Four of the top five global cross-border capital destinations for land and development site investments in the first quarter of 2024 were in Asia Pacific, according to a new report from Colliers. The report, Asia Pacific Global Capital Flows May 2024, listed China, Singapore, Australia and India within the top five destinations globally for cross-border capital investment in land/development sites in Q1 2024.

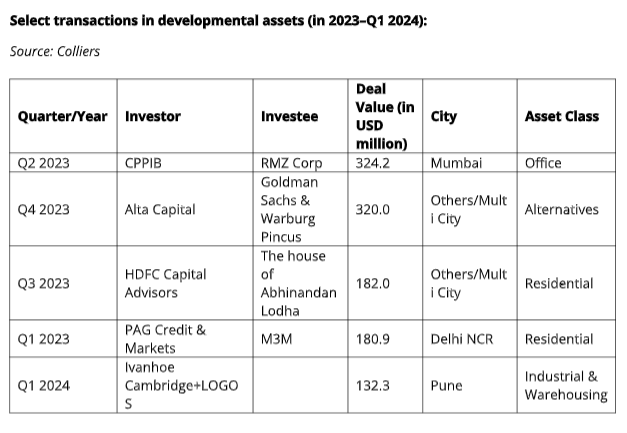

In India, the institutional investors are largely drawn to completed and pre-leased income-yielding assets due to their ability to provide immediate & steady returns, low risk profile, compliance assurance and lesser exit-related hassles. However, with the majority of the large Grade A projects being already funded, investors are also forging partnerships with local developers and investors, in developmental assets spanning across office, residential and industrial segments. The inflow in developmental assets (mainly in the form of platform deals) includes investments in various phases of developmental activity including land acquisition and asset development, etc.

The inflow into developmental assets includes investments directed toward creating new assets from the ground up. These investments span various phases of development, including the formation of platforms, land acquisition, and construction.

Over the last decade, institutional investments across various asset classes in the real estate sector have seen promising inflows, bolstered by a wave of infrastructure investments and comprehensive economic reforms. Persistent economic growth, strong demand fundamentals and optimistic business outlook in India relative to its global peers, have enhanced global institutional investor confidence in exploring multiple avenues for investments in India.

"Foreign investors continue to exhibit confidence in India’s real estate sector, infusing USD 3.6 Billion during 2023, driving 67% of the total inflows. The momentum continued in Q1 2024 as well, with foreign investors driving over 55% of the investment inflows at USD0.5 Billion. Their sustained preference for ready assets continues, evident from the 73% investment inflows in such assets during Q1 2024. Simultaneously, India also presents abundant opportunities for investment in developmental sites as the real estate sector is set to reach USD 1 trillion by 2030, accounting for 13-15% of India's GDP. The preference towards developmental as well as ready to move quality office assets will continue, with visible emphasis on sustainability. The Capital in Indian Real Estate is getting more diversified to sectors such as Residential, Logistics, Alternatives, Credit.” said Piyush Gupta, Managing Director, Capital Markets & Investment Services at Colliers India.

With the GDP set to cross USD 5 trillion soon, India offers burgeoning opportunities for real estate investment, both in ready assets and developmental sites. The real estate growth is likely to extend beyond the top 6 cities, covering multiple smaller cities across the country, backed by infrastructure advancements, increased digital penetration and supportive regulatory framework in these cities, offering an array of opportunities for the investors.

"This is an opportune time for investors to invest in developmental projects in India's real estate sector backed by stable economic conditions. The past two years have witnessed significant investments in land, particularly for residential projects, with prominent real estate developers keen to strategically acquire large contiguous land parcels. Institutional investments in the residential segment, meanwhile, have also witnessed a 20% YoY rise during 2023, at USD 0.8 Billion. With robust residential sales momentum across cities, this trend is expected to continue, making it an opportune moment to capitalize on greenfield development opportunities especially in residential real estate," said Vimal Nadar, Senior Director & Head of Research, Colliers India.

Chris Pilgrim, Colliers’ Managing Director of Global Capital Markets in Asia Pacific, said “APAC continues to show strong growth with stable forecasts, a factor that is driving the strength of the land and development market in particular. More broadly, investor confidence is returning both in terms of deploying capital and the belief that some economic headwinds have stabilized or are now factored into risk adjusted returns. Strong demand fundamentals are also driving significant investor interest in India, where office assets remain at the core, while industrial and residential assets are seeing heightened activity.”

Conclusion

The real estate sector in India is experiencing significant growth, buoyed by strong investor confidence and promising economic indicators, with the country's GDP poised to surpass USD 5 trillion. Foreign investors, driving substantial inflows, exhibit confidence in both completed assets and developmental projects, with a notable preference for ready assets but increasing interest in partnerships for developmental sites. This growth is not confined to top-tier cities but extends to smaller cities, supported by infrastructure advancements and regulatory reforms, offering diverse investment opportunities.

Investments in developmental projects, particularly in residential segments, have gained traction, with developers strategically acquiring land parcels and institutional investors showing heightened interest, indicating robust growth potential. Overall, investor confidence remains strong in the Asia Pacific region, including India, driven by stable forecasts and robust demand fundamentals, with the real estate sector poised to continue thriving, offering attractive returns and sustainable growth prospects.

.png)