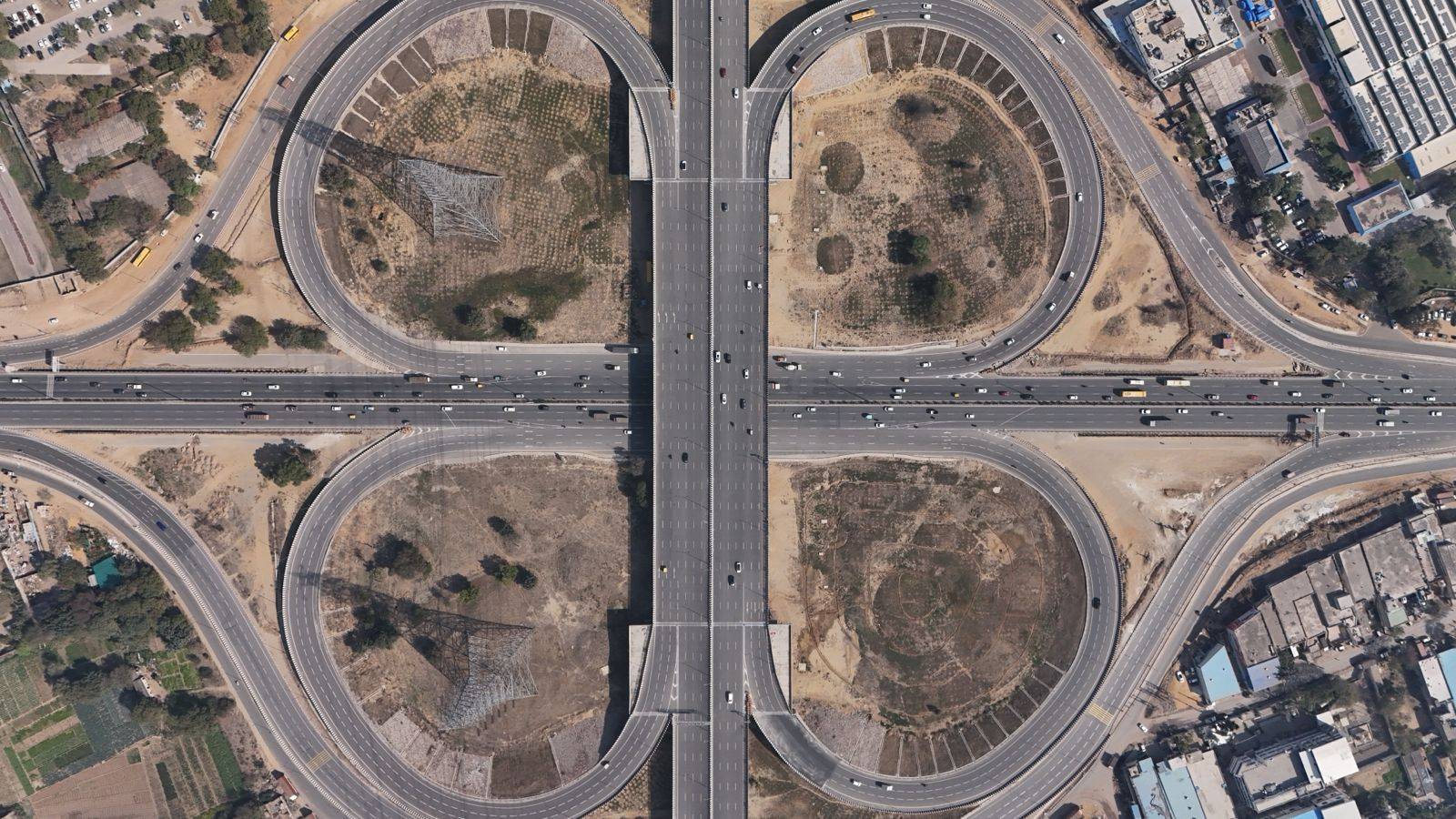

Dwarka Expressway has emerged as one of India’s most significant real estate corridors, recording a 58 percent year-on-year increase in property prices during the October-December 2024 quarter. This surge has positioned the region as the fastest-growing micro-market in the country, surpassing price growth in other major cities.

Market Trends

According to a joint study conducted by CREDAI, Colliers, and Liases Foras, the price rise along Dwarka Expressway was the highest among all monitored regions in Q4 2024. The findings indicate strong investor confidence and sustained demand for properties in this area. The expressway’s development, supported by planned infrastructure and connectivity improvements, has contributed to this significant appreciation in real estate values.

The expressway has gained prominence as a preferred investment destination within Delhi-NCR, drawing attention from homebuyers and institutional investors alike. The market momentum is driven by the combination of expanding infrastructure, increasing commercial developments, and better connectivity with key business districts.

Factors Contributing to Price Growth

Several factors have contributed to the price rise along Dwarka Expressway:

- Infrastructure Development: The expressway enhances connectivity between Delhi and Gurugram, reducing travel time and improving accessibility to commercial hubs.

- Housing Demand: The availability of well-planned residential projects has attracted both end-users and investors looking for long-term appreciation.

- Proximity to Business Districts: The location offers easy access to employment centers, making it a preferred choice for professionals.

- Government Initiatives: Policy support for urban development and regulatory improvements in the real estate sector have further boosted buyer confidence.

- Commercial Growth: The expansion of office spaces, shopping centers, and entertainment zones in the vicinity has increased the livability factor, attracting more buyers and investors.

- Infrastructure Projects: Ongoing metro expansions and new road linkages have enhanced the appeal of the region, driving demand further.

Comparison with Other Markets

The 58 percent price appreciation outpaced growth in other major real estate markets, including Mumbai, Bengaluru, and Hyderabad. While these cities experienced price increases due to high demand, none matched the rate observed along Dwarka Expressway. The region’s rapid development has positioned it as a key player in India’s expanding real estate sector.

Investor and Developer Interest

Developers have responded to the demand by launching new projects, ranging from affordable housing to premium residential developments. The surge in investor interest is evident in the increased number of property transactions and rising occupancy rates. Both first-time homebuyers and long-term investors are recognizing the potential of the region, leading to sustained growth in property sales.

Additionally, many national and international developers have shown interest in acquiring land parcels for future developments. Several luxury and high-end residential projects have been announced to cater to the growing demand from professionals, business owners, and NRIs looking to invest in high-potential locations.

Real estate analysts suggest that the price trend is likely to continue in the coming years, driven by further infrastructure enhancements and growing employment opportunities in the surrounding areas. Market observers believe that properties along the expressway will maintain their upward trajectory as connectivity and amenities improve.

Impact on Rental Market

The rising property prices have also influenced the rental market along Dwarka Expressway. The increasing number of professionals moving into the area has resulted in higher demand for rental housing. This trend is expected to continue as more commercial projects are completed, leading to further appreciation in rental values. For investors, this presents an opportunity to generate steady rental income along with capital appreciation.

Implications for Homebuyers and Investors

The rapid price escalation indicates strong demand, but it also presents challenges for new buyers. As property values rise, affordability becomes a key concern for those looking to purchase homes in the region. Experts recommend thorough research before making investment decisions, considering both current market conditions and future growth potential.

For existing property owners, the appreciation in real estate prices presents an opportunity for high returns on investment. Those who purchased properties in the early stages of development are likely to benefit from significant capital gains. Buyers seeking long-term investment potential should look for properties with good infrastructure connectivity and amenities that align with future urban development plans.

Despite the impressive growth, there are challenges that need to be addressed for sustained expansion. Delays in infrastructure projects, regulatory approvals, and fluctuations in market sentiment could impact future price growth. However, industry experts believe that continued government support and private sector investments will help maintain the positive trajectory.

With the upcoming completion of major infrastructure projects, including new metro lines and road networks, the expressway is set to become an even more attractive destination for both residential and commercial investments. Investors and homebuyers should keep an eye on future developments and policy changes that could impact the region’s real estate landscape.

Image source-x.com

.png)