- Strategic Imperative: Sustainability drives costs, tenant demand, regulations, and asset value—central to investment strategy.

- Climate Resilience: Measures against floods, storms, and heatwaves protect income and reduce financial risk.

- Energy Efficiency: Upgrades in HVAC, insulation, and renewable energy lower costs, emissions, and attract tenants and investors.

- Rising Market Adoption in India: Increasing green certifications and sustainable projects are rapidly shaping the country’s real estate investment landscape.

- Foresight & Necessity: Efficient, resilient, and socially responsible buildings ensure long-term value and durability.

- Foresight & Necessity: Efficient, resilient, and socially responsible buildings ensure long-term value and durability.

Sustainability has evolved into one of the leading factors influencing real estate value and investment performance. The manner in which properties are developed, funded, and operated is being affected by factors such as climate change, energy prices, regulatory restrictions, and changes in tenant demands. Here, sustainability is not merely a nice, to, have feature; it is a strategic imperative for financial viability in the future.

Among the sectors of the sustainability market real estate stands out because buildings are physical assets that their environmental performance has a direct impact on costs, risk and potential value. Energy consumption, water usage, emissions, and climate sensitivity are all factors that affect not only operating efficiency but also the level of trust of investors. Hence, sustainable real estate investment serves both environmental and economic goals and thus becomes an integral element of the present day investment strategies.

What Sustainability Means in Real Estate?

Sustainable real estate is conceived, developed, operated, and managed to decrease impact on the environment, while improving long-term value, robustness, and social benefit. Sustainability in real estate can be tracked, measured, and priced into investment decisions with performance data, third-party metrics, and certifications-instead of abstract claims.

Key dimensions of sustainability in real estate include:

- Energy efficiency and reducing emissions

- Climate resilience and disaster preparedness

- Water conservation and waste management

- Healthy indoor environments

- Social outcomes include those of affordability and accessibility.

The leading sustainability frameworks within the property industry, such as LEED, ENERGY STAR, BREEAM, WELL, and GRESB, offer standardized frameworks for assessment and benchmarking to support investors in the comparison of performance across their assets and portfolios.

Why sustainability should be a priority for real estate investors?

The property sector is a major factor in worldwide energy consumption and emissions, being responsible for around 3940% of total energy, related CO emissions and consumption globally. Besides, buildings produce waste, use water, and have an impact on the local ecosystems. These negative environmental effects involve physical financial risksand at the same time, they offer great openings to investors.

Looking at it from the point of investment, sustainability has an effect on:

- The costs of operations and net income

- The demand for tenants, occupancy, and retention

- The insurance risk, premium, and the availability of coverage

- The costs coming from the regulations and the need to upgrade

- The value of the asset over time and its marketability

The buildings that do not carry on with the changes in the sustainability field are facing the danger of getting functionally out of use, as they will have to bear higher operating expenses and weaker demand from the market.

Climate Risk and Resilience Building

The traditional real estate models did not consider the new risks that climate change is bringing. Climate risks are becoming a reality and it is evident now in the case of real estate markets. Heatwaves, storms, flooding and wildfires exposure are the main features of this reality. These natural elements come with different intensities as well as the frequency making the financial impact on property values, insurance market and costs absolutely real.

Unlike tenants who might move, the physical nature of the building does not allow the owner to relocate and so local adverse conditions are the determinate factors for the value and the use. Climate resilience has become one of the major investment considerations. Among those measures are:

- Re-inforcement of the structural elements for wind and water resistance.

- Floodproof design and resilient landscapes.

- Heat, adaptive materials and cooling systems.

- Backup power systems such as batteries or generators.

- Improved air filtration and ventilation.

Being proactive with resilience solutions is less expensive compared to the scenario one faces if resilience measures are not prioritised. If taken care of first, they are a way to avoid the scenario of long term income loss, having to make expensive repairs after the disaster and witnessing a sudden drop in asset value. In this way, besides protecting the income stream, the downside risk is effectively reduced.

Energy Efficiency and Emissions Reduction

Among real estate assets, energy costs are one of the largest continuing expenses. The fact is, the majority of existing buildings were not designed based on the latest efficiency standards, hence there is a great opportunity for upgrading. Sustainable upgrades can have a huge impact on lowering operating costs and emissions, and often the investment comes with reasonably short payback periods.

Common energy, focused sustainability measures include:

- High, efficiency HVAC and heat pump systems

- Improved insulation and energy, efficient glazing

- LED lighting and smart control systems

- On, site renewable energy installations (e.g., solar)

- Energy management and monitoring systems

- Demand for Tenants and Market Competitiveness

Tenant choices are now trending in a rapidly changing manner for residential as well as commercial establishments. Green developments with healthier environments and reduced electricity consumption have had a rising demand influenced by environmentally responsible organizations, employee flow patterns, and increased consumer awareness.

Sustainable properties rely heavily on:

- It would offer improved occupancy and leasing numbers.

- Rentals premium and other assets

- Longer periods of leasing and lower turnover rates for tenants

- More attraction towards ESG by the investors

In the world of competitive markets, “sustainability” is no longer a “nice-to-have,” but a differentiator in revenue stability and asset value enhancement.

Regulations, Insurance, and Financing

The regulatory measures regarding energy performance, emissions, and climate disclosure continue to grow and develop vigorously at various levels: local, regional, and international. The enforcement of energy efficiency in buildings and corresponding performance information becomes obligatory, making sustainability an operational imperative rather than an ambitious goal.

- Green buildings are poised to take advantage of these developments

- Comply with evolving standards

- Do not have to pay for costly retrofits or face fines

- Green loans, sustainability-linked loans, and preferred stocks

- Avail tax benefits, rebates, and subsidies

The insurance market is also incorporating the risk of climate change in the pricing and provision of cover. The risk associated with properties with weak resilience capacity may result in increased insurance rates or the unavailability of insurance cover.

Eco, friendly housing is more than just an environmental concern; it also impacts affordable housing profoundly. Energy and transportation costs are a major part of overall housing expenses, especially in low, to medium, income housing. Sustainable housing can lower these costs.

Investors have a role in affordability through it:

- Re- roofing with a goal of reducing energy useIntroducing energy, saving devices and insulationTransit, Oriented, Mixed Use

- Preserving or upgrading the affordable housing stock

- Lowering operating costs is a win, win for residential stability and asset performance. This is a perfect way to bring together the two outcomes, financial and impact.

Sustainability is talk of Town

The call for a paradigm shift - switching from uncontrolled growth to conscious and sustainable development has emerged as a major takeaway at the recently hels fifth edition of the Saifee Burhani Expo (Construction 360°) exhibition at Mumbai. The three-day exhibition was inaugurated by Shri Rahul Narweker, Speaker of the Maharashtra Legislative Assembly and saw brainstorming sessions on the theme of Construction and Allied Industries, emphasizing the need and implications of a ‘Viksit Bharat’ by 2047. Such lead themes on the main plenary sessions, such as ‘Building India’s Sustainable Future: Infrastructure Roadmap to 2047’ and ‘Form, Function & Finish - The Material Palette of Future-Ready Buildings,’ set the tone on the necessity of conscious growth and the required materials.

Speaking at the event Mr. Keval Valambhia, COO, Maharashtra Chamber of Housing Industry (MCHI), highlighted the critical gap in urban and regional planning, stressing the immense pressure on metro cities like Mumbai, where "nearly 800 people settle every day."

“Sustainability is often discussed today but rarely addressed in its true context. While India has a strong recycling culture and a comparatively lower carbon footprint, the real gap lies in urban and regional planning. Infrastructure investment has remained heavily metro-centric. Cities such as Nashik, despite robust agro, wine and industrial ecosystems, have not received proportional infrastructure support. The way forward lies in decentralized and region-led development, including horizontal expansion initiatives like Mumbai 3. India does not just need green buildings, but green cities. Over the next two decades, the focus must shift from unchecked growth to planned development that balances economic progress with environmental responsibility.”

Dr. Mala Singh, Chairperson IGBC (CII) Mumbai Chapter, Chairperson & MD, PEC Greening India, stressed the urgency of climate-responsive design, noting that "over 75 percent of global biodiversity already lost" and Mumbai's vulnerability to extreme rainfall. “As India enters a decisive phase of economic expansion, sustainability must be embedded at the core of development strategy. The building and real estate sector sits at the centre of this transition, with emissions driven as much by operational performance as by material choices. The next decade must prioritise deep decarbonisation through green materials, energy-positive design, lifecycle accountability and climate-resilient planning... Every building, new or redeveloped, must now be designed as climate-responsive infrastructure, supporting urban liveability and advancing India’s net-zero pathway towards 2070.”

Emphasizing the need for concrete action and collaboration, Mr. Vishal Thakkar, Partner, Prem Group and Joint Secretary, NAREDCO Maharashtra, pointed out the low adoption rate of existing sustainability frameworks.

“If India is to truly move towards a Viksit Bharat by 2047, sustainability must shift from policy intent to on-ground execution. While multiple frameworks exist today, adoption remains limited, with less than 10 percent of residential and commercial buildings leveraging solar energy despite abundant natural potential. Similarly, nearly 70 percent of treated wastewater in Mumbai continues to be discharged into the sea, even as successful models like Powai demonstrate how up to 90 percent reuse can support green urban ecosystems. The real gap lies in coordinated action, where government, developers and citizens work in partnership rather than isolation. Development cannot be driven by infrastructure alone, nor can sustainability succeed without community participation and safety as a core pillar. Environmental and social sustainability must progress together, with proactive, voluntary participation across industries, to ensure balanced and resilient urban growth.”

Market Data: The Scale and Growth Potential of Sustainable Real Estate in India

Sustainability is rapidly becoming central to India’s real estate growth trajectory, with multiple research reports highlighting strong adoption, expanding scale, and long-term investment potential:

Corporate occupiers are taking bold steps to reshape their workplaces across Asia Pacific, investing in quality, embracing hybrid models and exploring inclusive strategies to meet the needs of a diverse workforce, according to Colliers’ latest report “2026 Asia Pacific Workplace Insights”.

The report draws perspectives from more than 800 corporate occupiers surveyed across the region. According to the report, hybrid work, inclusive strategies, employee need fulfillment, sustainability adoption and technological adeptness are likely to remain at the forefront of workspace revolution across major office markets of the APAC region. Interestingly, the Indian office market already prioritizes inclusivity and sustainability to a greater degree as compared to others.

In fact, India’s office market, is not just scaling up, but is also evolving rapidly in terms of real estate quality and employee experience. In response to occupiers’ changing needs, developers are increasingly focusing on creating world-class workplaces, incorporating wellness-driven design, sustainability features, collaborative zones, and technology-adept infrastructure. Despite global trade frictions, India’s Grade A office space demand across the top seven cities continue to remain robust and is poised to touch 70 million square feet in 2025. New supply is also likely to follow closely at around 60 million square feet. The interplay of strong demand and availability of premium commercial developments continue to push rentals, reinforcing India’s position as one of the most dynamic office markets in the APAC region.

“Indian occupiers are clearly shifting towards sustainability and there is an evident flight-to-quality, driving the next phase of workplace evolution in 2026 & beyond. With over 80% of upcoming Grade A supply expected to be green-certified, the industry’s commitment to environmental goals is commendable. However, while green certifications are becoming a norm, the fulfillment of broader ESG goals remain a key monitorable. Meanwhile, as flexible workspaces rise — reflecting occupiers’ desire to balance agility and cost efficiency — along with strengthening return-to-office mandates, flexibility remains central to workplace strategy.” said Arpit Mehrotra, Managing Director, Office Services, India, Colliers.

Other Key insights from the report include:

- 48% of organisations have invested or plan to invest to drive workplace quality and employee experiences.

- 47% of organisations have hybrid models; most maintain attendance mandates and assigned seating.

- 15% are already considering, and 40% are starting to explore, the needs of five generations in the workplace by 2030.

- Sustainability is a bold ambition, with 52% collaborating with their landlord.

- 20% use AI tools to enhance employee experience; 6% use desk booking data; 3% have occupancy sensors.

According to Bengaluru-based real estate consultancy Vestian Research, report named "India Office Market: Sustaining the Sustainability" , over 65 per cent of Grade A office space in India’s top seven cities is green-certified. Of the 1,362 Grade A buildings across these cities, 805 are green certified.

Key Insights

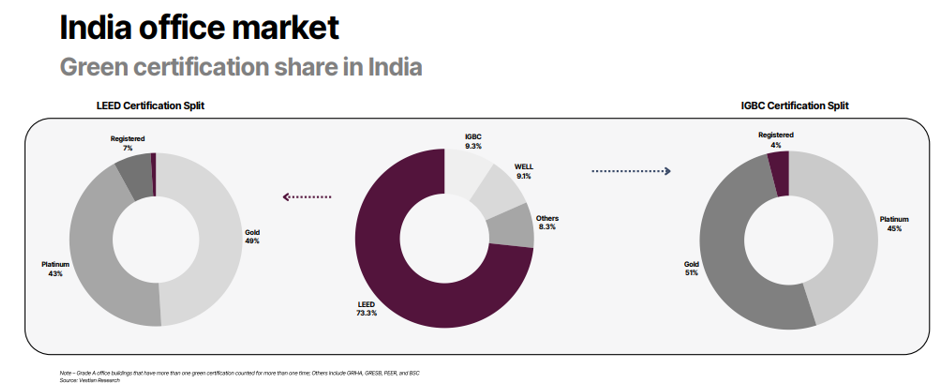

- Green Certification Prevalence: Over 65% of Grade A office space is green-certified, mostly LEED.

- Regional Concentration: Southern cities (Bengaluru, Chennai, Hyderabad) hold 58% of total green stock.

- Large Buildings Lead: 90% of office buildings >10 lakh sq ft are green-certified.

- Certification Type: Gold is dominant — 49% LEED Gold, 51% IGBC Gold.

- City Highlights:Bengaluru: Highest green stock in absolute terms (172 Mn sq ft)., Chennai: Highest proportion (83% of Grade A stock) and Pune: Lowest proportion (56%) despite strong MNC presence.

- Smaller Buildings Lag: Buildings <1 lakh sq ft rarely green-certified, indicating lower sustainability adoption among smaller developers/occupiers.

As Vestian latest report, India’s real estate sector attracted the highest-ever institutional investments of USD 8.1 Bn in 2025, anchored by an all-time high quarterly investment of USD 3.73 Bn in Q4 2025. Institutional investments in 2025 increased by 88% over 2023 and 19% compared to 2024, while the quarterly investments soared by 112% in Q4 2025 compared to the preceding quarter. Interestingly, 13% of the total quarterly investments were allocated towards sustainable project development, signalling investors’ decisive push to embed sustainability into real estate development.

Sustainability Integration into Investment Processes

Sustainability factors are relevant to the whole gamut of real estate investments strategies:

Direct Property Owners can focus on:,

- Energy audits and resilience evaluations

- Efficient targeted retrofits and upgrades

- Climate risk planning, considering the next several decades

- Market Investors may look at the following aspects:

- Public REIT exposure to the regions with a high climate risk

Capital Expenditure Plans correlated to Sustainability

- Public REIT exposure to the regions with a high climate risk

- Capital Expenditure Plans correlated to Sustainability

- ESG reporting quality and transparency

Developers and operators can incorporate sustainability into:

- Architectural design and selection of materials

- Technology adoption and energy use monitoring

- Neighborhood and mixed, use area development

Sustainability enhances the ability of industries to maintain their operations in the future and be competitive in the market.

Way Forward

“Traditional” assumptions about financial planning, such as stable climates, rising property values, and the cost of insurance, are also being questioned in the face of real climate changes. The long-term investor must now consider:

- Will these chosen spots be habitable in decades to come?

- What will be the future impact of climate trends on insurance rates and accessibility?

- What will be the required capital investments for maintaining asset performance?

- Will the demand for such asset classes remain sustained?

The integration of sustainability considerations into financial planning means that investment is made in line with future realities instead of past assumptions.

Sustainability: Preference, Prudence, or Necessity

As a starting point, sustainability is a function of values. However, in the context of real estate, sustainability very quickly crosses over into the domain of prudence. Efficiency, resilience, and affordability all play a direct role in determining operating expenses, risk, and potential values. In these regards, sustainability is not a choice, rather a requirement of intelligent investment.

Sustainability is just starting to change the dynamics of value for real property. Sustainable, efficient, resilient, and socially responsive property is going to better withstand economic disruption, economic change, and natural disasters. For investors, the word ‘sustainability’ means the same as ‘foresight’ and ‘durability’ and ‘relevance’ when it comes to the future. Firstly, this is because people who practice sustainability have future goals for their investments apart from protecting their returns.

.png)