The National Company Law Appellate Tribunal (NCLAT) has upheld a June 12, 2024 order of the National Company Law Tribunal (NCLT) directing the initiation of Corporate Insolvency Resolution Process (CIRP) against Supertech Realtors, developer of the Supernova project in Noida.

The appellate tribunal dismissed an appeal filed by company promoter Ram Kishore Arora, confirming that the insolvency process must proceed under the Insolvency and Bankruptcy Code (IBC) and CIRP Regulations, 2016. The case arose from a petition by the Bank of Maharashtra, part of a consortium of lenders, citing defaults on credit facilities.

According to the order, the consortium of banks rejected revised settlement proposals submitted by Arora. NCLAT stated that the decision of the Committee of Creditors (CoC) on such settlements could not be interfered with unless proven arbitrary, and that this case did not meet those criteria.

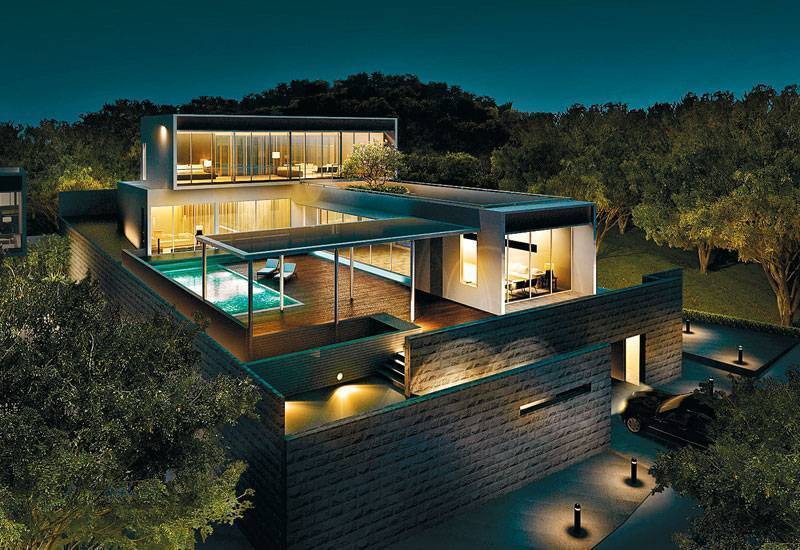

Supertech Realtors, a subsidiary of real estate developer Supertech, is constructing the Supernova project on 70,002 square metres of land in Sector 94, Noida. Planned as an 80-storey mixed-use development comprising residential units, offices, retail space, and a hotel, it is projected to reach a height of 300 metres, making it the tallest building in Delhi-NCR.

The project’s cost has been estimated at ₹2,326.14 crore. To finance construction, the developer sought assistance from a consortium of lenders led by Union Bank of India, requesting ₹735.58 crore. Within this, the Bank of Maharashtra sanctioned a term loan of ₹150 crore in December 2012. The loan carried a repayment schedule of quarterly instalments over a tenure of 10 years and four months, ending in March 2023.

The lenders alleged that Supertech Realtors failed to maintain financial discipline, committed breaches of loan covenants, and violated agreed credit limits. These actions led to the accumulation of substantial dues, which the Bank of Maharashtra stated exceeded ₹990 crore across all consortium members.

Following defaults, the Bank of Maharashtra filed a Section 7 application under the IBC before the NCLT Delhi Bench, which admitted the petition and appointed an interim resolution professional (IRP) to take charge of the process. The IRP was tasked with forming the CoC and proceeding with CIRP in accordance with the law.

On July 3, 2024, NCLAT had temporarily stayed the constitution of the CoC while considering Arora’s plea. Arora argued that the project was 80% complete and that investors were willing to infuse funds for completion. He submitted one-time settlement (OTS) proposals, including a revised offer involving Parmesh Construction Company as co-developer, but these were rejected by the consortium.

In its August 2025 order, NCLAT noted that the consortium’s rejection of Arora’s proposals was communicated via a letter from Union Bank of India, the lead bank, on July 15, 2025. The tribunal held that the reasons for the banks’ decision could not be reviewed within the scope of the proceedings.

The order further clarified that this was not a case where an application under Section 12A of the IBC for withdrawal of CIRP had been approved by 90% of the CoC, and therefore, the tribunal could not substitute its judgment for that of the creditors.

With the appeal dismissed, the IRP appointed by NCLT will proceed to constitute the CoC and advance the resolution process. This could involve inviting resolution plans from prospective bidders or, in the absence of a viable plan, initiating liquidation proceedings as per the IBC framework.

The outcome of the CIRP will determine the future of the Supernova project, which has been under development for over a decade. The project’s completion and delivery timelines will now depend on the resolution plan approved by the CoC and any subsequent directions from the adjudicating authority.

Supertech Realtors’ insolvency proceedings add to ongoing financial and legal challenges for the Supertech group, which is already facing similar cases for other projects.

.png)