As India witnesses an increase in its ageing population, a growing number of individuals over the age of 60 are seeking financial options to secure their retirement. One such avenue is investing in property, either for personal residence, gifting to children, or as a source of rental income. But a question arises—can a retired person get a home loan? The answer is yes. With evolving banking practices and customized financial products, several banks and housing finance companies now offer home loans tailored specifically for senior citizens.

However, the terms for senior citizens differ significantly from those offered to younger borrowers. There are tighter eligibility criteria, shorter tenures, and additional documentation requirements. This article provides an in-depth look into eligibility, interest rates, documents required, advantages, disadvantages, and how senior citizens can improve their chances of securing a home loan in India.

Can a Retired Person Get a Home Loan?

Yes, senior citizens can apply for a home loan even after retirement. While the process might involve stricter scrutiny, many financial institutions are open to lending provided the applicant has a stable post-retirement income such as a pension, rental income, or income from fixed deposits or investments. However, the eligibility depends greatly on the individual's financial profile, creditworthiness, and repayment capacity.

For example, some banks may restrict the maximum age to 70 or 75 at the end of the loan tenure, while others may require a younger co-applicant to mitigate the risk. The objective for most lenders is to ensure that the applicant is in a position to repay the loan without default.

Types of Home Loans Available for Senior Citizens

Senior citizens can choose from various home loan products that cater to different needs and financial situations.

1. Regular Home Loan

This is a standard home loan where borrowers repay the amount in EMIs. Due to shorter tenures, EMIs may be higher. A co-applicant can help extend the repayment period.

2. Reverse Mortgage Loan

Designed specifically for senior homeowners, this product provides monthly payouts instead of EMIs. The loan is repaid when the property is sold after the borrower’s demise.

3. Joint Home Loan

This option allows a senior citizen to apply for a loan along with a younger co-applicant, typically a child or spouse. It improves eligibility, increases the sanctioned amount, and allows a longer tenure.

4. Loan Against Property (LAP)

Senior citizens can leverage an owned property to secure a loan for buying another home, renovating a house, or meeting personal expenses. The loan is repaid through EMIs.

Popular Home Loan Schemes for Senior Citizens

Several banks offer home loan products customized for retirees. These schemes often include special terms such as flexible repayment options and relaxed documentation.

Key schemes include:

SBI Reverse Mortgage Loan: Offers monthly payouts based on the property value and borrower’s age. No EMI burden.

HDFC Home Loan for Pensioners: Available to retired employees with a steady pension or income. Offers competitive interest rates.

Bank of Baroda Home Loan for Retirees: Allows co-borrowing and demands a substantial down payment. Suited for pensioners with regular income.

LIC Housing Finance Home Loan: Caters to both salaried and self-employed retirees. Joint applications are allowed to enhance eligibility.

PNB Baghban Scheme: Specifically for pensioners. Requires stable income and allows shorter repayment terms.

Loan Amount, Interest Rates, and Tenure

Loan Amount

The loan amount sanctioned depends on the applicant’s income, age, and credit profile. Banks typically finance 60–80 percent of the property value. Senior citizens may need to arrange a higher down payment.

Interest Rates

Interest rates for senior citizen home loans generally range from 8 to 10.5 percent, slightly higher due to the shorter tenure and elevated risk. Both fixed and floating rate options are available.

Loan Tenure

Tenure is usually capped at 5 to 15 years. However, with a younger co-applicant, some banks allow longer repayment periods. Shorter tenure results in higher EMIs, which may impact monthly budgets.

Eligibility Criteria for Senior Citizens

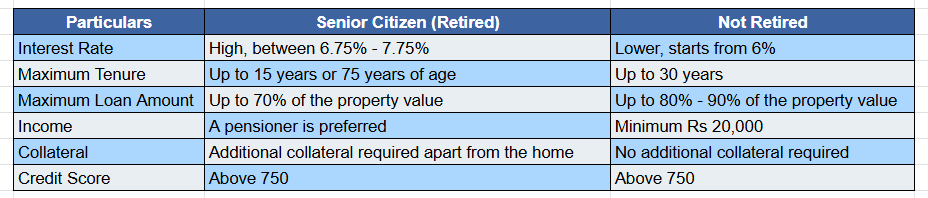

The eligibility criteria for senior citizens are understandably stricter than for younger, employed individuals. Key considerations include age, income source, credit history, and collateral. Here’s a comparison to illustrate the differences:

The stricter tenure and lower loan-to-value ratio (LTV) are meant to safeguard the bank's interest and reduce the risk of default.

Home Loan Interest Rate for Senior Citizens

While home loans are accessible to senior citizens, the interest rates offered tend to be slightly higher than those available to younger borrowers. This is due to the shorter loan tenure and the higher risk profile of older applicants. However, many leading lenders in India do offer special schemes and relatively competitive rates for pensioners.

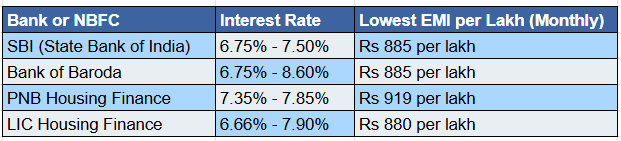

Here’s a look at some of the current interest rates and EMI options available for senior citizens:

These rates are indicative and may vary based on the applicant's credit profile, tenure, and property value.

Documents Required for Senior Citizen Home Loans

To apply for a home loan, senior citizens must provide a comprehensive set of documents to establish identity, income, and property ownership. Here’s a checklist:

- PAN card and Aadhaar card

- Proof of age (birth certificate, passport, etc.)

- Income proof (pension statement, Form 16, investment income)

- Last 6-12 months bank statements

- Property documents (sale deed, agreement to sell, property tax receipts)

- Passport-size photographs

- Proof of residence (utility bills, rental agreement, etc.)

Having all documents in order speeds up the processing time and improves the likelihood of approval.

Advantages of Home Loans for Senior Citizens

- Achieve financial independence: Retired individuals can continue to invest in property without depending on family.

- Tax benefits: Under Sections 80C and 24(b), borrowers can claim deductions on principal and interest.

- Legacy planning: Property can be passed on to children as an asset.

- Joint loans: Applying with a younger co-applicant improves eligibility.

- Customised products: Many banks offer specific products with flexibility for seniors.

Disadvantages

- Shorter repayment tenure: Higher EMIs can strain post-retirement finances.

- Higher interest rates: Rates are generally 0.25% to 0.5% higher.

- Additional collateral: Some banks ask for extra security.

- Limited income sources: Pension or fixed income may not meet all eligibility norms.

- Health concerns: Banks may require medical assessments for very senior applicants.

Smart Tips to Improve Loan Eligibility After 60

If you're a retiree and serious about getting a home loan, here are 6 actionable steps to boost your chances:

1. Add a Co-Applicant

Bring in an earning co-applicant (your child or spouse). This not only increases your loan eligibility but also allows both to claim tax deductions under Sections 80C and 24(b).

2. Pledge Additional Collateral

Offering fixed deposits, gold, or another property as additional security increases the bank’s confidence in your repayment capacity.

3. Opt for a Lower LTV (Loan-to-Value)

Try to pay a higher down payment (30%-40%). A lower LTV means lower risk for banks, which often leads to faster approvals.

4. Use Online EMI Calculators

Before applying, calculate your EMI using online tools. Make sure your EMI doesn’t exceed 50%-55% of your monthly pension/income.

5. Improve Your Credit Score

A CIBIL score of 750+ is considered healthy. Clear existing debts and avoid multiple hard inquiries to keep your score up.

6. Avoid Multiple Applications

Applying with many banks at once leads to hard pulls on your credit profile. Instead, use platforms like Magicbricks, BankBazaar, or PaisaBazaar to compare loan offers without hurting your CIBIL score.

Real-World Scenario: Why These Tips Work

Let’s say Mr. Sharma, a 66-year-old retiree with a pension of ₹35,000/month, wants to buy a ₹40 lakh flat. Alone, he qualifies for only ₹10–₹12 lakh due to income and age. However, by:

- Adding his working son as co-applicant

- Opting for a 40% down payment

- Pledging a ₹5 lakh FD as backup collateral

… he can now get a ₹24–₹26 lakh loan with lower EMI pressure and longer tenure, while enjoying tax benefits jointly.

Home loans are no longer restricted to the younger generation. With proper planning and awareness of eligibility norms, senior citizens in India can successfully avail home loans to fulfil their post-retirement housing needs. While the process may be slightly more challenging, it is certainly achievable with the right approach. Always compare offers, understand the fine print, and choose a lender that aligns with your financial capacity and long-term goals.

If you're a senior citizen planning to apply for a home loan, start by assessing your finances, gathering necessary documents, and consulting with your bank or a financial advisor. The right decision now can secure a comfortable and independent future.

.png)