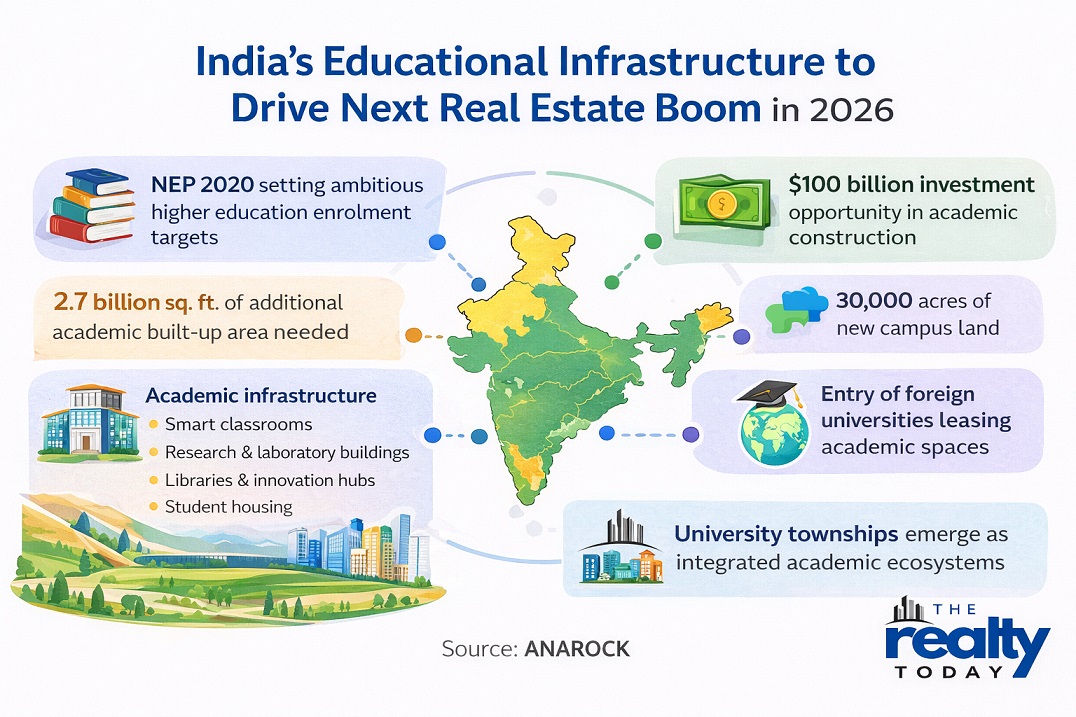

Educational Infrastructure driving India’s next real estate boom in 2026:Key Highlights

- ANAROCK identifies educational real estate as India’s next major real estate supercycle, moving beyond traditional residential, office, and retail segments due to sustained policy and demographic support.

- Higher education reforms under NEP 2020 are expected to require 2.7 billion sq ft of academic built-up space over the next decade, spanning classrooms, labs, libraries, research centres, and innovation hubs.

- To bridge the supply gap, India will need nearly 30,000 acres of fresh land, driving expansion into peri-urban zones, transit-linked corridors, and emerging education hubs, accelerating regional development and decentralisation.

- Core academic infrastructure alone could unlock a $100 billion investment cycle, excluding land and student housing—positioning education as one of the most capital-intensive and stable asset classes in Indian real estate.

- Integrated university townships combining academics, housing, retail, and innovation hubs are set to grow, while foreign universities may fuel a new institutional leasing model, offering developers long-term rental income and portfolio diversification.

For a long time, India's real estate market has mostly been dominated by the residential, commercial, and retail sectors. These three areas have collectively been the main focus of capital, policy, making, and developers' attention over the years. However, a recent report by ANAROCK Capital reveals that the next big major structural change in Indian real estate may be caused by an unlikely yet powerful segment, educational infrastructure.

As per the report The Academic Real Estate Supercycle published by ANAROCK Capital, the educational reforms under the National Education Policy (NEP) 2020 are facilitating a large- scale evolution in the establishment, construction, and expansion of educational institutions. This evolution is generating consistent, long- term demand for campuses, classrooms, laboratories, research facilities, and student housing all over the country, thereby making education one of the largest institutional real estate opportunities in India's history.

NEP 2020 is reshaping academic infrastructure requirements

NEP 2020 has set highly ambitious targets for substantially increasing the enrolment rate in higher education up to 2035. To hit these targets, India will need to grow both the capacity and the quality of universities and colleges. The demand for enrolment is continuously increasing, however, the academic infrastructure remains, for the most part, unchanged, thus, the supply gap is getting wider.

According to ANAROCK, a study concluded that closing such a gap would mean an additional requirement of 2.7 billion square feet of academic built up area over the next ten years. The growth of the education sector is not merely about the traditional classrooms but concerns the whole education ecosystem, including:

- Lecture halls and smart classrooms

- Advanced research laboratories

- Libraries, digital learning centres, and innovation hubs

- Faculty offices and collaborative spaces

A requirement of such massive scale has the potential to reshuffle the entire institutional land planning in India, especially in case of peri, urban areas and education hubs that are getting developed.

Land acquisition and spatial expansion

Besides this, fulfilling the infrastructure demand will also attract substantial requirements of land resources. ANAROCK predicts that India as a whole will need close to 30, 000 acres of fresh campus land. This is a clear indication of how the educational institutions are evolving from being small urban campuses in city centers to large, format institutional developments alongside transit avenues and in major city suburbs

Such a physical spread is likely to trigger regional development, lift urban decentralisation and open up education, and drive micro markets all over India.

A $100 billion construction, led investment cycle

On an investment front, the report brings out that higher education real estate has a radically different risk, return profile from residential or commercial properties. Education infrastructure development projects are generally long term, supported by government policies, and the least affected by fluctuations in the economic cycle.

ANAROCK figures that investing in the construction of core academic infrastructure only, can potentially open up a $100 billion investment market. The amount includes the expenditure on:

- Classrooms and teaching blocks

- Research and laboratory buildings

- Libraries and institutional facilities

It is worth mentioning that the figure for the estimate does not cover the cost of the land acquisition and student accommodation. The inclusion of these additional components results in an overall investment opportunity that is substantially larger, therefore, education real estate will be one of the most capital intensive sectors for growth in the next ten years.

India's demographic advantage and the global scenario

India's demographic advantage is what makes this opportunity exceedingly attractive. Across the world, there are very few countries that have a combination of a young population, increasing demand for higher education, and strong policy backing. According to ANAROCK, as enrolments go up, and with international collaborations and education globalisation, India could be one of the countries that witness a massive higher education infrastructure build out.

For the developers, it is an opportunity to expand their portfolio beyond just housing and offices to the stable institutional assets that have predictable demand and long term visibility.

University townships are envisioned to become the next major model of development

The report cites university townships as a major feature of the future; they are cohesive, self- sufficient education ecosystems that are based on current and even futuristic academic lifestyles. The fact that the traditional campus is a singular and isolated unit is what differentiates the university township, which is a combination of several functions within one area including:

- Academic and research buildings

- Student hostels and faculty housing

- Retail outlets, recreation centres, and green spaces

- Innovation, incubation, and startup hubs

University campuses integrated with townships are set to gain prominence as institutions aim to develop world class campuses that not only provide facilities for learning but also living and collaboration in one place. Developers having a strong track record in large, scale master planning are expected to be the key influencers of such ventures.

International universities and rented academic spaces

Moreover, the entry of foreign universities, post regulatory reforms, is anticipated to be another major driver of growth. ANAROCK highlights that a number of international universities might opt for leasing ready, made academic infrastructures instead of getting involved in land acquisition and construction.

Such a scenario will probably give rise to a new institutional leasing segment, akin to commercial office leasing, thus offering developers the opportunity to generate a consistent stream of rental income while at the same time, the globalization of the higher education market in India through the entry of foreign education players is being accelerated.

Driven by the implementation of India's education reforms as per NEP 2020, academic infrastructure is becoming one of the strongest and most sustainable engines for growth in the real estate sector. With the demand expected to be in the range of billions of square feet, investments to reach hundreds of billions of dollars, and the firm support of the policy, educational real estate is likely to be the main factor determining the shape of the Indian property market of the next 5 to 10 years.

.png)