According to the Vestian report, BFSI and Flex Spaces were the main drivers of office space demand in Q3 2024, accounting for 39% of pan-India absorption, a 20% increase from the previous quarter. In contrast, the share of the IT-ITeS sector declined from 38% in Q2 2024 to 23% in Q3, signaling a shift in the demand-supply dynamics across the country.

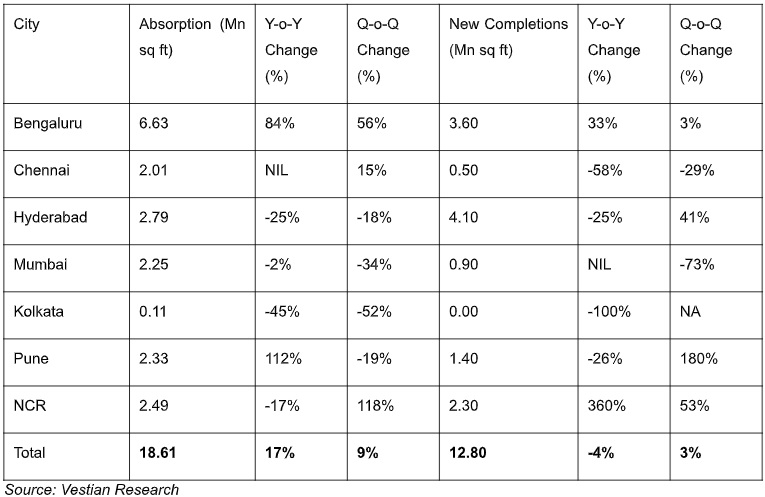

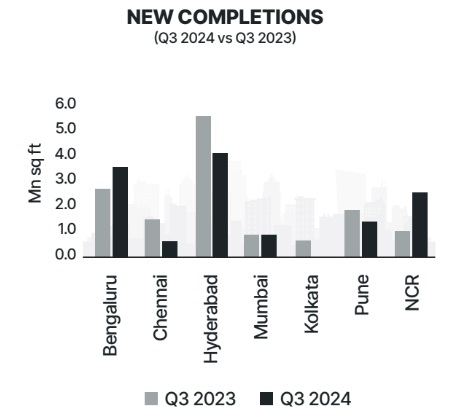

Q3 2024 recorded the highest quarterly absorption rate in 2024, totalling 18.61 million square feet amid heightened geopolitical tensions in the Middle East. Moreover, an increase of 17% over the previous year and 9% compared to the last quarter in absorption could be attributed to India’s robust GDP growth compared to other major economies of the world which lured several large MNCs to lease new office spaces or expand. Following the same trend, new completions also increased by 3% over the previous quarter, reaching 12.80 Mn sq ft in Q3 2024. However, construction activities have reduced by 4% compared to the corresponding quarter of last year.

Amid robust absorption and healthy supply, pan-India vacancy was reduced by 90 bps over the previous quarter, reaching 14.8% in Q3 2024. Despite a reduction in vacancies across the top cities, average rentals remained range-bound over the previous quarter.

City-wise Analysis of Commercial Real Estate Performance in Q3 2024

Growth in Southern Cities' Share of Absorption

In Q3 2024, southern cities—Bengaluru, Chennai, and Hyderabad—accounted for 61% of the total pan-India absorption, an increase from 55% in Q2 2024. This surge can be attributed to the increased leasing activities across key micro-markets, particularly in Bengaluru. The city’s share in absorption rose significantly from 25% in Q2 2024 to 36% in Q3 2024, making it the top performer in the market. In contrast, Mumbai’s share decreased from 20% to 12%, highlighting a slowdown in leasing activity in the city.

Bengaluru continued to lead the commercial real estate market, with 6.63 million square feet of absorption in Q3 2024, followed by Hyderabad with 2.79 million square feet. The city’s growth is driven by its strong commercial infrastructure and business environment. Notably, NCR experienced a significant 118% rise in office space take-up, largely fueled by the growing demand for flex spaces.

Construction Activity and New Completions

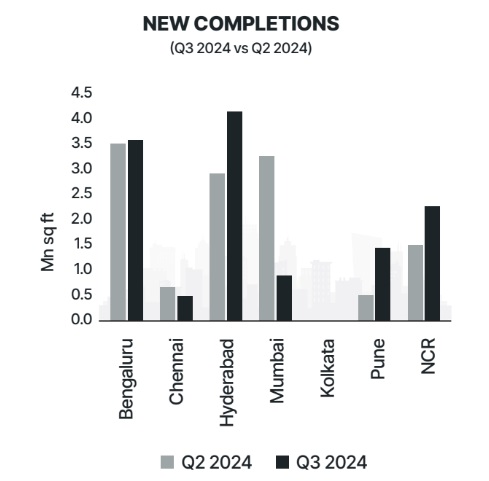

Hyderabad emerged as the leader in new office space completions, with 4.10 million square feet delivered, the highest in the past four quarters. Bengaluru, with a stable share in completions, accounted for 28% of new space, maintaining its strong position. Meanwhile, Mumbai and Chennai faced declines in new completions. Mumbai saw a 73% drop, while Chennai reported a 29% decrease in Q3 2024 compared to the previous quarter.

Rental Growth and Vacancy Trends

Bengaluru saw the highest rental growth among major cities, with average rentals appreciating by 1.1% over the previous quarter. In contrast, Kolkata maintained stable rental rates. Vacancy rates remained low in Bengaluru (8.2%) and Pune (7.2%), indicating tight office space availability and strong demand in these cities. This low vacancy rate is a positive indicator of the health of the commercial real estate market in these regions.

Way Forward

Looking ahead, the commercial real estate market is poised for continued growth, driven by the increasing demand for flexible office spaces and the ongoing strength of sectors like BFSI. Cities like Bengaluru and Hyderabad are expected to maintain their dominance, with a focus on expanding commercial infrastructure and attracting multinational companies. While the market faces challenges like fluctuating construction activity and supply constraints, the trend towards flexible workspaces and evolving tenant needs will likely shape future leasing strategies and development projects, ensuring sustained demand in key urban centers.

.png)