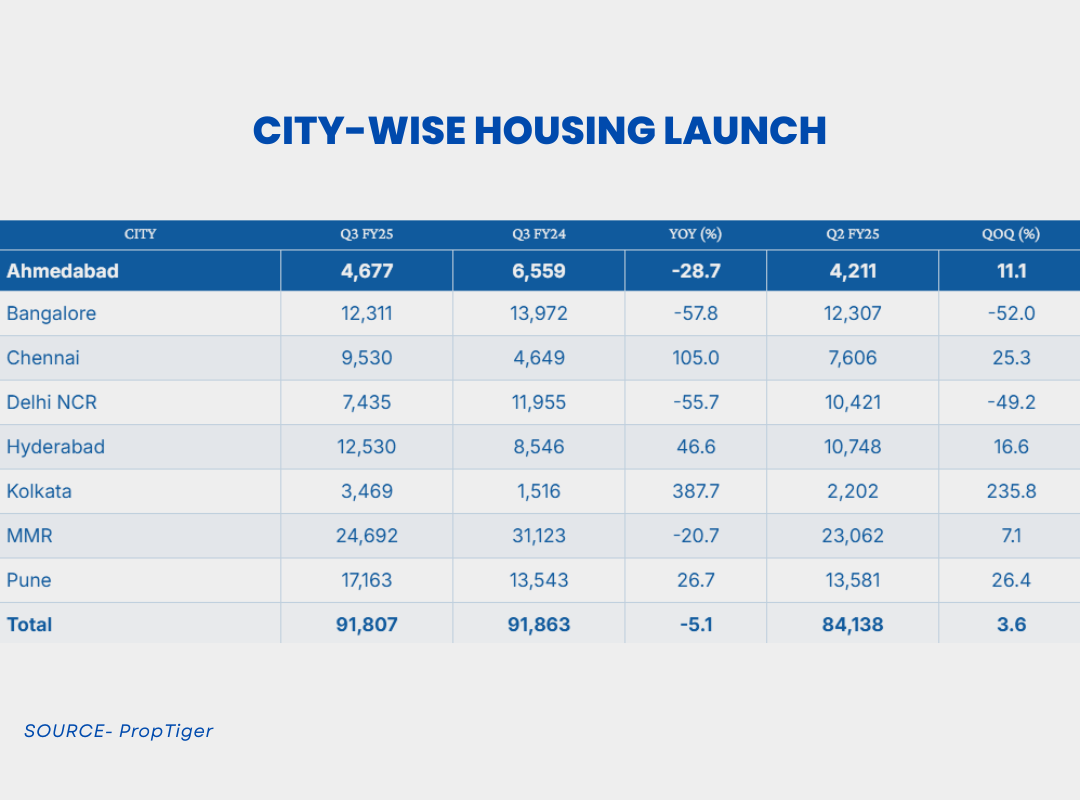

The report also highlighted that new supply across the top eight cities saw a 5.1% annual decline, with 87,179 units launched. However, new launches registered a 3.6% growth over the previous quarter, signaling cautious optimism among developers. This trend suggests that developers are strategically launching higher-value projects to align with the current buyer demand, which is heavily skewed towards the premium and luxury segments.

Commenting on the report’s findings, Mr. Onkar Shetye, Executive Director of Aurum PropTech said, “The Indian residential market is clearly transitioning from a broad-based, volume-led recovery to a more mature and sustainable phase of value-driven growth. This quarter’s performance underscores the remarkable resilience of the premium segment, which continues to be the market’s primary growth engine, supported by stable macroeconomic fundamentals and strong buyer sentiment. Favorable conditions, such as the stability in interest rates and proactive policy reforms like the recent GST reduction on cement, have provided a crucial buffer against rising input costs and bolstered developer confidence. We are optimistic about the upcoming festive quarter, which will serve as a key indicator of consumer demand. However, it will also be a true test of the market’s ability to balance this growth momentum with emerging affordability challenges, particularly in the mid and entry-level segments.”

City-Wise Trends

The Q3 2025 data reveal a marked regional divergence in India’s residential real estate performance. Southern and eastern markets emerged as the new engines of growth, with Chennai recording an exceptional 120.9% year-on-year (YoY) increase in sales, followed by Hyderabad with a robust 52.7% YoY growth. This contrasts with moderation in key western markets, where major hubs like the Mumbai Metropolitan Region (MMR) and Pune registered annual declines of 22.2% and 27.9%, respectively. Despite the dip, MMR remained the largest contributor to quarterly sales with a 24.4% share, followed by Hyderabad (18.5%), Bangalore (13.7%), and Pune (13.6%).

City-level sales performance highlighted this divergence further. MMR saw a sharp 22% decline in units sold, from 30,010 to 23,334 units, while Delhi-NCR recorded a 21% fall to 7,961 units. Pune also experienced a significant dip, with sales declining 28% to 12,990 units, and Ahmedabad saw a more moderate decrease of 5%, totaling 8,889 units. On the other hand, cities like Bengaluru, Hyderabad, Chennai, and Kolkata recorded strong growth: Bengaluru led with an 18% rise to 13,124 units, Hyderabad surged 53% to 17,658 units, Chennai jumped 121% to 7,862 units, and Kolkata grew 33% to 3,729 units.

Supply Units

On the supply side, developer activity revived in select markets. While total new launches across the top eight cities declined 5% YoY to 91,807 units, several markets saw significant growth. Kolkata witnessed a phenomenal 387.7% annual surge in new launches, and Chennai’s new supply more than doubled with a 105.0% YoY increase, reflecting renewed developer confidence in high-demand regions. Hyderabad and Pune also reported healthy growth in launches, while Bengaluru remained relatively stable at 12,311 units despite a nearly 58% YoY decline, indicating a cautious approach to balancing supply with ongoing demand.

Theresidential market is shifting from a broad-based, volume-led recovery to a more mature, value-driven phase. Strong growth in southern and eastern cities, alongside moderated performance in western hubs, underscores a regional rebalancing in housing demand. Developers appear increasingly focused on high-growth, high-demand areas, aligning new supply with market potential while maintaining cautious strategies in slower-performing regions.

Factors Driving Market Dynamics

Analysts point to stability in interest rates, proactive policy reforms, and recent GST reductions on cement as key factors supporting developer confidence and buyer sentiment. These measures have provided a buffer against rising input costs and sustained growth in premium and mid-tier housing segments.

The Q3 2025 performance indicates that India’s residential market is entering a more mature, value-driven phase. Cities like Bengaluru, Hyderabad, and Chennai are likely to continue seeing healthy demand due to strong urbanization trends, IT and business hubs, and rising disposable incomes. Conversely, markets such as Mumbai, Delhi-NCR, and Pune may see slower growth in volumes but maintain robust value due to the premium segment’s performance. Overall, while the volume-led recovery is stabilizing, the surge in transaction values highlights a shift toward sustainable, quality-focused growth, signaling a positive long-term trajectory for the Indian housing sector.

.png)