Since its enactment in October 2016, India's Insolvency and Bankruptcy Code (IBC), which will mark its 9th anniversary in October 2025, is on the verge of another round of substantial reforms and policy changes as legislators work to solve long-term difficulties in the areas of diminished recovery rates and prolonged resolution may be accomplished. Credit rating service firm ICRA reports that the recommended modifications to IBC will likely create positive influences in improving recovery for creditors in cases outside of the real estate industry and decreasing the timeframes associated with receiving payment for those debts, thanks to the suggested improvements that will be introduced by MCA and IBBI alongside the future changes to IBC.

However, ICRA cautioned that the current set of proposals does not adequately address the real estate and construction sector, which continues to face unique structural challenges under the insolvency framework. The real estate sector has the second-highest share of cases undergoing the corporate insolvency resolution process (CIRP) as of September 30, 2025. Given the government’s sustained focus on protecting homebuyers and resolving stalled housing projects, ICRA believes that targeted and sector-specific reforms will be necessary to meaningfully address insolvency issues in this segment.

IBC Performance After Nine Years

Since its implementation in 2016, the IBC has emerged as India’s most effective institutional mechanism for corporate debt resolution, delivering better realisations for creditors compared to earlier recovery modes. Despite its shortcomings, the framework has enabled cumulative recoveries of approximately ₹4 lakh crore.

The Corporate Insolvency Resolution Process was started for a total of 8,658 corporate borrowers, who entered the Corporate Insolvency Resolution Process (CIRP) as of September 2025. Of these cases, approximately 63% have been closed via a successful resolution plan, withdrawn or withdrawn from the CIRP process, or liquidated. Although the rate at which the cases have been closed has been consistent and positive, recovery from the corporate borrowers has remained low. The average recovery for successful resolution plans is approximately 32% of the value of the creditors' claims.

ICRA noted that prolonged resolution timelines have been a key factor contributing to value erosion. Data indicates that nearly three-fourths of ongoing CIRP cases had exceeded 270 days from the date of admission by the National Company Law Tribunal (NCLT) as of September 30, 2025, despite the mandated outer limit of 330 days, including litigation.

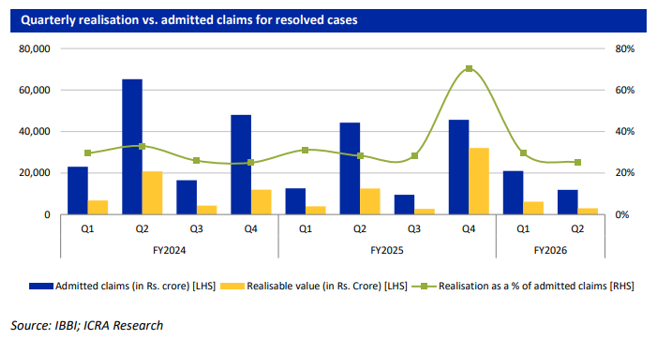

Recovery Rates Weaken in H1 FY2026

After displaying gradual improvement until the fourth quarter of fiscal year 2025, the recovery trends reversed in the first half of fiscal year 2026. The ICRA has observed decreases in the entire volume of recoveries, as well as in recovery as a proportion of the volume of admitted claims. This was observed for all sizes of insolvencies, including the large insolvencies which involved claim amounts greater than ₹1,000 crore.

Claims volume admitted continues to be at a high level, however, the amount expected to be recovered from the volume of admitted claims is not keeping up with new claims, resulting in lower recovery ratios. The slowdown in recoveries has been attributed to a number of issues still being faced by the industry, including delays due to litigation, a limited number of participants bidding for assets within certain cases and/or challenges associated with determining the value of an asset.

Also, the number of approved resolution plans has declined. Presently, only 105 resolution plans have been approved during the first half of fiscal year 2026, as compared to 124 approvals within the same period of time during the first half of fiscal year 2025. Although the number of new insolvencies being admitted has decreased, the lower percentage of resolution approvals indicates that the bottlenecks within the overall IBC system are still occurring.

Legislative Developments and Amendment Bill

The Amendment Bill to the Insolvency and Bankruptcy Code aimed at addressing structural inefficiencies and procedural inefficiencies was detailed in the Lok Sabha on 28th August 2025. The Select Committee of the Lok Sabha is currently considering the Amendment Bill. Reports and Recommendations by the Ministry of Corporate Affairs (MCA) and the Lok Sabha Select Committee have been submitted as of the last winter session of the Parliament. The winter session of Parliament was supposed to witness the passing of the Amendment Bill. However, the Budget session is expected to see its consideration instead.

Commenting on the developments, Manushree Saggar, Senior Vice President and Group Head, Structured Finance Ratings at ICRA, said that although recovery rates improved until Q4 FY2025, the trend reversed in H1 FY2026. She added that based on data as of September 30, 2025, nearly three-fourths of ongoing CIRP cases had exceeded 270 days post-admission by the NCLT. According to her, the SCLB’s recommendations, if implemented, are expected to improve recovery rates and reduce timelines under the IBC framework.

Key Recommendations of the Select Committee

One of the key recommendations of the SCLB is the permission for more than one resolution plan for a corporate debtor. Thus, asset, wise or business vertical, wise resolution can be carried out, which will be particularly helpful for companies that operate in multiple business segments. ICRA is of the opinion that such a flexibility may lead to better resolution outcomes as it will attract a larger and more diverse bidder pool.

The SCLB has also supported the clean slate principle, which inter alia, guarantees that settled judicial pronouncements will not be reopened and that the legal liability of the corporate debtor will be distinctly separated from that of the former promoters and senior management. This step is likely to provide more certainty to resolution applicants and lessen the incidence of post, resolution litigation.

Moreover, the Committee has suggested the introduction of a statutory timeline of three months for the National Company Law Appellate Tribunal (NCLAT). This measure may facilitate the confirmation of appellate proceedings at a brisk pace and the minimization of the wait for the appeal stage.

Judicial Capacity Constraints Remain

ICRA pointed out that, while the proposed measures may be viewed as steps in the right direction, the issue of delays at the NCLT level continues to be the most significant problem that has not been addressed in the proposals. As of March 2025, there were over 30, 000 IBC cases pending before various NCLT benches throughout the country. It is estimated that, given the current capacity, it would take more than ten years to clear the backlog.

While the Ministry of Corporate Affairs intends to set up more benches for the NCLT and NCLAT, ICRA expressed the view that the substantial increase in the judicial workforce would be instrumental in bringing down the average CIRP duration, which is currently over 700 daysmore than double the time stipulated by the law.

New Mechanisms: Out-of-Court, Group and Cross-Border Insolvency

ICRA also supported the idea of a creditor, initiated insolvency resolution process with an out, of- court initiation method. A system like this could lead to resolutions that are not only quicker and less expensive but also cause less disruption to the business, thus relieving the judicial system.

The introduction of group insolvency provisions is likely to have a positive effect on corporate groups with operations and finances that are interdependent. Similarly, cross, border insolvency provisions would bring India's insolvency framework in line with the global standard, particularly for companies with international operations and creditors.

On a related note, the IBBI had issued a notification on December 22, 2025, with amendments making the disclosure of ultimate beneficial ownership mandatory in resolution plans. ICRA is of the view that this measure will help in addressing the issue of opaque ownership structures and will also prevent promoters from hiding the real control by way of complex holding structures.

Real Estate Sector Still Needs Targeted Reforms

Notwithstanding the broadly based reforms proposed, ICRA has reiterated that the lack of real estate specific measures is a major gap. Considering the sector's substantial share of ongoing insolvency cases and the government's focus on the protection of homebuyers, ICRA is of the opinion that structural reforms specifically designed for the real estate sector will be indispensable in bringing about the improvement of resolution outcomes.

Overall, ICRA views the proposed IBC amendments as a timely and necessary step toward strengthening India’s insolvency framework. However, their success will depend on swift legislative approval, expansion of judicial capacity, effective implementation of new mechanisms, and targeted interventions for sectors such as real estate, where challenges remain deeply entrenched.

.png)