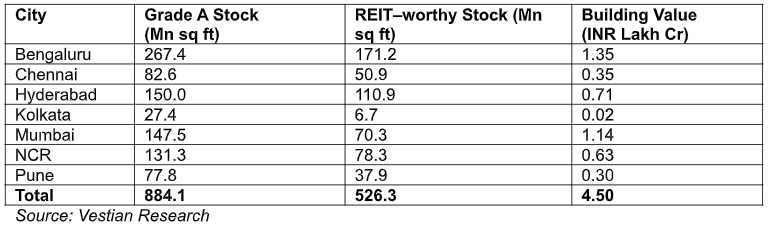

Vestian's latest report on ‘REITs: Reshaping India’s Commercial Space’ states that 60% of India’s total Grade-A office space qualifies as REIT-worthy, highlighting the upside potential of REITs to transform the commercial real estate investment landscape. However, India’s REIT market is currently at a nascent stage compared to major global economies with only four listed REITs, covering an area of 125 Mn sq ft across the retail and office markets.

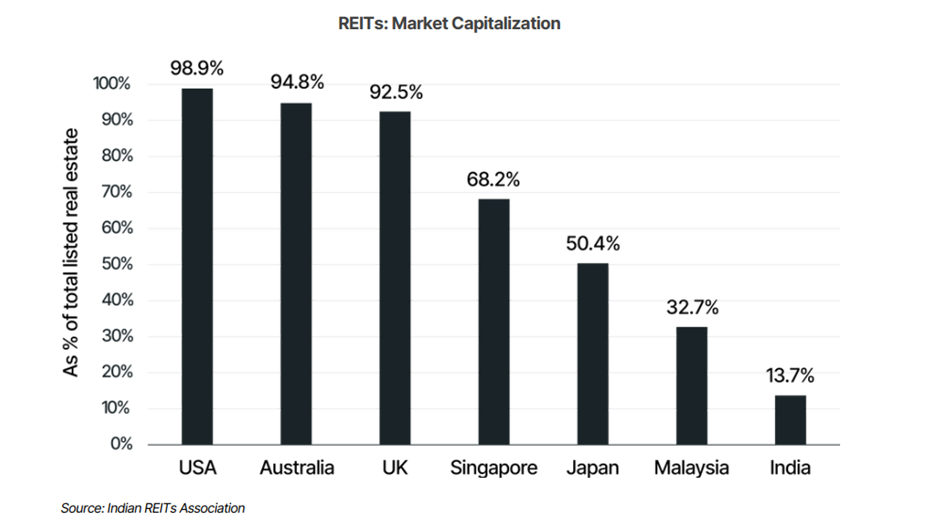

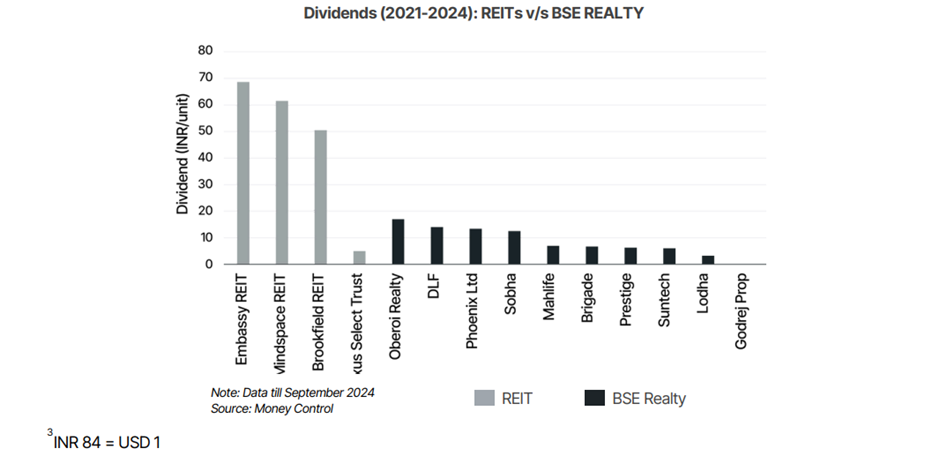

Gradually, REITs are becoming popular among foreign and domestic investors owing to attractive returns in the form of dividends. Since their inception, REITs have distributed INR 16,800 crore, more in dividends compared to the entire NIFTY Realty Index. Despite producing better returns compared to the NIFTY Realty Index, the market capitalization of REITs remains relatively low. India has a market capitalization of 13.7% of the total listed real estate sector which is low compared to mature markets such as the USA (98.9%), Australia (94.8%), and UK (92.5%).

Moreover, Embassy REIT, Mindspace REIT, Brookfield India REIT, and Nexus Select Trust REIT generated returns of 24%, 18%, 6%, and 39% respectively since their inception. On the other hand, BSE Realty Index has provided higher returns (317% in the past 66 months) compared to REITs. However, favourable regulatory environment, better returns on investment, and a rapidly expanding office market are likely to provide impetus to the REITs market in India.

City-wise Analysis

Among India’s top seven cities, Bengaluru leads the pack with 33% share of the total REIT-worthy stock. It is followed by Hyderabad and NCR with 21% and 15% shares respectively. While Mumbai and Pune together account for 21% of India's REIT-worthy stock, Chennai holds 10% and Kolkata contributes a mere 1%.

Hyderabad has the highest proportion of REIT-worthy stock, accounting for approximately 74% of the city’s total office inventory, while Kolkata holds the lowest share at around 24%. Notably, the majority of REIT-worthy assets are concentrated within the commercial hubs of these cities, driven by the presence of branded Grade-A office buildings in these prime locations.

Expert Opinion

Mr Amal Mishra, Founder and CEO, UrbanVault believes that India's economy has been experiencing significant growth in recent years, showcasing robust performance and a strong trajectory expected to continue for the foreseeable future. This economic expansion has driven a surge in demand for Grade A office spaces, especially for flexible and managed office spaces. However, the current supply remains constrained, creating a gap in the market.

He said "The demand and absorption for Grade A offices are projected to grow steadily. Recognizing this trend, many developers are actively focusing on this segment, with new projects in the pipeline to address the increasing need for premium commercial spaces. REITs (Real Estate Investment Trusts) in India currently hold a relatively small percentage of total Grade A office space. Given that REITs primarily invest in rent-yielding commercial assets, the dynamics of Grade A office supply and demand play a pivotal role in their growth. This presents a significant opportunity for REITs to expand their footprint in India, leveraging the rising demand for high-quality office spaces to enhance their portfolios and deliver value to investors."

Sustainable REIT-worthy Stock

Nearly 67% of the total REIT-worthy stock in India is green-certified, highlighting the increasing focus on sustainability among Grade-A developers. According to our report on sustainability, green-certified buildings command a rental premium of 12-14% over non-green buildings. This makes them an attractive investment option, as higher rental yields can lead to greater dividend distributions for investors. Future of REITs

The future of REITs in India looks promising with mutual funds and corporations gradually increasing their stakes in REITs. Many are also planning to launch dedicated schemes based on REITs' performance in the stock market. These developments could enhance liquidity for REITs, enabling them to secure funding more efficiently and at competitive rates. Furthermore, REITs are expected to be an indispensable investment tool to diversify investor portfolios and provide consistent income.

REITs in India are still in the early stages of growth but are gradually expanding, supported by a favorable regulatory environment and proactive government policies from SEBI. As the regulatory framework matures, India is expected to see more REIT listings and expansion into new real estate segments. The launch of SM REIT is a positive step, targeting smaller value assets and enhancing liquidity in the real estate sector.

.png)