GCCs to Anchor India’s Office Demand Growth- Key Highlights

- GCCs may drive up to 50% of India’s total office space demand across the top 7 cities over the next few years.

- Annual Grade A office leasing by GCCs is projected at 35–40 million sq. ft., reflecting sustained expansion by global firms.

- US companies dominate GCC activity (≈70% share since 2020), but EU and UK firms are expected to increase their share driven by ongoing trade agreements.

- Trade deals with the US, EU, and UK are likely to boost long-term demand across Technology, BFSI, Engineering & Manufacturing, and Consulting sectors.

- GCCs have contributed 117 million sq. ft. of leasing since 2020, accounting for nearly 38–40% of India’s cumulative Grade A office absorption.

- As per Colliers Inda report, India remains one of the fastest-growing major economies, with the IMF recently revising its GDP growth projections for 2026 upwards by 20 bps – from 6.1% to 6.3% (Jan 2026 World Economic Outlook update vs Oct 2025 update). A forecasted growth rate of 6.5% in 2027 also draws comfort from strength of domestic demand across economic sectors and recent positive developments with respect to multiple bilateral trade agreements.

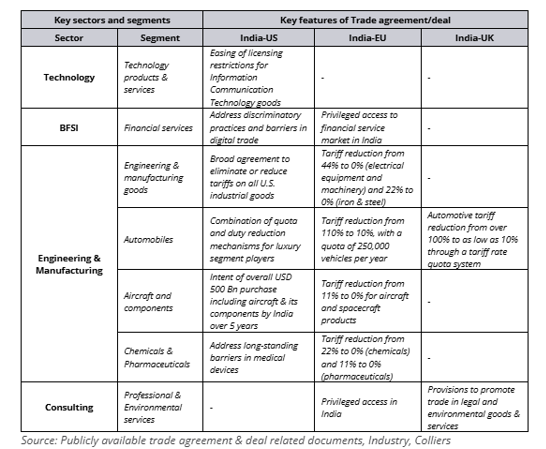

Free Trade Agreements (FTAs), Comprehensive Economic and Trade Agreement (CETA) and trade deals between India and the US, EU, the UK & France are in various stages of engagement and this is likely to enhance India’s long term export competitiveness and simultaneously reduce entry barriers, incentivizing global firms to expand their India operations across key sectors such as Technology, Banking & Financial Services (BFS), Engineering & Manufacturing, Consulting, etc. As global firms and capability centers from these countries increase their India footprint over the course of next few years, we envisage traction in real estate demand, particularly in Grade A offices and warehouses.

Trade agreements to fuel long-term demand across major office markets

Recent tariff rationalization and sector-specific trade facilitation measures under the anvil of ongoing bilateral engagements with the US, EU and the UK are expected to expand the market for global firms in India. In addition to enhancing the position of India as a competitive manufacturing destination in the APAC region, elimination of barriers in the service industry can potentially further attract GCCs into the country. Capability centers in India are increasingly likely to become integral centers of research, product development, engineering, advanced analytics, artificial intelligence, machine learning, and cloud computing.

Recent trade agreements & deal features: Select high impact sectors from a GCC demand (in India) perspective

Note: All trade agreements and deals are in various stages of implementation and are yet to be fully finalized. Benefits of tariff rate reduction, market access improvement etc. on GCCs in India are indicative and can be fully ascertained when exhaustive list/ finer details are available in public domain

“Recent trade agreements with the US, EU and UK can potentially boost foreign investments in country and amplify real estate demand across economic sectors including GCCs in India. This is likely to complement the regulatory push and ongoing policy tailwinds, boosting the annual demand for Grade A office space in India. We anticipate 35-40 million sq.ft. of annual GCC leasing, accounting for 40-50% of the overall office space demand over the course of next few years. While Technology based GCC demand from US firms can stabilize, we anticipate increasing traction from companies of EU and UK origin, especially within the Engineering & manufacturing, BFSI and consulting domains.” says Arpit Mehrotra, Managing Director, Office Services, Colliers India.

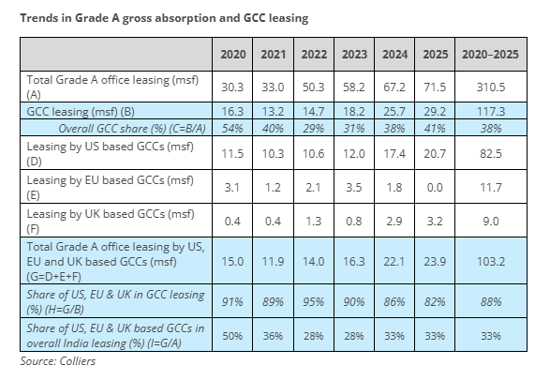

GCCs account for ~40% of the Grade A office demand across top 7 cities

India’s office market has scaled up significantly in recent years with consecutive demand peaks in the post-pandemic era. This scaling up has been powered by GCCs, which have moved beyond cost-arbitrage centers and transitioned into innovation-driven globally integrated knowledge & research hubs. Of the 310 million sq ft. of cumulative office space demand since 2020, GCCs have accounted for around 117 million sq ft of office space, representing 38% of the overall leasing activity in India. In fact, the steady growth in GCC demand is evident from the increase in space uptake from around 16 million sq ft in 2020 to close to 30 million sq ft in 2025. Simultaneously, their share in India’s overall leasing activity has increased from sub 30% levels few years ago to over 40% in 2025, further adding credentials to the ongoing transformation of GCCs. Notably, GCCs headquartered in the US, EU and UK continue to drive this transformation - contributing nearly one-third of the overall office space demand in India since 2020.

Gross absorption does not include lease renewals, pre-commitments and deals where only a letter of Intent has been signed | The top 7 cities include Bengaluru, Chennai, Delhi-NCR, Hyderabad, Kolkata, Mumbai and Pune

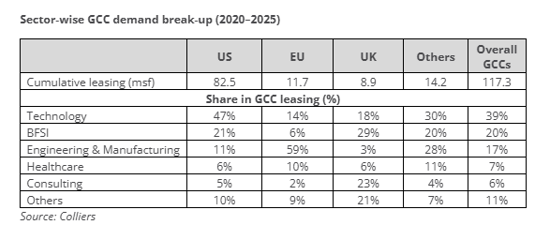

Distinct demand patterns across US, EU & UK based firms to accentuate occupier diversification

Interestingly, ongoing trends reveal distinct India expansion strategies of GCCs across the US, UK and EU. Demand from US headquartered GCCs continue to be dominated by Technology firms (47% share in US based GCC leasing), alongside a notable presence of BFSI companies (21% share). EU-origin companies are predominantly anchored in Engineering & Manufacturing sector, which accounts for ~60% of their GCC demand in India. Tariff concessions and secured market access in the India-EU trade agreement can indirectly boost office space demand from such firms in India. Meanwhile, UK-origin GCC demand patterns show a diversified occupier profile led by BFSI firms (29% share) and Consulting players (23% share).

Gross absorption does not include lease renewals, pre-commitments and deals where only a letter of Intent has been signed | Others include consumables and e-commerce | The top 7 cities include Bengaluru, Chennai, Delhi-NCR, Hyderabad, Kolkata, Mumbai, and Pune

In fact, GCC leasing is increasingly becoming broad-based, with global companies across sectors expanding their operations in India. Moreover, leasing volumes by BFSI, engineering & manufacturing, and healthcare GCCs have been on the upswing in recent years. While US GCCs have driven space uptake, accounting for nearly 70% of the total GCC demand since 2020, their share is expected to moderate over the next few years. Simultaneously, driven by the trade agreements, EU & UK based GCCs are expected to gain traction in the near-mid term.

“GCCs will continue to anchor India’s office space demand, supporting the ongoing scale-up and diversification of occupier base. With global trade frictions relatively moderating, supported by recent developments pertaining to bilateral agreements between India and its leading trade partners, we envisage positive sentiments to translate into traction across key demand drivers of Indian office market. Although GCC leasing will continue to be driven by technology sector, the demand is likely to become broad-based, with BFSI and engineering & manufacturing firms expected to contribute 40–50% of the space uptake in 2026.” says Vimal Nadar, National Director & Head of Research, Colliers India.

Overall nuanced demand patterns underscore the Indian GCC ecosystem alignment with high-value, domain-intensive functions rather than transactional back-office operations. Additionally skilled talent availability and cost arbitrage will continue to fuel expansion of capability centers in India.

.png)