Canonicus Capital–TREVOC Partnership: Key Highlights on ₹500 Crore Platform for Stalled NCR Projects

- ₹500 Crore Platform Launched: Aimed at completing stalled residential and mixed-use projects in NCR, focusing on structurally sound and demand-backed developments.

- Initial Investment: Canonicus Capital will invest ₹125 crore in the first phase, with the platform expected to scale up to ₹500 crore over the next few years.

- Execution-Led Governance: TREVOC Group manages construction, contractor coordination, and delivery timelines, while Canonicus oversees funding discipline, governance, and capital deployment.

- Milestone-Based Funding: Structured capital deployment ensures timely delivery, stakeholder accountability, and predictable outcomes for near-completion projects.

Private equity firm Canonicus Capital, which specialises in last, mile real estate financing, has teamed up with NCR, based real estate developer TREVOC Group to unveil a 500 crore funding and execution platform that will help in finishing the stalled residential and mixed, use projects in the National Capital Region (NCR).

The focus of the initiative is on projects that are structurally sound and have demand but have been delayed owing to execution problems and lack of liquidity. As per the statement on February 3, the platform will deliver projects that are almost completed and will focus on removing the bottlenecks which have been caused by fragmented execution frameworks, contractor inefficiencies, and limited working capital.

The platform has thoroughly assessed a set of residential and mixed, use projects throughout NCR that are nearing completion. The projects were selected on the basis of clear land titles, solid demand at the base level, and high completion readiness. The firm disclosed that it is in discussions with more developers in the region to broaden the deployment pipeline over the next several years.

Canonicus Capital will invest up to 125 crore for the initial phase, while the entire platform is projected to grow to 500 crore in the Delhi, NCR area over the next few years.

“This funding platform addresses one of NCR’s most persistent challenges: projects that are structurally sound and demand-backed, yet delayed due to fragmented execution frameworks, contractor inefficiencies, and constrained working capital. Under the partnership, TREVOC Group will assume responsibility for on-ground execution, construction management, governance, and delivery timelines, while Canonicus Capital will provide structured institutional capital support,” the company said.

Key elements of the platform include:

- Focus on near-completion residential and mixed-use projects

- Institutional capital infusion combined with execution-led governance

- Structured milestone-based funding to ensure timely delivery

Industry experts note that stalled projects in NCR have historically eroded buyer confidence, even when projects are close to completion. The Canonicus–TREVOC platform seeks to address this gap by integrating capital deployment with strong execution systems and accountability.

“Near-completion projects are not resolved by capital alone. What they require is strong execution systems, governance frameworks, and accountability at every level. This platform has been designed to combine disciplined capital with a structured execution model, enabling faster closures, better stakeholder coordination, and predictable delivery outcomes,” said Gurpal Chawla, founder, TREVOC Group.

Under the partnership, TREVOC Group will take charge of construction management, contractor coordination, and delivery schedules, while Canonicus Capital will oversee funding discipline, governance standards, and capital deployment.

“Last-mile funding works best when capital deployment is backed by robust controls, transparency, and clear execution responsibility. The partnership with TREVOC allows us to deploy capital through a clearly defined operating framework, ensuring that funds are utilised efficiently while project milestones, governance standards, and buyer interests remain firmly protected,” said Rajan Gupta, Executive Director, Canonicus Capital.

TREVOC Group is an NCR-based real estate development and execution company with a focus on residential and commercial assets. Canonicus Capital is a private equity firm specialising in special situations and last-mile real estate financing.

Recently, Canonicus Capital closed a dedicated ₹200 crore private equity fund targeting high-potential NCR real estate opportunities, including last-mile completion financing. The newly launched platform aligns with this strategy by addressing stressed but viable assets and accelerating project completion.

With buyer sentiment increasingly favouring completed or near-completion developments, the partnership is expected to contribute to faster project deliveries, improved transparency, and greater confidence in NCR’s residential real estate market.

Residential Market Potential of Delhi NCR

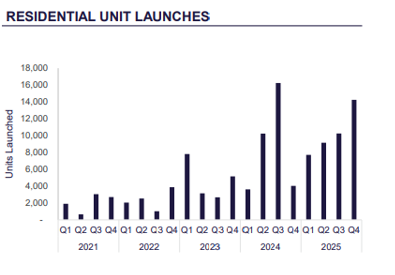

As per Cushman and Wakefield report, Delhi NCR recorded 14,248 new residential unit launches in Q4 2025, marking a 39% rise over the previous quarter, and 2.5X higher on a y-o-y basis. Gurugram witnessed 50% of the quarterly launches, while Noida and Ghaziabad contributed 29% and 16% share, respectively.

Total number of launches for 2025 stands at 41,358 units – an increase of 21% on yo-y terms. Majority of the launches in 2025 were seen in peripheral locations, such as Dwarka Expressway (27%), New Gurgaon (11%), and Yamuna Expressway (8%). Improved and hassle-free connectivity to the IGI Airport, affordability relative to central Gurgaon, and strong return prospects are driving residential activity in New Gurgaon and Dwarka Expressway. Robust infrastructure development, competitive pricing, and growth expectations surrounding the Noida International Airport are key factors for the heightened activity in Noida and Greater Noida.

.png)