A recent survey by Knight Frank India reveals that home loans are the top financing choice for potential homebuyers, with 79% of respondents indicating a preference for using loans for property purchases. The report titled "Banking on Bricks" explores the factors influencing homebuyers' decisions, providing a comprehensive view of how financing, location, and other preferences shape the real estate market. The study surveyed 1,629 urban homebuyers across India, highlighting a growing trend in homeownership and the evolving dynamics of the property market.

Home Loans: A Preferred Mode of Financing

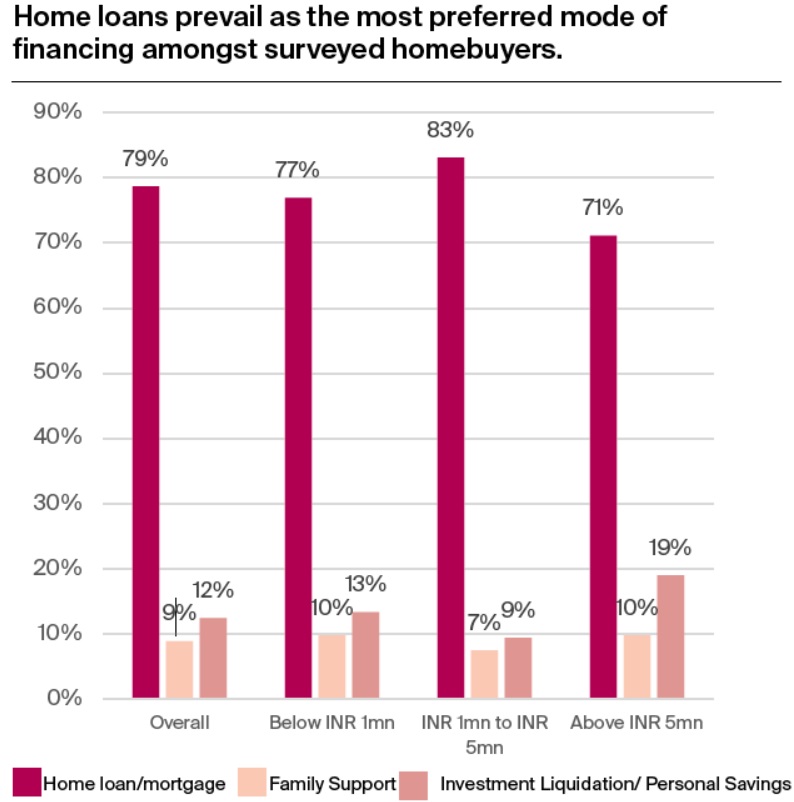

The preference for home loans is consistent across all income groups, with 79% of respondents relying on loans for property purchases. However, there is a noticeable difference in how various income groups approach financing. Notably, 83% of households earning between INR 1 million and INR 5 million prefer home loans. In contrast, more affluent buyers with household incomes above INR 5 million show a greater tendency to use personal savings or liquidate investments, with 19% of them opting for this route, compared to 11% in the lower-income bracket. This suggests that wealthier individuals take a more diversified approach to financing, blending traditional home loans with personal resources to fund property acquisitions. While home loans remain the dominant option for many, affluent buyers exhibit a strategic approach, using their savings or investments alongside loans to manage their assets more effectively.

Homebuyers' Expectations from Banks and Financial Institutions

The Knight Frank survey reveals key preferences of homebuyers for financial institutions during the homebuying process:

- 74% prioritize competitive interest rates for affordable financing.

- 48% value flexible loan tenures for better repayment options.

- 38% prioritize quick loan approval, emphasizing the need for fast processing in a competitive market.

Additionally:

- 25% seek guidance on legal and documentation for transparency.

- 15% look for home insurance options, seeking more comprehensive financial packages.

Property Preferences: Apartments Lead the Way

The report sheds light on the types of properties that are in demand. Apartments dominate the preferences, with 52% of respondents indicating a preference for this housing type. Apartments are followed by studio apartments (19%) and independent houses or villas (17%). Interestingly, options like gated communities (7%) and plots of land (5%) appear less popular, suggesting that buyers are more inclined towards ready-to-move-in options and community living spaces.

This preference for apartments is reflective of the urbanization trends in India, where more people are looking for compact, modern living spaces that offer convenience and amenities. Apartments, particularly in well-established urban areas, provide easy access to essential services and infrastructure, making them an attractive choice for city dwellers.

Key Factors Influencing Homebuyers’ Decisions

When it comes to decision-making, several factors play a crucial role in determining the final choice of property. The survey highlights the importance of the following factors in the home buying process:

- Location (50%): Location remains a timeless priority, with half of the respondents citing it as a key determinant in their decision-making process. Proximity to work, access to public transportation, and overall neighborhood quality are some of the reasons why location remains a priority for homebuyers.

- Size and Layout (45%): The layout and size of the property are equally important, as they determine how well the space meets a buyer’s lifestyle needs. Homebuyers are increasingly focused on securing homes that offer value for money while accommodating their living requirements.

- Price and Affordability (45%): Price continues to be a significant consideration, as many buyers want to make sure they are purchasing a property that fits within their budget. As real estate prices rise, the demand for affordable yet spacious homes increases, especially in metropolitan areas.

- Builder Reputation (35%): Trust in the builder or developer plays an important role. Buyers are more likely to invest in properties from reputable developers who have a history of delivering quality homes on time.

- Proximity to Workplace (33%): The convenience of living close to work or having easy access to public transportation is crucial, particularly in bustling urban areas where commuting times can be long and exhausting.

- Amenities (32%): The demand for integrated amenities such as gyms, parks, swimming pools, and co-working spaces is on the rise. Buyers are increasingly looking for properties that offer more than just a place to live—they want a holistic living experience.

- Financing Options (29%): The availability of financing options is another important factor influencing the decision to buy a home. Home loans, in particular, are crucial in making property purchases more accessible to potential buyers, allowing them to spread the cost over several years.

- Future Resale Value (22%): The potential for the property to appreciate in value over time is also a key consideration, particularly for those who are purchasing homes as investments. Buyers are keen to ensure that their property will have long-term value and can be sold at a profit in the future.

Homeownership Preferences Across Generations

The survey also reveals interesting insights about homeownership preferences across different generations. It shows that a significant majority of people across age groups prefer to own a home:

- 79% of Baby Boomers (those born between 1946-1964) prefer homeownership.

- 80% of Gen X (born between 1965-1980) also favor owning a home.

- 82% of Millennials (born between 1981-1996) express a preference for homeownership.

However, the sentiment is different among Gen Z (born between 1997-2012). Only 71% of Gen Z respondents prefer homeownership, with 27% leaning towards renting. This generational difference highlights a shift in how younger people view homeownership, possibly influenced by factors such as mobility, financial constraints, and lifestyle choices.

Reasons for Purchasing a Home: Investment vs. End-Use

The survey also explored the motivations behind purchasing property. 37% of respondents are purchasing homes to upgrade to a better living space, which is indicative of the growing demand for mid-range and luxury homes. This trend is particularly notable in Tier 1 cities, where people are increasingly seeking homes that offer better amenities and modern living features.

Additionally, 32% are first-time homebuyers purchasing for end-use, while 25% are investing in property for future returns. Another 7% of respondents cite other reasons, such as purchasing a second home or a vacation property.

This generational shift towards upgrading homes and investing in mid- to high-range properties suggests that the real estate market is expanding beyond the traditional buyer profile. Increasingly, people are looking for homes that offer both personal satisfaction and long-term financial gain.

Key Takeaways:

- 80% of respondents prefer home loans for financing property purchases.

- Location (50%), size/layout (45%), and affordability (45%) are key factors in decision-making.

- Gen Z is more inclined to rent, with 27% opting for renting rather than homeownership.

- 37% of buyers are upgrading to better homes, contributing to the trend towards mid-range and luxury properties.

- Financing options (29%) and future resale value (22%) are pivotal considerations for potential homeowners.

The Future of India’s Real Estate Market

India’s real estate sector is evolving rapidly, with significant shifts in buyer preferences and financial support systems. As the economy grows, more people are aspiring to homeownership, and financing tools such as home loans play a central role in facilitating this growth. The survey highlights that buyers are not just looking for a place to live but are also focusing on homes that offer value, comfort, and a high quality of life.

Images- knightfrank.com, freepik.com

.png)