In the April-June quarter of 2024, Bengaluru emerged as the leading city in office space absorption in India. According to a report by property consultancy Vestian, the city led the nation in office space absorption during the April-June quarter, capturing a substantial 25% share of the total office absorption across India. According to Vestian’s quarterly office market report, The Connect Q2 2024, AI and robotics companies accounted for 21% of Bengaluru’s office space absorption in the second quarter of 2024. The rapid global advancements in artificial intelligence, coupled with a supportive ecosystem in Bengaluru, have significantly driven the demand for office space in the city. Overall, the IT-ITeS sector, including AI and robotics, dominated the market, accounting for 69% of Bengaluru’s total office absorption in Q2 2024.

A Deep Dive into the Numbers

The report reveals that the IT/ITeS sector, encompassing artificial intelligence (AI) and robotics firms, played a pivotal role in driving office space absorption in Bengaluru. The sector accounted for an astounding 69% of the city’s total office space absorption in Q2 2024. This surge can be attributed to the rapid global advancements in AI and robotics, coupled with a supportive ecosystem in Bengaluru that fosters innovation and growth in these cutting-edge fields.

Overall, office absorption in Bengaluru for Q2 2024 was remarkable, highlighting the city's appeal as a premier destination for IT/ITeS companies. The city's strategic location, well-developed infrastructure, and availability of skilled talent have cemented its position as a preferred hub for technology-driven industries.

Comparative Analysis with Other Major Cities

While Bengaluru led the pack with a 25% share of office absorption, Mumbai and Hyderabad were not far behind, each capturing a 20% share. The performance of these cities underscores their importance as significant players in India's commercial real estate market.

Interestingly, Pune recorded the highest growth in office absorption during the quarter, with a 307% increase in value terms. This substantial growth indicates a rising demand for office space in Pune, driven by the city's burgeoning IT and manufacturing sectors. On the other hand, Chennai experienced a 48% decline in office space absorption, reflecting a contrasting trend in its commercial real estate market.

Delhi-NCR also reported a decline in office absorption, with a quarterly and annual decrease of 37%. Despite these variations, the overall office absorption across the top nine cities in India reached 17.04 million square feet in Q2 2024, marking an increase of 27% over the previous quarter and 23% compared to the same quarter in the previous year.

The Role of Flex Spaces and Future Projections

According to Shrinivas Rao, FRICS, CEO of Vestian, the demand for office space is expected to increase further, driven by the IT/ITeS and BFSI (Banking, Financial Services, and Insurance) sectors. Flex Spaces, which offer flexible office solutions, are anticipated to play a pivotal role in the growth of office markets in India. The adaptability and cost-effectiveness of Flex Spaces make them an attractive option for companies seeking to establish or expand their operations without committing to long-term leases.

The report projects that the total office space absorption for the calendar year 2024 is expected to surpass the 60 million square feet mark, a significant milestone reflecting the strength of India's commercial real estate market. This projection is based on the robust demand for grade-A office spaces across the top seven cities in India, which collectively recorded an annual uptick of 18% in office space absorption during the first half of the year.

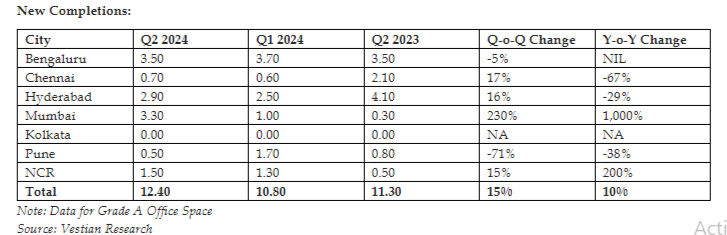

New Completions and Their Impact

New completions of office spaces during the first half of 2024 increased by 17% year-on-year, reaching 23.2 million square feet. Mumbai reported 3.3 million square feet of new completions during Q2 2024, registering the highest quarterly rise of 230%. Bengaluru, with a 28% share, dominated new completions, closely followed by Mumbai at 27%.

The southern cities, Bengaluru, Chennai, and Hyderabad collectively accounted for 57% of the total new completions reported in Q2 2024. However, this share has dropped from 63% in the previous quarter, indicating a shift in the distribution of new office space across different regions.

The Strategic Significance of Bengaluru

Bengaluru’s dominance in office space absorption can be attributed to several factors. The city’s reputation as the Silicon Valley of India attracts a multitude of IT/ITeS companies, including global giants and innovative startups. The presence of a supportive ecosystem, including top-tier educational institutions, research facilities, and a vibrant startup culture, further enhances Bengaluru’s appeal.

Moreover, the city’s infrastructure development, including the expansion of metro lines and improvements in road connectivity, has made commuting more convenient, thereby attracting companies to set up offices in Bengaluru. The availability of a skilled workforce, particularly in technology and engineering, ensures that companies have access to the talent they need to drive innovation and growth.

Conclusion

The report by Vestian underscores Bengaluru's pivotal role in India's commercial real estate market. The city's leadership in office space absorption, driven by the IT/ITeS sector and particularly AI and robotics companies, highlights its importance as a hub for technological innovation. As the demand for office space continues to grow, driven by advancements in technology and the evolving needs of businesses, Bengaluru is well-positioned to maintain its dominance in the commercial real estate market.

Image source- pixabay.com

.png)