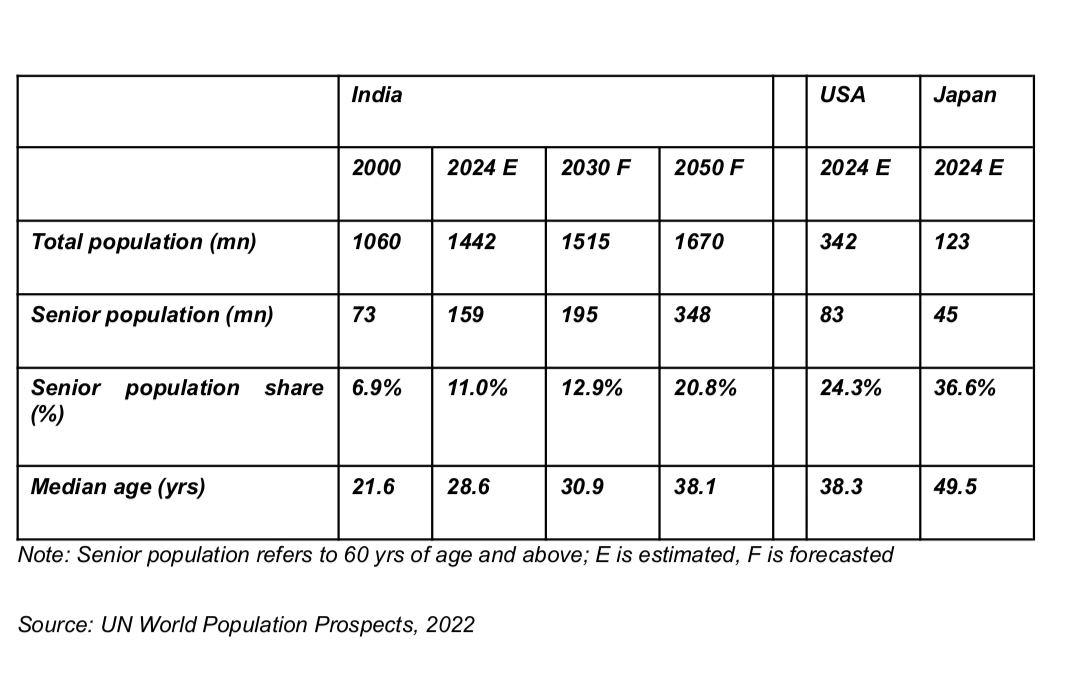

The Indian senior living market is poised for remarkable growth, projected to expand fivefold from its current levels to approximately USD 12 billion by 2030. This surge is fueled by demographic shifts, with India's median age expected to increase from 29 to 38 by 2050, and the proportion of individuals aged 60 and above rising from 11% to 21% during the same period. As the country's population ages, there is a growing need for housing and care tailored to seniors' unique requirements. Despite the immense potential, the senior living market in India is still nascent, presenting lucrative opportunities for private developers and institutional investors alike.

The Colliers report provides a comprehensive analysis of India's senior living market, highlighting its potential for substantial growth in the coming years. It emphasises demographic shifts, such as an ageing population and increasing life expectancy, as key drivers of demand for senior housing and care services. The report underscores the significant gap between current supply and projected demand, indicating lucrative opportunities for developers and investors. Moreover, it explores various trends and factors shaping the senior living landscape, including the rise of targeted offerings, innovative financing schemes, government support, and integration with existing townships. Overall, the report offers valuable insights into the evolving senior living sector in India and its implications for stakeholders.

“Like most emerging market economies, the demographic pattern of India is undergoing a steady yet definite shift. The population pyramid of the country will slowly but surely transform from the current expansionary stage to a more stable state in the next few decades. The current nascent senior living market presents a lucrative opportunity for private organised developers to capitalise on the untapped market. With rising interest from institutional players and leading real estate developers, senior housing in the country is set to be almost 5x times by 2030, compared to current levels” said Badal Yagnik, Chief Executive Officer, Colliers India.

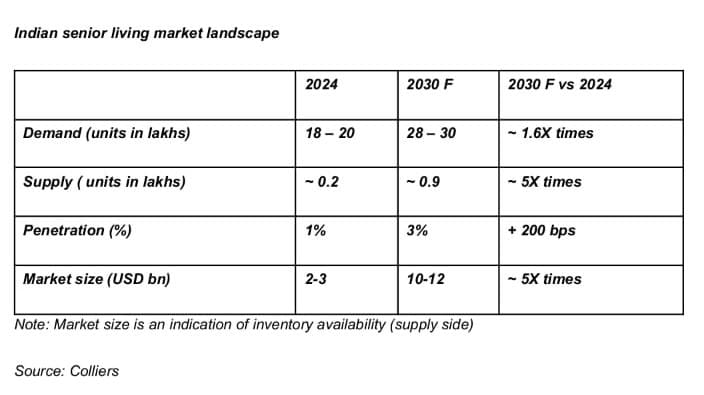

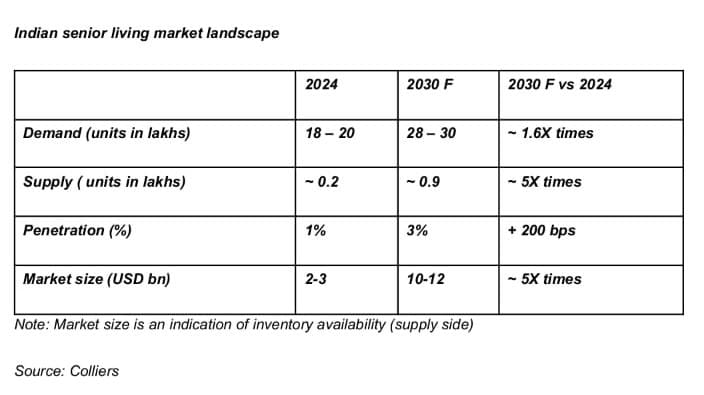

India’s senior living market still at a nascent stage

Estimating the demand for senior housing in India

With the rise in the aging population, the demand for senior living services including medical, insurance, housing etc. has been steadily increasing. Factors like rising life expectancy, nuclearization of families, higher income levels, increasing importance of a stable post-retirement life and changing lifestyle are driving the demand for senior living especially in urban areas. With increased focus on health and wellness, seniors today are more active and engaged than previous generations – looking for senior living options that offer amenities such as fitness centres, recreational activities, and cultural events to support a vibrant and fulfilling lifestyle. Colliers estimates the current demand for senior housing at 18-20 lakh units, which is likely to increase significantly in the next five-six years. This growing demand creates lucrative opportunities for real estate developers and institutional investors.

Does India have enough supply to accommodate the rising senior population in the country?

With close to 20,000 units in the organised sector, current availability of senior housing in India translates into a 1% penetration rate, indicating a huge demand supply gap. In contrast, countries like the US, UK and Australia have established senior living markets with 6-7% penetration rate. Moreover, a lower population base also means significantly less demand supply gap in these matured markets.

“While currently the senior living market size in India is estimated to be about USD 2-3 billion, it is expected to witness a CAGR of more than 30% and reach ~USD 12 billion by 2030. Although the demand supply gap will remain high even in 2030, the penetration in the senior living market has the potential to improve significantly in the long-term. All in all, the senior living market in India is likely to witness accelerated growth in the next few years and embark upon an eventual transition into maturity with changing demographics” said Vimal Nadar, Senior Director & Head of Research, Colliers India.

Indian senior living market landscape

Rise in targeted offerings for ageing population to meet unique needs

Senior living in India currently is being offered by private developers through apartments ranging from 1 to 3 BHK or villas, in two formats – independent living and assisted living. Independent living facilities are typically preferred by seniors who can manage their daily activities independently but seek the convenience of community living.

The average ticket size of independent senior living in India is about INR 1 to 2 crore, largely depending on the city and location. Currently, there are very few developers that focus on the senior living segment in India. Some of the major organised developers include Ashiana, Columbia Pacific, Paranjape, Anatara and Primus senior living. A significant portion of the supply side is concentrated in southern cities, leaving substantial room for growth and development in other parts of the country.

At the same time, the concept of assisted living is picking pace, where developers provide additional facilities like housekeeping in individual units, medical coordinators, physiotherapists, on-premise nursing attendants, emergency panic alarm response and professional society maintenance and management services as well.

Road ahead for the senior living segment

Growing traction in tier II and spiritually focused cities

Senior living has been gaining traction in tier II cities led by preference for slower pace of life, ease of living and lesser population related infrastructure stress. Cities like Ahmedabad, Surat, Coimbatore, Kochi and Panaji are preferred cities for senior living accommodation. The segment is also witnessing a boom in places of pilgrimage such as Vrindavan, Ayodhya, Dwarka and Rameswaram. According to Association of Senior Living India (ASLI), currently, about 60% of the senior living demand emancipates from tier II cities. Limited senior housing inventory in these cities presents immense potential for private developers looking to diversify their portfolio across the country.

Potential for low- and mid-income segments within senior living

Currently, organised senior living supply in India mainly caters to upper-mid and high-end segment. Moreover, specific design and construction elements often translate into high construction costs for developers. Amidst rising cost of construction and project profitability targets, developers are unable to cater to low and mid-income senior living projects. Advancements in construction technology such as Building Information Modelling (BIM), 3-D printing, usage of robotics, Artificial Intelligence (AI), Augmented Reality (AR) etc. has the potential to permeate in senior living projects and make them accessible for residents across income categories by reducing labour costs and enhancing efficiency.

Innovative financing schemes can facilitate healthy activity in senior living segment

Due to comparatively high price points, potential end-users often face financing challenges to invest in housing purpose built for senior people. Banks and financial institutions have a critical role in the evolution of senior living products in the country, particularly in mid and affordable segment. Funding schemes specially curated for older citizens may involve refinancing of loans and revolving credit facilities. Furthermore, lower interest rates can facilitate seniors to purchase age-appropriate dwelling and facilities associated with senior living. Bank tie-ups with senior housing projects can fast-track the entire credit appraisal process in senior living disbursements. Additionally, insurance players can explore partnerships with developers leading to reduction in fixed component outflow for the cost-sensitive end-user.

Increased assistance from government

Enhanced policy support for development of senior living facilities will provide a thrust to developers and institutional investors to increasingly foray into the particular segment. Existing government schemes like Atal Vayo Abhyuday Yojana (AVYAY), aims at providing financial assistance to eligible organizations for running and maintenance of Senior Citizen Homes to improve the quality of life of senior citizens. Further, provision of tax-based incentives, relaxation in development charges, increased ground coverage and inclusive land use zonal permits will encourage developers to take up more such projects. Moreover, states such as Maharashtra have recently drafted model guidelines for senior living housing projects through MahaRERA to ensure senior living facilities are built as per the needs of senior citizens.

Integration of senior living units in townships

Interestingly few leading developers are considering a portion of apartment towers within townships to be dedicated for senior living housing. Such an integration not only makes senior living more vibrant and livelier for the elderly, but increases feasibility and profitability for developers, creating a win-win situation for everyone. Few branded developers like Wadhwa Group, Adani Realty, Max Estates have already announced their plans to launch integrated senior living projects across major cities in the next few years.

Emerging asset class for institutional investment

Institutional investors in search of opportunities in alternative real estate assets are increasingly realizing the untapped potential of the senior living asset class. With a rising senior population, the demand for senior living will consistently rise across the country. With global players coming into the Indian market, the segment is likely to witness significant innovation in terms of offerings, business models and pricing strategies as well. As and when the senior living market matures in India, alternate models are likely to gain momentum. Operator based model - similar to co-living and coworking spaces, is likely to gain traction in the future.

Conclusion:

The trajectory of India's senior living market points towards significant expansion and evolution in the coming years. With demographic shifts driving demand, there is a pressing need for innovative solutions to cater to seniors' housing and care needs. As the market matures, there is potential for inclusive growth, with offerings tailored to diverse income segments and regions. Government support, integration with existing townships, and increased institutional investment are key factors that will shape the future of senior living in India, transforming it into a vibrant and sustainable sector.

.png)