The Mumbai Metropolitan Region (MMR) witnessed a substantial rise in land acquisitions in 2024, with developers securing approximately 407 acres across 19 transactions. This represents the highest land acquisition volume in the last three years, underscoring the region’s growing appeal for real estate investments. The surge is part of a broader nationwide trend, with land acquisitions in India increasing by 41% compared to 2023’s 288.9 acres, according to a report by global real estate consultancy JLL India.

Major Transactions and Key Locations

The largest deals in MMR primarily consisted of single-plot acquisitions of 50 acres or more in emerging micro-markets such as Khalapur, Palghar, and Khopoli. These locations are gaining traction due to their improved connectivity, upcoming infrastructure projects, and cost advantages compared to core urban centers.

Additionally, the per-acre cost of land in MMR surged from ₹11 crore in 2022 to ₹17 crore in 2024, reflecting increasing demand and limited availability of prime land parcels.

Key Transactions in MMR

Birla Estates acquired Hindalco’s 24.5-acre plot in Kalwa, Thane, for ₹537.42 crore in September 2024. The location is expected to be developed into a residential and commercial hub.

- A 70.92-acre land parcel in Boisar was purchased for ₹104.32 crore, with potential for industrial and affordable housing projects.

- K Raheja Corp Real Estate secured a 5.75-acre plot in Kandivali East’s Ashok Nagar for ₹466 crore in December 2024, adding to its growing land bank in Mumbai.

- In August, K Raheja Corp also acquired The Bayside Mall and Popular Press in Tardeo, near Haji Ali Junction, for over ₹355 crore, strengthening its retail and commercial portfolio.

- Mahindra & Mahindra sold a 20.5-acre plot in Kandivali’s Akurli area to Pune-based Rucha Group’s Blueprintify Properties for ₹210 crore in July 2024.

Factors Driving the Real Estate Land Rush

Several factors have contributed to this surge in land acquisitions across MMR and other regions:

- Rising Demand for Residential and Mixed-Use Developments – With Mumbai’s housing demand growing, developers are securing land in emerging micro-markets to cater to future residential projects.

- Infrastructure Expansion – Upcoming metro rail projects, expressways, and economic corridors are making suburban and peripheral regions more attractive for large-scale developments.

- Limited Availability in Core Urban Areas – The scarcity of large land parcels in central Mumbai has pushed developers to acquire plots in areas such as Thane, Navi Mumbai, and extended suburbs.

- Increased Investor Confidence – The post-pandemic recovery in real estate has fueled developer interest in land banking for future projects.

- Growth of Industrial and Logistics Hubs – Locations like Khalapur and Boisar are emerging as industrial and logistics centers, further driving land acquisitions.

Impact on Real Estate Prices

The rising cost of land in MMR is expected to impact property prices, as developers pass on increased expenses to homebuyers. Besides land costs, factors such as inflation-driven hikes in construction materials, labor wages, and compliance costs are also influencing pricing trends.

Industry experts predict that property prices in MMR will rise over the next two years, particularly in newly developing micro-markets. Affordable housing projects may also experience upward price adjustments, as developers incorporate land costs into pricing models.

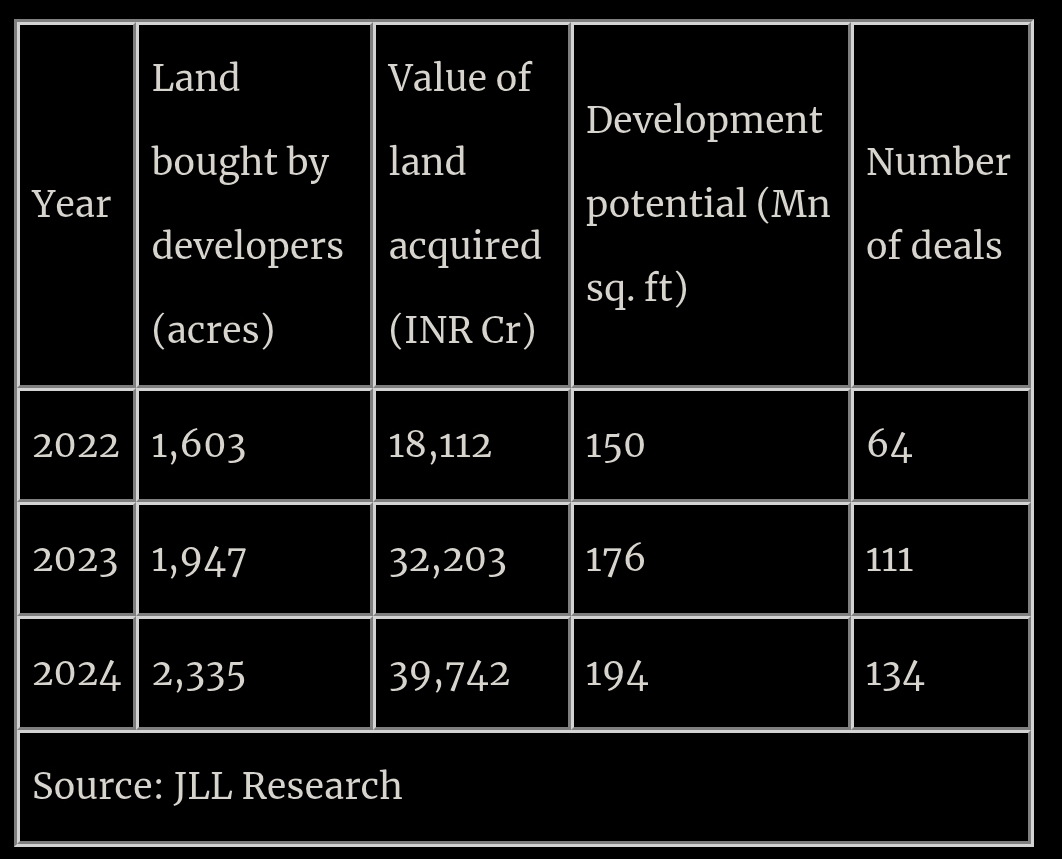

Nationwide Land Acquisition Trends

The JLL report highlights that India witnessed 2,335 acres of land acquisitions across 134 transactions in 23 major cities in 2024. These transactions were valued at ₹39,742 crore and are expected to support 194 million sq. ft of real estate development.

While Tier I cities accounted for 72% of total land deals, a notable shift towards smaller urban centers was observed. Tier II and III cities accounted for 28% of total acquisitions, totaling 662 acres. Cities such as Nagpur, Varanasi, Indore, Vrindavan, and Ludhiana emerged as new real estate hotspots due to their growing population, infrastructure investments, and affordability compared to metropolitan cities.

Developers are strategically expanding their land banks to fuel future project pipelines. Arkade Developers’ chairman and managing director, Amit Jain, emphasized the company’s focus on strategic acquisitions, stating, “We completed four projects last year and immediately replaced them with four new acquisitions, including a four-acre plot at Filmistan in Goregaon West for premium 3 and 4 BHK residences.”

NCR Led in Transactions

While MMR led in terms of total land area acquired, the National Capital Region (NCR) recorded the highest number of transactions, with 36 deals closed in 2024.

Key NCR Land Acquisitions:

- Gurugram witnessed 21 transactions, making it the most active real estate market in NCR.

- Noida followed with 14 transactions, driven by increased demand for residential and commercial projects.

- Ghaziabad recorded one major transaction,.

This trend indicates that developers are not only strengthening their land banks in established cities but are also tapping into Tier II and III cities for long-term growth.

The surge in land acquisitions in 2024 reflects the confidence of developers in the long-term potential of India’s real estate sector. MMR’s leadership in land deals highlights the region’s focus on large-scale developments, while the increased activity in emerging markets suggests a diversification strategy among developers.

With the ongoing expansion of infrastructure, strategic acquisitions, and changing market dynamics, the real estate sector is expected to remain active in land banking in 2025 and beyond. However, the challenge remains in balancing land costs with affordability, particularly in premium markets like MMR and NCR.

Image source- freepik.com

.png)