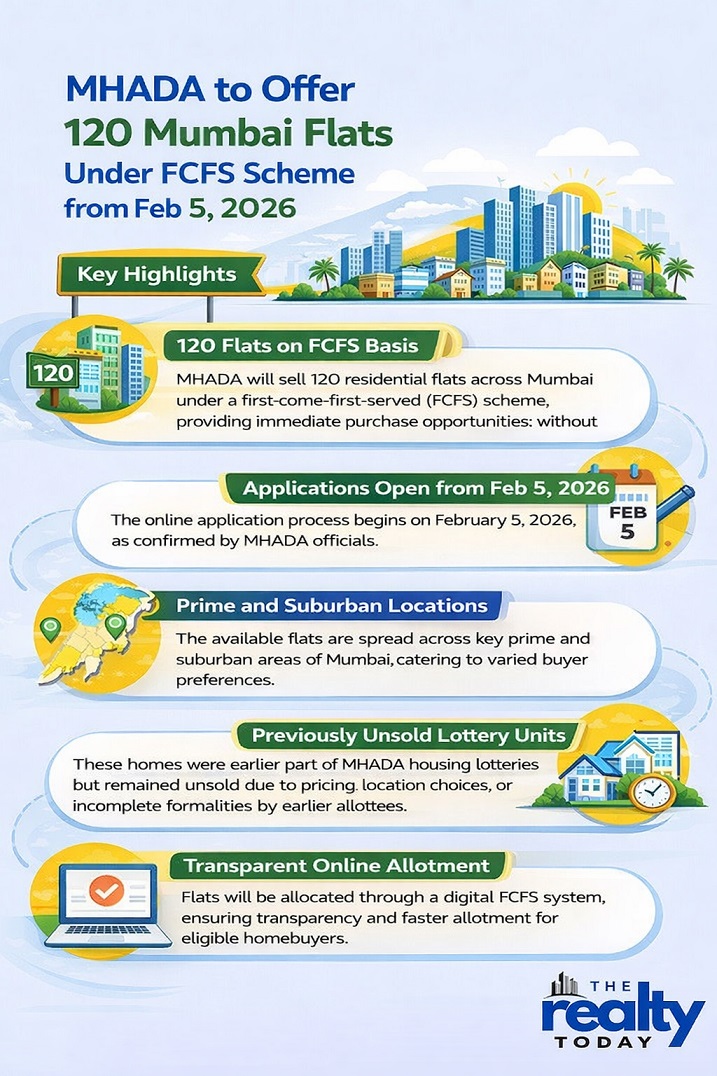

MHADA to Offer 120 Mumbai Flats Under FCFS Scheme from Feb 5, 2026- Key Highlights

- 120 flats on FCFS basis: MHADA will sell 120 residential flats across Mumbai under a first-come-first-served (FCFS) scheme, providing immediate purchase opportunities without a lottery draw.

- Applications open from Feb 5, 2026: The online application process begins on February 5, 2026, as confirmed by MHADA officials.

- Prime and suburban locations: The available flats are spread across key prime and suburban areas of Mumbai, catering to varied buyer preferences.

- Previously unsold lottery units: These homes were earlier part of MHADA housing lotteries but remained unsold due to factors such as pricing, location choices, or incomplete formalities by earlier allottees.

- Transparent online allotment: Flats will be allocated through a digital FCFS system, ensuring transparency and faster allotment for eligible homebuyers.

Maharashtra Housing and Area Development Authority (MHADA) has announced a proposal to sell 120 residential flats in various locations of Mumbai on a first, come, first, served (FCFS) basis, thus giving homebuyers the opportunity to buy flats in both city and suburban localities. MHADA officials said that the application process for these flats started on February 5, 2026.

MHADA has stated that the flats offered through the FCFS scheme were at one time lottery flats in different projects but for a variety of reasons, such as price, location preference, previous allottee's non, fulfillment of formalities, etc., they remained unsold. These apartments are now available again to the public via an online selection process.

Key Highlights of the FCFS Scheme

- Number of Flats: 120 flats available across Mumbai in prime and suburban locations.

- Origin of Flats: These were earlier unsold lottery flats in previous MHADA projects.

Locations and price range

The 120 flats are not only situated in the suburbs but also in South Mumbai. If you want to be precise about the locations of these flats, you might as well refer to the list of areas such as Kandivali, Charkop, Shimpoli, Antop Hill, Wadala, Powai, Malad, Mankhurd, Ghatkopar, Vikhroli, Byculla, Tardeo, Lower Parel, Sion, Juhu, and Andheri.

The prices of the flats are in a range which depends on the size of the flat and the location. It is being said that the most expensive flat is in Tardeo, South Mumbai, and the price of the flat is over Rs. 8 crores while the cheapest flat is around Rs. 38 lakhs. Therefore, the scheme can be of great assistance to buyers from different income groups.

Application and booking process

Application and booking process MHADA informed that the interested people can apply for registration only through the official website, https://bookmyhome.mhada.gov.in. Registration for projects will start on February 5, however, the process of flat selection and payment will be started from February 12, 2026.

After registration, the applicants will have to pay a security deposit and the application fee. Upon completing this step, they will be able to see the Book My Home section on the portal. This segment provides applicants with the option to check the availability of flats in real time along with other information like the building/wing number, flat number, and floor, etc.

If the applicant wishes to proceed with the flat that is available, he can go ahead and do the final booking. MHADA has enforced a rule that the selected applicants have to pay 10% of the flat sale price within 48 hours of their selection. After getting the payment, MHADA will send a temporary online offer letter to the buyer thus giving the buyer an option to continue the payment process for the balance amount.

Cancellation policy and refund

MHADA has set stringent rules for the timelines and cancellations. If an applicant does not pay 10% of the amount within 48 hours of choosing a flat, the allotment will be cancelled automatically, and the entire security deposit will be forfeited.

Moreover, if the applicant cancels the flat after the temporary allotment letter is given, fails to pay the remaining amount within the set time, or if the allotment is cancelled for any reason, 1% of the flat's total sale price will be taken as a deduction, and the rest of the amount will be refunded without any interest, said MHADA.

Eligibility and documents required

For applying for a flat under this scheme, the applicant must be an Indian citizen and at least 18 years old on the date of application.

The following documents are required:

- Aadhaar Card and PAN Card for unmarried applicants

- Aadhaar and PAN cards of both husband and wife for married applicants

- For divorced applicants, a certified copy of the court judgment or a copy of the appeal filed

MHADA has clarified that the possession of the flat will not be given without the final court judgment, and the flats will not be allotted without the decree certificate, if applicable.

Home loan facility

Applicants intending to take a housing loan should submit a pre, sanction letter from their bank by logging in with their credentials. Accordingly, MHADA will provide a No Objection Certificate (NOC) to the bank. After the payment of the entire flat price and stamp duty, MHADA will release the final allotment and possession letters.

The officials of MHADA had also stated that there is a possibility of a much bigger housing lottery later this year. About 5, 000 affordable homes may be made available in Mumbai in the next two to three months, with almost half of these units being in Goregaon.

The houses that are to be put up will probably meet the needs of different income categories such as Economically Weaker Sections (EWS), Lower Income Groups (LIG), Middle Income Groups (MIG), and High Income Groups (HIG).

With the demand for housing in Mumbai still very strong and the affordable supply being limited, MHADA's FCFS scheme is anticipated to garner considerable attention, especially among those buyers who are looking for ready, to, move- in or centrally located homes.

Image source- mhada.gov.in

.png)