The real estate sector in India is undergoing a transformation as women increasingly take an active role in homeownership. This shift reflects changing societal norms, greater financial independence, and supportive policy initiatives. Recent data highlights a steady rise in residential property purchases by women, signifying their growing influence in the sector.

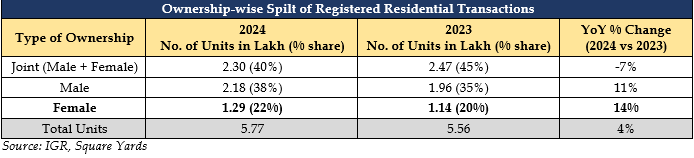

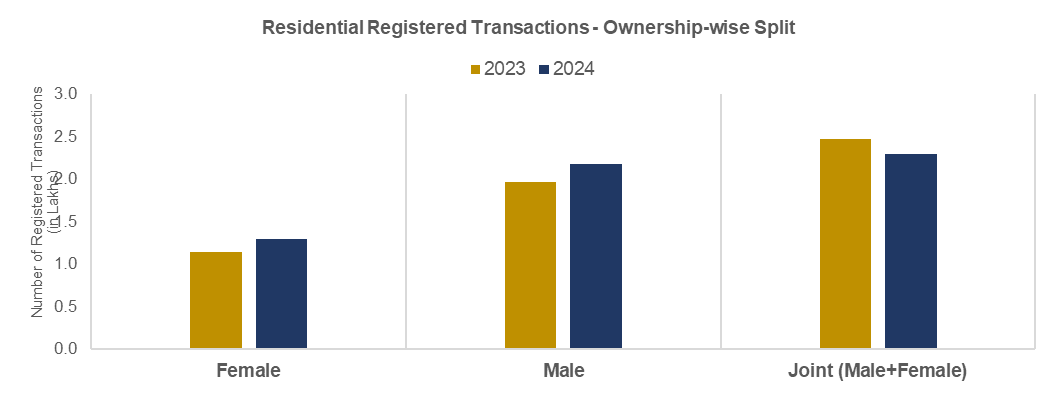

According to Square Yards’ report, ‘Key Holders of Change - Women Driving Real Estate Growth and Transformation’ (2024), total residential transactions registered with IGR across key cities—Mumbai, Navi Mumbai, Thane, Pune, Bengaluru, Hyderabad, Noida, Greater Noida, and Ghaziabad—stood at 5.77 lakh, marking a 4% increase from 5.56 lakh in 2023. Significantly, transactions by sole women buyers grew by 14% year-on-year, rising from 1.14 lakh to 1.29 lakh, increasing their share in total residential transactions from 20% in 2023 to 22% in 2024.

By comparison, transactions by sole male buyers increased by 11%, from 1.96 lakh to 2.18 lakh. Meanwhile, joint ownership (male + female) transactions declined by 7% but remained the dominant category, accounting for 40% of total registered residential transactions.

Note: Analysis includes Pune, Thane, Mumbai, Navi Mumbai, Bengaluru, Hyderabad, Noida, Greater Noida, Ghaziabad unless mentioned otherwise. Includes both primary and secondary residential registered transactions for apartments, plots, and villas. Data rounded off to the nearest lakh.

Growing Financial Independence and Changing Trends

Kanika Gupta Shori, COO and Founder of Square Yards, highlighted that. “As women gain greater empowerment through education, workforce participation, and financial independence, they are emerging as formidable decision-makers and influential consumers across industries—real estate being no exception. Our data reinforces this ongoing shift: in 2024, residential transactions across top cities with women as sole owners grew by 14% annually, outpacing the 11% growth seen among sole male buyers. It’s inspiring to see women homebuyers grow from strength to strength each year. While there is still a long way to go, the current momentum speaks volumes, as women continue to emerge as a dominant force in homeownership, securing their futures with confidence.”

Square Yards’ report further emphasizes that homeownership sentiment among women is at an all-time high. Analysis of property registration documents reveals a steady rise in female buyers, driven by financial security, long-term investment goals, and government incentives.

Tanuj Shori, CEO and Founder of Square Yards, noted, , "Women homebuyers are emerging as a transformative force in the property markets, propelled by increasing workforce participation and supportive government initiatives. The numbers speak volumes—this year alone, 1.29 lakh residential transactions were registered under sole women homebuyers. Underscoring this trend, women make up close to 53% of our clientele as sole or joint homebuyers on our platform. At Square Yards, we recognize the invaluable perspectives women bring to the industry, both as discerning buyers and influential contributors. By championing their voices and fostering opportunities, we are steadfast in our commitment to building a stronger, more inclusive real estate ecosystem.”

Factors Driving Women’s Homeownership Growth

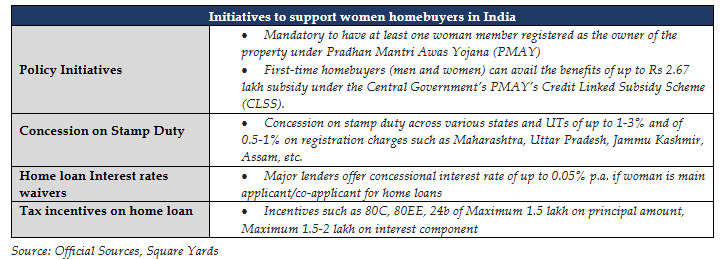

The rise in female homeownership is being propelled by a combination of government incentives, financial benefits, and digital advancements. Several state governments offer stamp duty concessions of 1–3% and reduced registration charges of 0.5–1% for female buyers. Additionally, leading major lenders provide a 0.05% reduction in home loan interest rates for women. Also, tax benefits under Sections 80C and 80EE further enhance affordability, making property ownership more accessible.

Notably, technology has also played a crucial role in this shift. Digital tools like online property search platforms, mortgage calculators, and budgeting applications enable women to make informed purchase decisions. Social media, community forums, fintech innovations, and digital payment systems have improved accessibility and financial inclusion, giving women greater autonomy in the homebuying process.

Way Forward

The rising number of women homebuyers is a positive trend that reflects broader financial independence and changing societal norms. To sustain this momentum, targeted policy interventions, enhanced access to home loans, and awareness about existing benefits will be crucial. Real estate developers and financial institutions can further support this shift by offering tailored solutions that address the unique needs of women buyers. Strengthening digital tools and platforms will also play a key role in making property transactions more transparent and accessible. With continued support from various stakeholders, the share of women homebuyers is expected to grow further, shaping the future of the housing market.

.png)