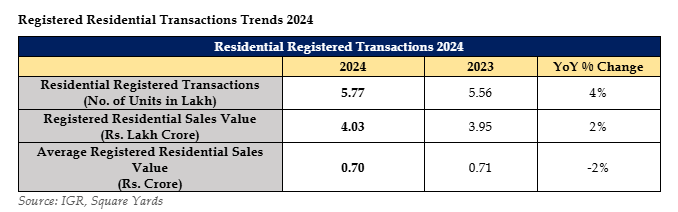

India's property market maintained its upward trend in 2024, recording 5.77 lakh residential transactions across primary and secondary markets, 4% increase from 2023. These transactions crossed ₹4 lakh crore in value, reflecting a 2% year-on-year growth. The steady rise highlights the continued demand for residential properties and the market's strong performance over the past year.

Analysis includes Pune, Thane, Mumbai, Navi Mumbai, Bengaluru, Hyderabad, Noida, Greater Noida, Ghaziabad unless mentioned otherwise. Includes both primary and secondary residential registered transactions for apartments, plots and villas for 2024. Rounded off to the nearest lakh.

Tanuj Shori, Founder and CEO, Square Yards said, “The Indian residential real estate market has entered a promising upcycle post-pandemic, bolstered by pent-up demand and a stronger sentiment for homeownership. Over the past two to three years, the sector experienced exceptional growth, which has naturally moderated in 2024. Having said that, the numbers speak volumes – annual sales have exceeded 5 lakh units and Rs. 4 lakh crore in gross value, well above pre-2020 averages. Hence this is not a slowdown but a natural part of the cycle, reflecting a maturing market ready for its next wave of growth. In 2025, we foresee residential demand and supply to grow in close ranges, setting the stage for steady, sustainable progress.”

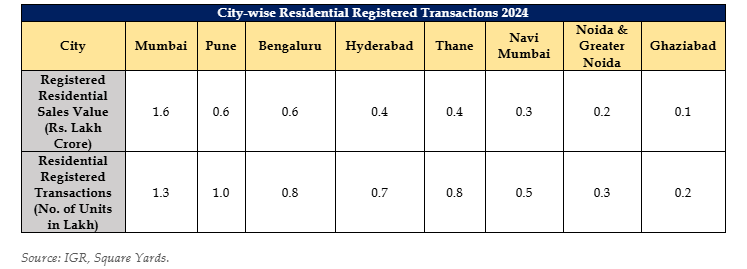

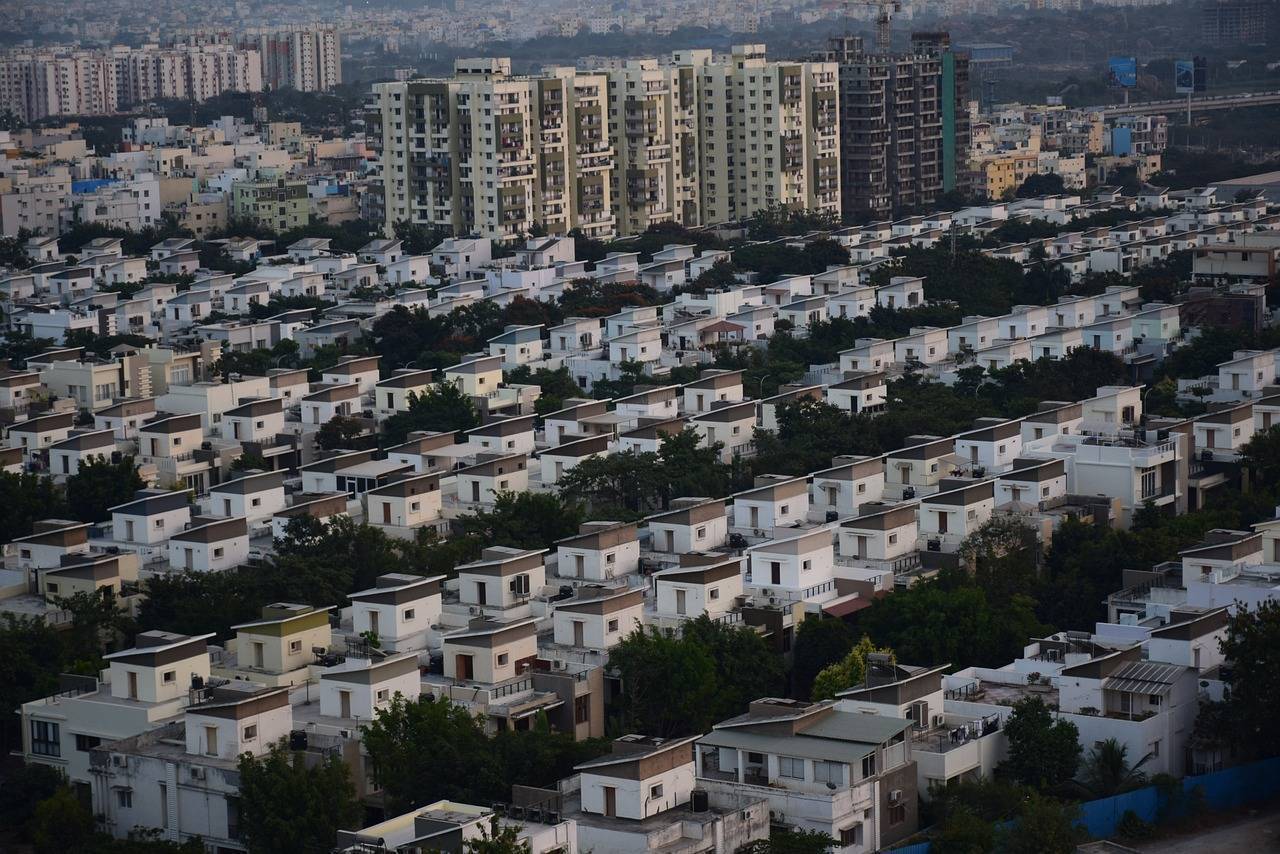

The western region emerged as the dominant force in India’s property market, with cities such as Mumbai, Thane, Navi Mumbai, and Pune accounting for 61% of registered transactions and 69% of the total sales value. In the southern region, Bengaluru and Hyderabad contributed 25% of the total transactions. Bengaluru recorded nearly 0.8 lakh registrations, though a slight dip was observed due to the E-khata rollout. Hyderabad’s performance continued its upward trajectory, achieving 80% of Bengaluru’s volume and cementing its position as a key real estate hub.

Includes both primary and secondary residential registered transactions for apartments, plots and villas for 2024. Rounded off to the nearest lakh.

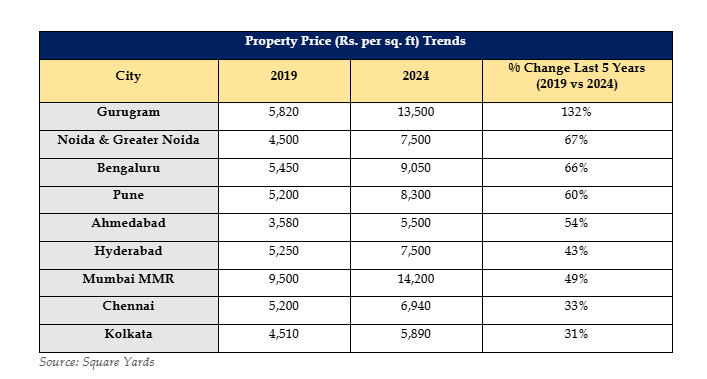

Residential Property Price Trends 2024

The sustained demand has driven significant property price growth. While western and southern cities led in transaction volumes, northern cities like Gurugram made waves with remarkable price escalations. Gurugram witnessed an extraordinary 132% growth in property prices since 2019, driven by the increasing demand for luxury and ultra-luxury properties. Key areas within the city recorded even higher price spikes.

Following Gurugram, Greater Noida and Noida experienced a 67% increase in property prices over the past five years. The upcoming Jewar Airport has significantly boosted buyer interest in these areas, with improved connectivity and anticipated economic opportunities acting as major drivers.

Average property prices as per data trends observed on www.squareyards.com in 2024. The prices shown are average values and may vary by location and property-specific factors.

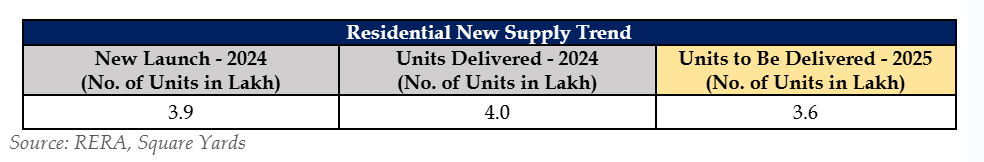

Residential New Supply Trends - 2024

Developers showcased strong confidence in 2024, launching over 3.9 lakh new units and delivering more than 4 lakh units across major cities. Homebuyers’ preferences for gated communities and lifestyle-oriented amenities prompted developers to align their offerings accordingly. Both local and national developers adopted cutting-edge technology and innovative designs to cater to evolving customer demands. This robust demand has also translated into a stellar performance in the equity markets. The NIFTY Realty Index, which tracks the performance of 10 leading real estate stocks, emerged as the top-performing sectoral index on the NSE in 2024, registering an impressive 40% gain year-to-date.

Analysis includes Pune, Thane, Mumbai, Navi Mumbai, Bengaluru, Hyderabad, Noida, Greater Noida, Ghaziabad, and Gurugram. Includes only primary residential units for apartments, plots and villas for 2024. Rounded off to the nearest lakh.

Way Forward for 2025

The outlook for 2025 remains optimistic, with over 3.6 lakh units expected to be delivered across major Indian cities. Top listed developers are working towards completing an ambitious pipeline of approximately 300 million sq. ft. for FY2025. This robust pipeline is expected to further boost transaction volumes and cater to diverse buyer preferences. Although the growth rate has moderated, signalling a maturing market, the Indian property sector’s performance remains well above pre-pandemic levels. A positive economic environment, coupled with shifting lifestyle preferences, is likely to sustain the momentum in the coming year. Developers, homebuyers, and investors can look forward to another promising year in 2025.

.png)