In one of the largest bulk residential transactions in South Mumbai this year, the promoter family of the Lloyds Group has acquired six ultra-luxury apartments at Kalpataru Prive, located in the upscale Tardeo locality. The total consideration for the deal stands at ₹227 crore, according to property registration documents accessed by Zapkey.

The buyers include Ravi Agarwal, chairman of Lloyds Realty, and Babulal Agarwal, chairman of Lloyds Group. The transaction involves the purchase of six apartments situated between the 18th and 23rd floors of the Kalpataru Prive tower, developed by Kalpataru Hills Residency Pvt Ltd. The project is located along Altamount Road, one of India’s most expensive and limited-supply residential streets, often referred to as ‘Billionaires’ Street’.

The six flats collectively span a carpet area of 17,908 sq ft, with the overall per sq ft rate working out to ₹1.26 lakh. The deal also includes 24 car parking slots.

Altamount Road’s residential supply is among the most exclusive in the city, with most buildings offering limited inventory targeted at high-net-worth individuals and business families. The apartments in Kalpataru Prive are designed for buyers seeking privacy, panoramic city views, and full-floor layouts with luxury-grade amenities.

The Lloyds Group, which has interests in metals, engineering, realty, and luxury segments, has been actively expanding its real estate portfolio in Mumbai. Ravi Agarwal leads the real estate vertical through Lloyds Realty Developers Limited, while Babulal Agarwal continues to head the overall group operations.

The current acquisition at Kalpataru Prive follows another high-value deal by family members in 2024. That earlier transaction involved the purchase of a triplex apartment in Worli by Abha Gupta and Shreekrishna Gupta, related to the Lloyds Group. The apartment, located in the Sea Krest project by Sugee Group, was bought for ₹107 crore and included 16 parking spaces.

Such investments are seen as part of a broader family strategy to consolidate high-end real estate assets in key locations within South Mumbai.

The Altamount Road micro-market continues to attract corporate promoters, family offices, and HNI buyers. The area’s premium positioning is driven by factors such as its low-density planning, central location, and proximity to Mumbai’s commercial zones like Nariman Point and BKC.

New launches in this area are rare, and most transactions occur through private sales or limited builder inventory. With a stable price band and limited churn, properties here often serve as both a lifestyle and wealth preservation asset.

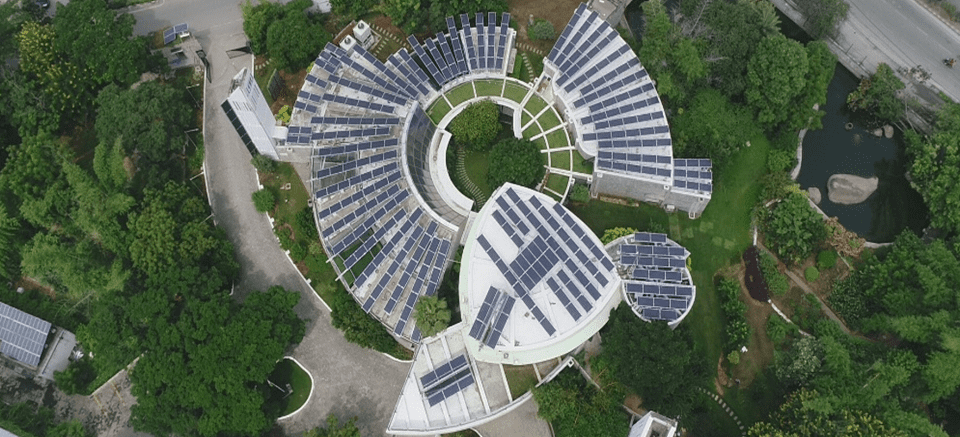

The seller, Kalpataru Hills Residency Pvt Ltd, is part of the Kalpataru Group, a long-standing developer known for luxury residential and commercial properties in Mumbai. Kalpataru Prive is among its marquee offerings, with specifications catering to buyers who seek exclusivity and quality in location-sensitive zones.

Each unit in the building reportedly comes with private lobbies, high-end finishes, and access to luxury amenities, positioning it among a small number of projects that meet the expectations of ultra-premium buyers.

High-value bulk transactions in Mumbai’s residential segment have picked up over the past two years, with several promoter families and senior executives acquiring multiple units in a single project. These deals are driven by a mix of lifestyle preferences, family planning, and strategic asset deployment.

In the ultra-luxury segment, buyers typically seek full or half-floor residences, high security, and long-term capital preservation. Such buyers also often negotiate for bundled amenities like parking, storage, and exclusivity clauses, which are reflected in the structure of this Kalpataru Prive transaction.

As per property experts, the South Mumbai ultra-luxury market has remained resilient due to limited inventory and the steady interest of wealthy buyers looking to either upgrade or hold assets in legacy locations.

The Lloyds Group’s acquisition at Kalpataru Prive underscores this demand trend and adds to the growing list of recent premium transactions concentrated in Altamount Road, Worli, and Malabar Hill.

.png)