Industrial Investment Trust Limited (IITL), one of India's leading non-banking financial companies (NBFCs), has announced its plans to launch a Category I Alternative Investment Fund (AIF) to capitalize on India’s rapidly expanding real estate sector.

With a target corpus of ₹500 crore, the new AIF will focus on investing in both residential and commercial real estate. The fund seeks to benefit from the growing demand for housing, record-breaking office leasing, the rise of flexible workspaces, and the increasing surge in domestic tourism across the country.

IITL’s portfolio, as of 30th September 2024, stands at ₹405 crore, with diversified investments spanning multiple industrial sectors, including a strong focus on real estate. The company’s strategic move to launch an AIF is designed to position it as a significant player in the flourishing Indian real estate market. The fund aims to offer investors a strong growth opportunity by tapping into high-demand areas and collaborating with leading developers.

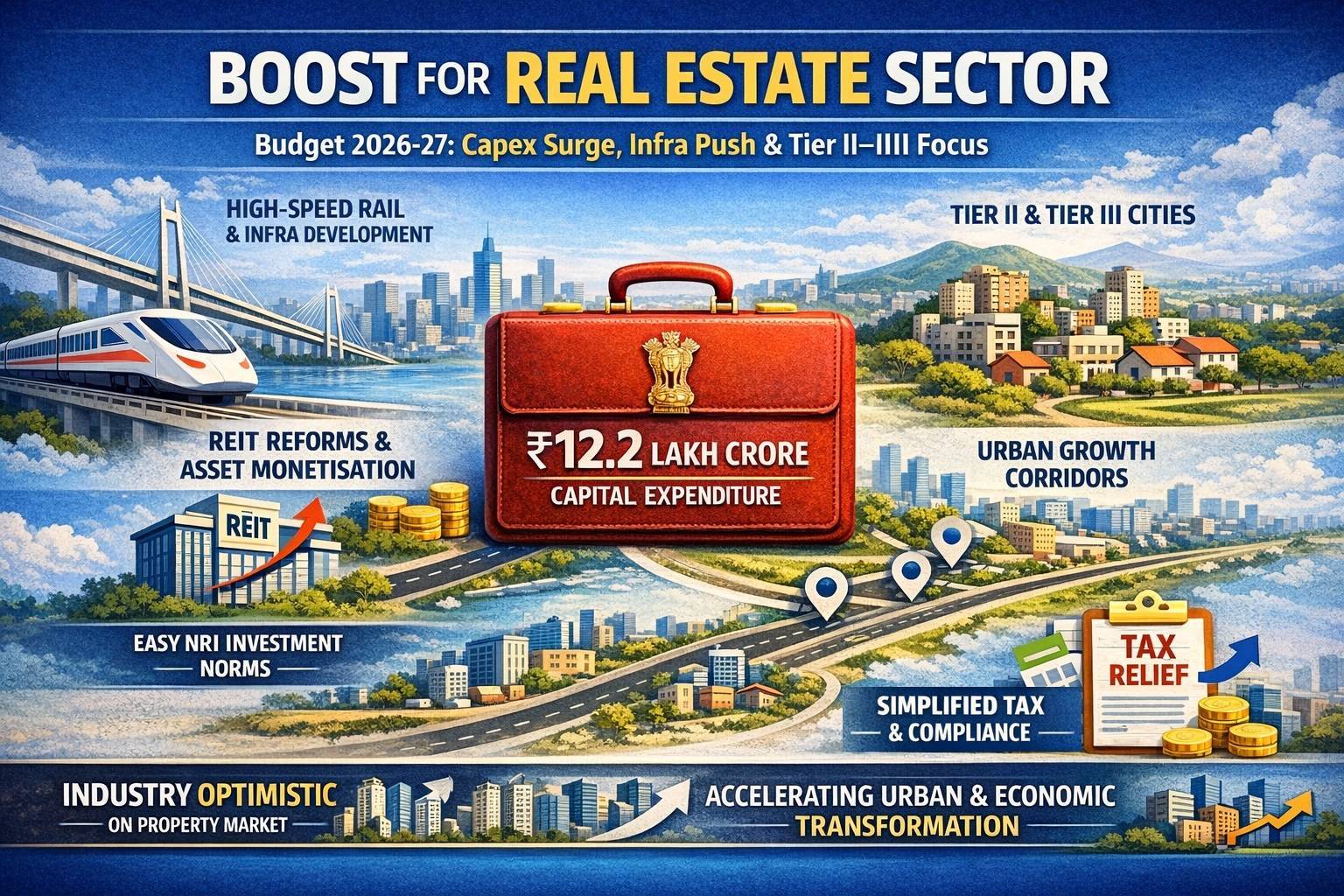

The AIF will primarily target Tier 1 and Tier 2 cities, which are witnessing substantial economic growth. These cities are expected to see continued development due to urban expansion and infrastructure improvements, making them attractive for real estate investment. IITL will partner with Grade A developers to bring high-quality residential and commercial projects to life. This strategic focus will not only contribute to the growth of urban landscapes but also create significant value in the real estate sector.

In addition to the AIF, IITL is also launching a Housing Finance Company, a subsidiary dedicated to offering accessible financing solutions for home buyers and property upgraders. This new initiative will simplify the home financing process, making homeownership more accessible and hassle-free for a larger customer base. The Housing Finance Company is aligned with IITL’s vision of supporting the Indian population in realizing their homeownership goals while contributing to the overall development of the housing sector.

Mr. Bipin Agarwal, Chairman & Managing Director of Industrial Investment Trust Ltd., expressed confidence in the growth of India’s real estate market, stating, “India’s real estate sector is on a powerful growth trajectory, and we see immense potential in partnering with esteemed developers across the country. With the launch of this AIF, we aim to deliver value-driven investment options to our stakeholders while supporting urban expansion and sustainable development. The Housing Finance Company will further solidify our commitment to aiding Indians in achieving their homeownership goals. Together, these initiatives position IITL at the forefront of India’s evolving real estate and housing finance sectors.”

IITL is working with several top developers across the country to push these initiatives forward. These partnerships align with IITL’s strategy of offering valuable investment and financing solutions to support growth and change in India’s real estate market.

Image source- iitlgroup.com

.png)