The Securities and Exchange Board of India (SEBI) is set to auction eight properties belonging to HBN Dairies & Allied Ltd in August 2024. This decisive move comes in response to the company's involvement in illicit collective investment schemes, aiming to recover the funds raised unlawfully.

Supreme Court Authorization

This auction is being carried out under the authorization of a Supreme Court order dated May 14, 2024. The order granted SEBI the authority to sell the assets of HBN Dairies & Allied Ltd, with the active involvement of a liquidator. This legal backing underscores the gravity of the situation and SEBI's commitment to ensuring justice for the affected investors.

Failed Refund Efforts

The auction process was initiated by SEBI after repeated failures by HBN Dairies & Allied Ltd and its directors to refund the investors' money. The directors involved in the fraudulent activities are Harmender Singh Sran, Amandeep Singh Sran, Manjeet Kaur Sran, and Jasbeer Kaur. Despite SEBI's efforts to secure refunds for the investors, the company's inability to comply with these directives has necessitated the auction of its properties.

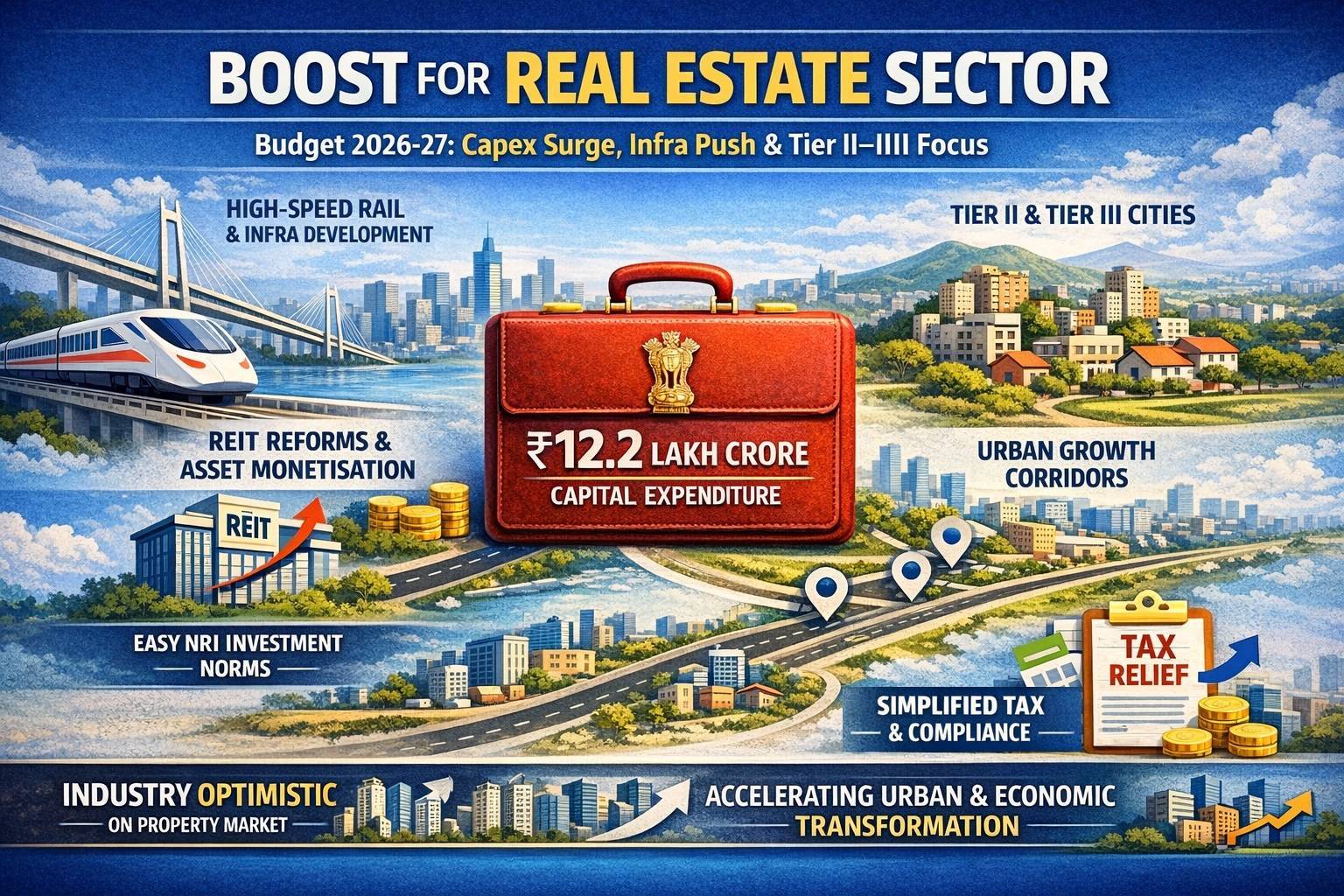

Auction Details

The properties slated for auction include a diverse range of assets: a shopping mall-cum-multiplex, a hotel, plots, and commercial shops. These properties are spread across several states, including New Delhi, Punjab, Madhya Pradesh, Gujarat, and Maharashtra. The reserve price for these assets has been set at Rs 67.70 crore, reflecting their significant value.

SEBI has enlisted Quikr Realty to assist in the e-auction, with C1 India appointed as the e-auction service provider. The involvement of these reputable firms ensures a transparent and efficient auction process.

Bidder Requirements

Potential bidders have been advised by SEBI to conduct independent inquiries regarding any encumbrances, litigations, attachments, and acquisition liabilities associated with the properties before submitting their bids. This due diligence is crucial to ensure that bidders are fully aware of any legal or financial complications that may affect the properties. The online auction is scheduled for August 13, from 11 am to 1 pm, providing a limited window for interested parties to participate.

Illicit Activities

The necessity for this auction stems from the illicit activities of HBN Dairies & Allied Ltd, which had illegally mobilized Rs 1,136 crore from investors. The company enticed investors with schemes involving the purchase of cattle to earn high returns from the sale of ghee. These schemes violated regulatory norms and left many investors without the returns they were promised.

SEBI's auction of HBN Dairies & Allied Ltd's properties is a significant step towards rectifying the wrongs committed by the company. The involvement of the Supreme Court, the strategic planning of SEBI, and the collaboration with reputable firms all contribute to the importance and effectiveness of this auction. Investors and potential bidders alike are closely watching this development, which underscores the critical role of regulatory bodies in safeguarding market integrity and investor interests.

Image source - Pinterest

.png)