India has topped major APAC countries with the highest data centre capacity of 950MW in the Asia-Pacific region (excluding China), overtaking major countries like Australia, Hong Kong SAR, Japan, Singapore, and Korea, a report released by real estate consulting firm, CBRE South Asia. This growth is not just in numbers but also reflects the substantial economic impact, with the sector receiving a whopping $40 billion in investment commitments between 2018 and 2023.

Surge in Data centre Capacity

According to the report, India is expected to maintain its dominance with a capacity addition of about 850 MW between 2024 and 2026, more than its significant counterparts in the region. The report further states that the combined capacity of operational and non-operational data centres, which was estimated to be 1,030 MW by the end of 2023, is expected to rise by 30% annually to reach 1,370 MW in the current calendar year.

Investment and Development Trends

The investments in India's data centre sector have been fueled by both global and domestic players. This influx is largely driven by the demand from multinational corporations (MNCs) and large-scale cloud service providers, which see India as a lucrative market due to its vast digital consumer base and increasingly reliable infrastructure. Notably, over 85% of the $27 billion committed in 2023 is aimed at developing hyperscale facilities, which cater to the heavy computational needs of large tech companies.

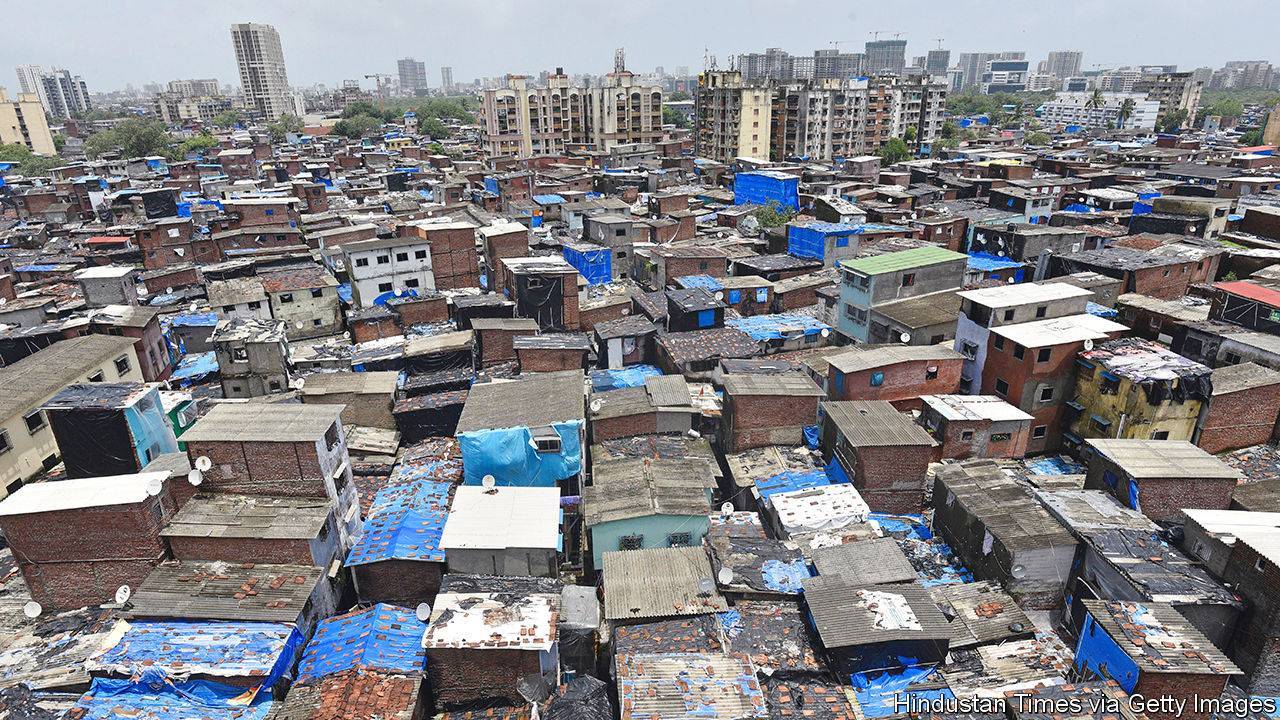

Mumbai: The Epicentre of India's Data Centres

Mumbai, India's financial capital, continues to dominate the data centre market, holding a 50% share of the country’s total capacity as of 2023. The city's appeal as a data centre hub is enhanced by its robust infrastructure, including reliable power supply and broadband connectivity, as well as its strategic geographic location, which facilitates connections to the Middle East and Europe.

Other Emerging Hubs

Following Mumbai, Chennai claims the second spot with an 18% share, thanks to its strategic location on the east coast, enhancing connectivity to East Asia. The report also highlights that more than 60% of the anticipated new data centre supply will be concentrated in these two cities. However, regions such as Delhi-NCR, Bengaluru, and Hyderabad are also expected to account for a significant portion of the market expansion, with emerging markets like Kochi and Ahmedabad showing promising growth due to enhanced infrastructure developments.

Government Policies and Future Outlook

The Indian government has revised its data centre policy to facilitate and streamline the establishment of more such parks across the country. This proactive approach by the government is likely to further boost investor confidence and catalyse the sector's growth.

The Role of Real Estate in Data Centre Expansion

Real estate developers and private equity funds have also been key players in the expansion of data centres in India. The integration of real estate strategies with tech infrastructural needs has created a unique niche market that benefits from high occupancy rates and long-term leases typical of data centre operations. This symbiosis between real estate and digital infrastructure is poised to enhance the efficiency and scalability of data centres in India, further solidifying the nation's position as a critical hub in the global digital landscape.

Conclusion

As the digital ecosystem continues to evolve globally, India’s strategic advancements in data centre capacity not only enhance its position in the Asia-Pacific region but also attract significant global investments into the sector. With government support and substantial investment inflows, the future of India's data centre market looks promising, poised to support the burgeoning demand from both domestic and international businesses seeking reliable and scalable data processing capabilities.

.png)