The Uttarakhand government announced a significant revision of circle rates across the state, with increases ranging from 9% to 22%, depending on the locality. The average hike is around 15%, reflecting rising land demand and a surge in construction activity over the past two years.

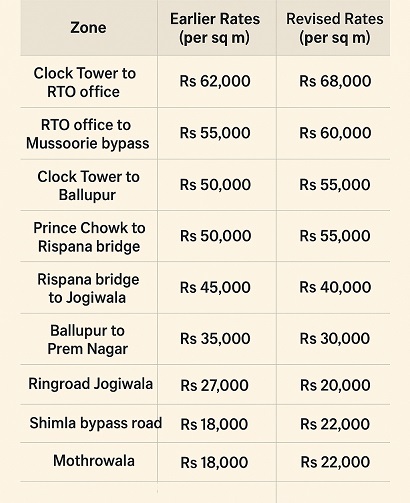

Dehradun’s Rajpur Road, the city’s most expensive residential and commercial corridor, saw rates increase by 9%, moving from Rs 55,000–62,000 per square metre to Rs 60,000–68,000 per square metre. The last revision, conducted in 2023, had seen rates rise between 10% and 20% across most areas. Officials explained that the current update was necessary due to the steady growth of construction projects and the increasing demand for residential and commercial land.

Bansidhar Tiwari, Vice-Chairman of the Mussoorie Dehradun Development Authority (MDDA) and director general of information, stated that the revision of circle rates was based on inputs received from all 13 districts. The government had requested proposals on anticipated changes from district authorities, reviewed these submissions, and conducted discussions before approving the new rates, which came into effect on Monday. The updated rates are also expected to boost state revenue through property registrations.

The steepest hike of 22% occurred along Thano Road, which connects Dehradun city to the airport and the Rishikesh highway. Key stretches, including the area from the RTO office to the Mussoorie bypass on Rajpur Road, also saw substantial increases, from Rs 55,000 to Rs 60,000 per square metre.

The government continues to follow the principle of "closer to the main road, higher the rate." Properties within 50 metres of the main road now attract the highest rates, followed by parcels between 50 and 350 metres, while land situated beyond 350 metres is valued at a lower rate. Officials noted that this structured approach ensures a balanced assessment of property values across the state.

The revised rates are likely to have an immediate impact on residential and commercial property prices. Buyers of flats and commercial spaces may experience higher transaction costs, while state revenue from registration and stamp duties is expected to increase. Analysts suggest that developers and investors will need to factor the revised rates into pricing strategies and project planning.

District-level implementation has been coordinated with local authorities to ensure smooth adoption of the revised rates. The MDDA and district offices have been tasked with updating records, guiding buyers, and monitoring property transactions to avoid discrepancies. The revision is also expected to influence new real estate projects, particularly in high-demand corridors like Rajpur Road, Thano Road, and Mussoorie bypass areas.

Info- Times of India

The Uttarakhand government emphasized that these adjustments are not only aligned with market realities but also aim to support systematic urban growth and infrastructural development. By linking circle rates to construction activity and land demand, authorities aim to create a sustainable revenue base for the state while promoting orderly urban expansion.

Real estate experts highlighted that the 22% hike in certain high-demand areas represents the largest increase in the last decade and may encourage faster registration of properties, reducing informal sales. They also noted that the revision provides a benchmark for developers planning new residential and commercial projects in Dehradun and other growing towns within Uttarakhand.

While homeowners and buyers may face higher acquisition costs in the short term, officials stated that the structured revision ensures long-term benefits in terms of property valuation, regulatory clarity, and state revenue generation. Observers expect that property developers, investors, and buyers will now recalibrate their strategies to align with the updated circle rates, marking a notable shift in Uttarakhand’s real estate landscape.

.png)