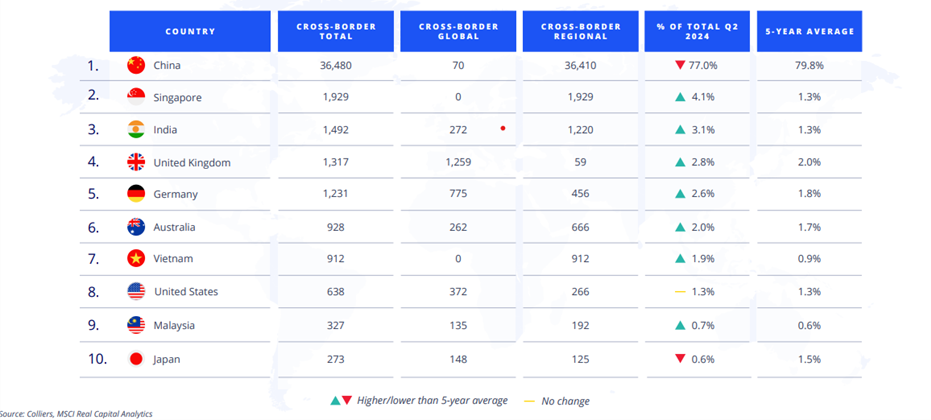

New research from Colliers has found that the Asia Pacific region was home to four of the top ten global cross-border capital sources in the first half of 2024 – Singapore, Hong Kong, Japan and China. When it came to global capital, targeting standing assets, Japan and China were in the top five destinations globally with Australia too representing the APAC region within the top ten list, according to Colliers’ Global Capital Flows Report- H1 2024.

India notably features prominently at the third place in the list of Global cross-border capital destinations for land and development sites in the report.

The office sector was the most sought after in terms of investment activity in APAC in the first half of 2024, followed by industrial sector. In India too, investments in industrial & warehousing and office assets remained strong in the first half of the year. Investments in Industrial assets especially, were 5X times, compared to same period last year. Amidst rising demand for superior quality Grade A assets and evolving supply-chain models, global investor confidence in the sector is improving significantly.

"Foreign investment in India's industrial & warehousing sector has been gaining significant traction in recent times. In H1 2024, nearly 70% of the total foreign inflows in India’s real estate sector were directed towards industrial & warehousing assets. Investor affinity is being driven by rising demand from 3PL & E-commerce players and strengthening of manufacturing capabilities across key industrial corridors of the country. In fact, the growing appeal of India as a key destination for industrial investments reinforces long-term confidence in the sector," said Piyush Gupta, Managing Director, Capital Markets & Investment Services at Colliers India.

With USD 3.5 billion of inflows in H1 2024, institutional investor interest in Indian real estate has remained firm. While 70% of investments during H1 2024 were focused on ready assets, India’s fast-paced growth and infrastructure development will continue to offer numerous opportunities in developmental assets over the coming years.

“Backed by robust domestic demand, healthy GDP growth and likely easing of monetary policy in the next few quarters, investments in Indian real estate sector will remain steady. Evident from a 73% share during H1 2024, foreign inflows will continue to dominate institutional investments in the near-term. Although North America and EMEA will lead the foreign inflow of funds, we can witness increasing traction from investors in the wider APAC region," said Vimal Nadar, Senior Director and Head of Research, Colliers India.

“APAC is a powerhouse of economic activity, offering diverse investment opportunities across traditional sectors such as residential, commercial and industrial & logistics as well as growing specialized sectors like data centers and cold storage. Improving fundamentals are set to create new investment opportunities in the months ahead, with global rate cuts signaling positivity for real estate markets.” said Chris Pilgrim, Colliers’ Managing Director of Global Capital Markets, Asia Pacific.

Way Forward

India's rise to the third position in global cross-border capital destinations underscores its growing appeal in real estate. With substantial foreign investment, particularly in industrial and warehousing sectors, the country continues to attract significant global interest. As India's infrastructure and economic landscape evolve, it remains a key player in the global real estate market, promising continued investment opportunities.