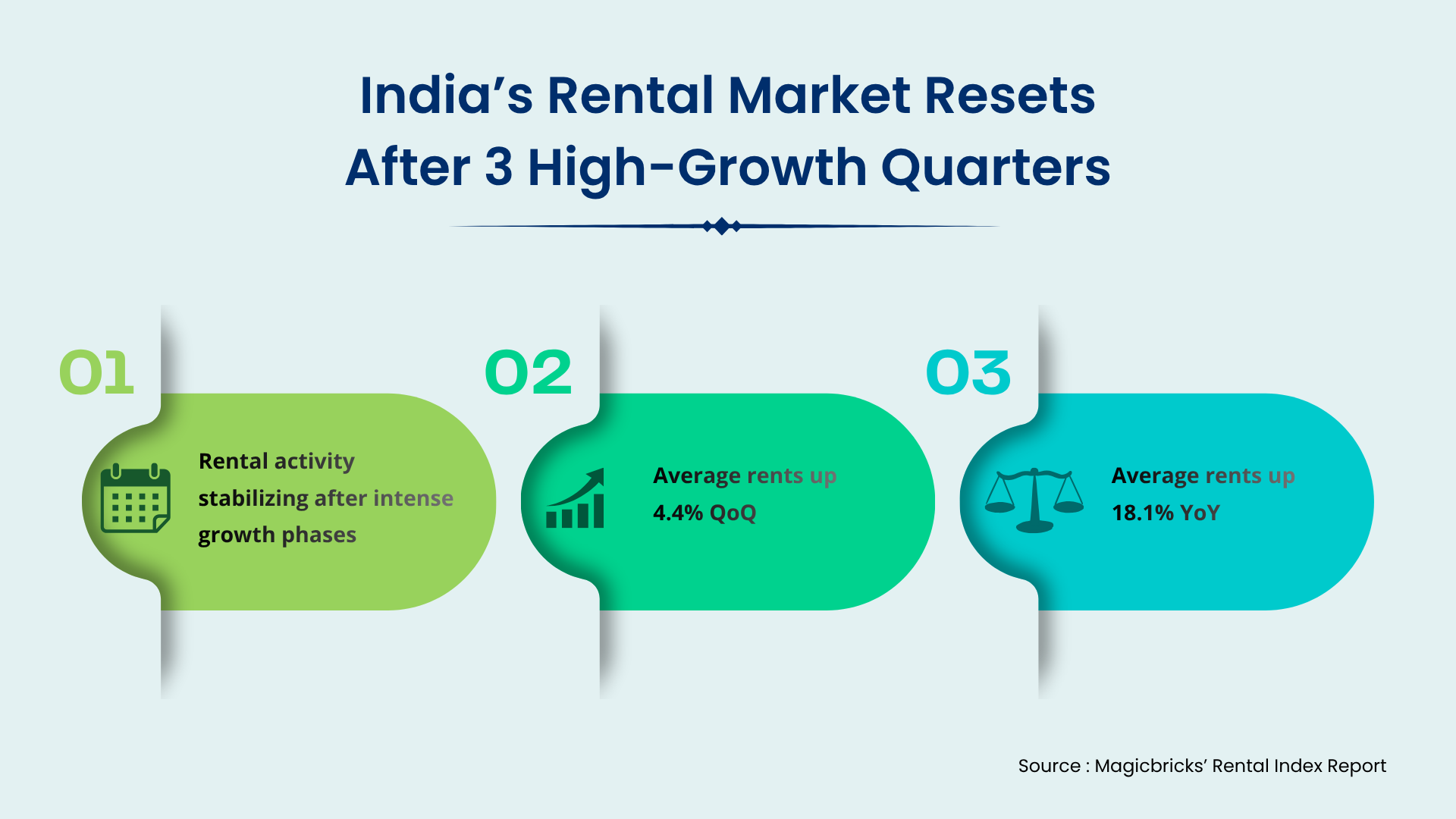

The Magicbricks Rental Index for the July–September 2025 (JAS ’25) quarter indicates that the rental market is gradually resetting after three consecutive quarters of heightened activity. Despite this transition toward stability, average rents continued their upward trajectory, rising 4.4% QoQ and 18.1% YoY, even as tenant activity varied across key metros during the period.

Between July – August 2025 witnessed a period of consolidation where moderation in both demand and supply is helping the market progress toward a more stable rhythm. National rental demand rose marginally by 0.2% QoQ and 0.4% YoY, while supply increased by 0.6% QoQ and 5.9% YoY, signalling a shift towards closer alignment between tenant interest and available listings.

According to the report, the quarter’s movement was shaped significantly by Delhi–NCR, where demand surged in Greater Noida (29.5% QoQ), Delhi (17.8% QoQ) and Noida (10.8% QoQ). Kolkata also recorded a 5.4% QoQ rise, indicating sustained traction. Several major cities, including Chennai, Bengaluru, Hyderabad, Pune and Mumbai, witnessed softer shifts with demand easing between –1.2% and –7.2% QoQ. On the supply front, Delhi registered the sharpest rise at 17.6% QoQ, followed by Ahmedabad at 6.5%, supporting the broader trend of the market moving toward balance.

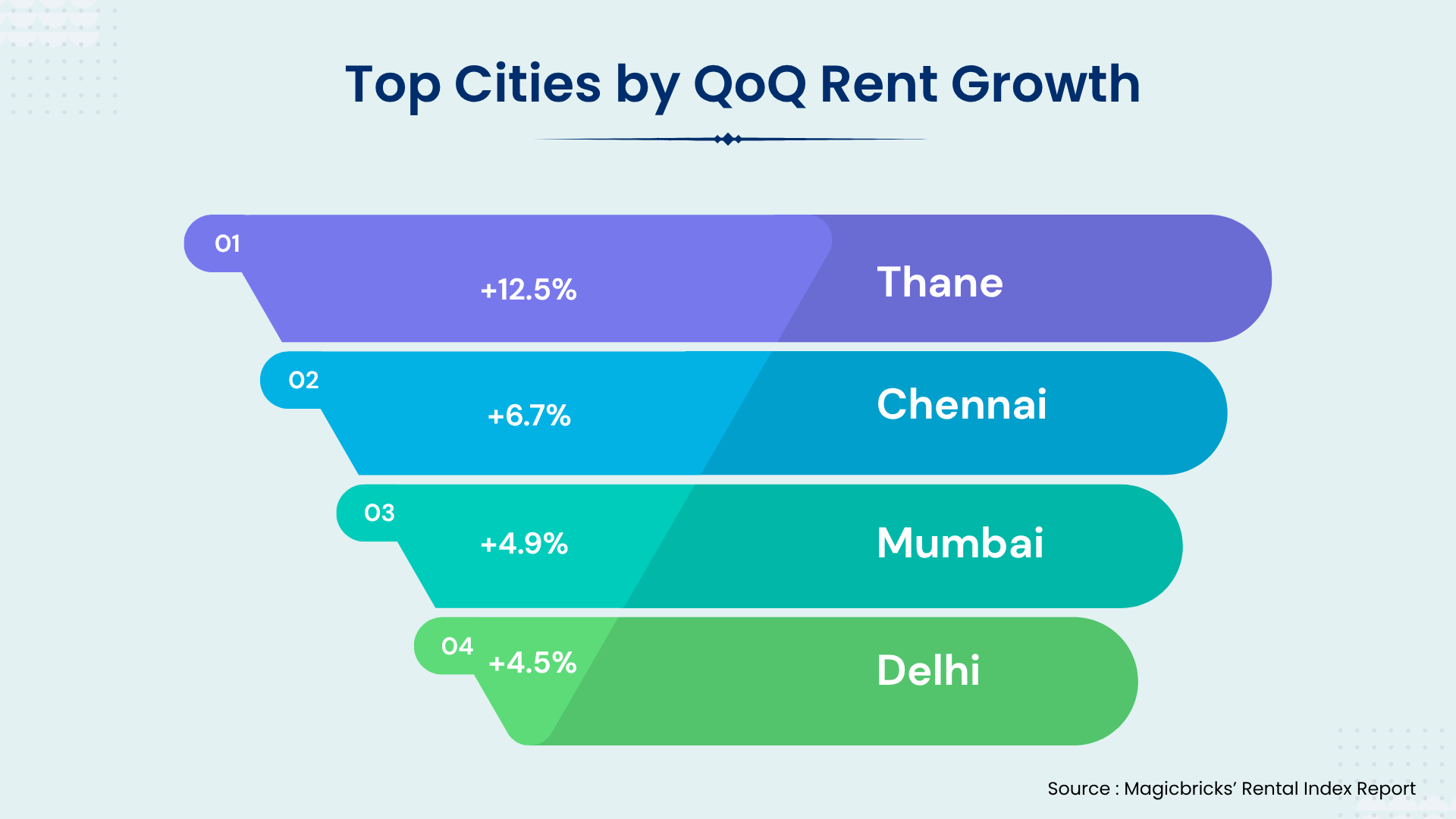

Average rent continued to rise across most markets; Thane led the trend by posting the sharpest uptick at 12.5% QoQ, followed by Chennai at 6.7% QoQ and Mumbai at 4.9% QoQ along with Delhi’s 4.5% QoQ growth reflected steady absorption.

“While the national rental market has begun to stabilise after several quarters of rapid growth, the continued momentum in NCR shows how infrastructure upgrades, better connectivity and a steady flow of mid-sized homes are sustaining tenant interest. The moderation in rents across most cities also indicates a healthy shift toward balance, where supply is catching up with demand. This phase is likely to improve affordability for tenants while creating a more predictable environment for homeowners and investors,” says Mr. Prasun Kumar, CMO, Magicbricks.

At the national level, tenant choices remained consistent. Two-bedroom homes accounted for 44% of demand, followed by one-bedroom units at 32%. Semi-furnished homes dominated with 51% of demand and 54% of supply, while mid-sized homes between 500 and 1,500 sq. ft. continued to shape the majority of rental activity, capturing 77% of tenant preference.

.png)